By Tom Luongo

February 8, 2023

"Well, I'm not the princess you seek, but we can still have a really good time!"

Aeryn Sun, Farscape "John Quixote"

Last Friday's Non-Farm Payroll report came out with a massive 517,000 new jobs created in January. It blew expectations completely out of the water and forced onto global markets a different view of the US economy than the one it held just two days earlier when the FOMC announced another 0.25% hike to the Fed Funds rate.

Of course, this number was likely 'goal-seeked' as Zerohedge put it in their initial article. I don't disagree with Zerohedge's conclusion.

In fact, it's this idea of 'goalseeking' that I want to expound on. That observation is telling, not because there isn't a nugget of truth in it, but because we are living in a world so awash in narratives supported by 'data' that it is a Herculean task to make any sense of what's really going on.

That being said, if you look at the initial article from Investing.com they go over the other data released as well: hourly wages (beat expectations), hours worked (beat expectations and rising to 34.7 hours), and the overall U-3 Unemployment Rate falling to 3.4%, which is suspect due to new calculations and end of the year 'book squaring' of last year's data.

The relentless criticism of the financial space, both normie and dissident, of the Federal Reserve here is the thing that is so noteworthy.

No matter what the Fed does it is and will be criticized.

The normie press want a return to the zero-bound to fund excessive leverage and the real wealth harvesting operation of the global oligarch class.

Y'all know who they are, The Davos Crowd.

"You Must Goalseek the Treasure"

The dissident press, centered around Zerohedge, wants to be proven right that they are good at Austrian economics, when they clearly aren't. They are routinely frustrated that the world they have 'goalseeked' through the single-variable analysis of 'the money supply' keeps failing to materialize.

They can see bits and pieces of the moving picture and can easily identify the lies, statistical fudging, and desperate policies but they cannot ascribe any other motivation to them than incompetence.

I have come to the conclusion that this is the weakness of so many other commentators in this space. There is a stunning amount of hubris out there thanks to a lot of people having read a book by Rothbard or Mises and thinking they have the Rosetta Stone for global-macro economic analysis.

The problem with that is, as I routinely point out and emphasize, there is no 'macro-economics.' There is only a trillion little 'micro-economic' decisions taken by billions of people in real time that in a very rough sense create a more macro picture.

There is no 'economy' folks.

There is just you, me, and the 7+ billion other schleps on this planet trying to dodge bullets everyday. And in a world awash with this much leverage, credit money masquerading as real money, most of those bullets are coming from our own governments and those who hold their strings.

The fundamental fallacy to much of the analysis is that there are 'free capital markets' acting independently of the political milieu which circumscribe those 'markets' every day. This is one of my basic criticisms of both Bitcoin Maxis, who've never seen BTC operate outside the context of central banks intentionally debasing their own currencies, and Jeff Snider's "Eurodollar" analysis which grew up in the context of a globalist putsch to use the dollar as a whip to punish the unwashed.

That would be you and me.

This isn't to say in any way I've given up my fervent belief in the power of the individual to act according to their best interest and overcome/adapt to the diktats of the Wesley Mauchs of this world (Atlas Shrugged reference). Quite the opposite.

I'm more convinced than ever of this power. The problem is identifying what it looks like today when we project that power forcing a clash with the entrenched power structures and their likely range of decisions to counter our decisions.

Electrons Over Profits

This is the hard part. This is where people act like electrons; forever unwilling to be nailed down to a particular course of action. What do I mean by this? Remember, I'm very well versed in quantum mechanics and the lessons of Heisenberg's Uncertainty Principle.

The TL;DR for the layman is the following. In any system greater than a single hydrogen atom floating in a box (pretty much the entire Universe) knowing both the position (x) and the momentum (p) of any electron is unknowable precisely using vector-based math to solve for the forces acting on a multi-electron system.

I'll honestly never forget the moment I first had this derivation proven to me on the third floor of Leigh Hall at 8:30 in the morning desperately clinging to my coffee cup, nursing a bit of a hangover.

It fundamentally changed the way I view not just the Universe, but also pretty much all of human endeavor.

Because of this mathematical fact when we fix either of these variables, x or p, position or momentum, the electron's behavior is modified by adding the observer to the system.

The mere act of observing the elements of a system alter the system itself.

In short you can know where it is (x) or how fast it's traveling (p) but you can't know both.

The best we can do is create probability fields of these two variables. And thus the entirety of molecular orbital theory was born.

The philosophical takeaway of this is, like I said, people are like electrons. They alter their behavior when they know they are being watched. Their behavior is unpredictable precisely because we are wired to avoid detection since detection equals threat to our survival.

Our brains are wired with very acute threat detection systems. In fact we devote most of one half of our brains to this basic instinct. So, it makes sense that if you have a group of people hellbent on fixing your behavior in time and space another group of people will react to counter that.

What does this have to do with labor statistics?

Ideological Slider Bars

Well, everything Measuring this behavior in a macro sense to create mathematical models based on such flawed data is a fool's errand, even taking into consideration advances in 'chaos math' and advanced statistical models.

Those models are, at best, gross approximations with assumptions of the range of our predicted behavior. They have error in them, and those errors multiply very quickly the more data you add and the farther out a person's decision tree you get.

At this point a reading of Borges' The Garden of Forking Paths is called for.

So, using this data to fit to the model in their head (the half-trained Austrians) or their spreadsheets (the Econometrists at the Fed & BLS) is nothing more than begging the hypothesis and creating data and projections of that data which are detailed, tautological, and wrong.

With erroneous models firmly in hand, predicated on false premises, we're inundated with conclusions about the future that conform to what Dexter White calls the "Excel Slider Bar" problem.

Everyone puts their numbers into Excel, isolates a single variable to solve for, and then drags the slider bar on their model 'all the way to the right' and makes some grand prediction.

In a recent Gold Goats 'n Guns Podcast, Alex Krainer and I talk about a chart put out by the US Treasury Dept ( tweeted by Lyn Alden) which is the perfect example of this kind of insanity.

Does this not look like Mann's Hockey Stick of future temperatures? Where in god's name did they get that curve? How could anyone seriously publish this as some rational projection of the future of the US's debt to GDP ratio?

What should first come to mind is what's implied here and why do they want us to believe this nonsense, because it's clearly propaganda?

That said, this graph is the essence of why Thomas Malthus was wrong. Even if Malthus' worry was based on something rational - can food production keep up with population expansion - the idea that this single-variable, linear food production, is something humans will not respond to is observably wrong.

I can forgive Malthus for not understanding the biology, but The Davos Crowd or anyone listening to their apocalyptic religious bullshit?

If food is scarce and women are skinny, they don't ovulate or bear healthy children if they manage to get pregnant. Malthusian model broken by basic biology.

And those most susceptible to this thinking are people who will look you straight in the eye and tell you that they 'know things' and that they are 'intelligent.'

Ok, Boomer.

It is this single-variable isolation, this abuse of algebra, that plagues modern society.

and all in the name of "ScienceTM"

But, more broadly, it is why all "Malthusian" thinking is wrong. It assumes people do not respond to incentives and alter their behavior. And it's why those half-trained Austrians decrying Powell and "Printer go brrr!" need to realize they carrying water for the globalists who are crafting policy based on equally moronic analysis.

Because every time they are wrong they help invalidate the underlying arguments having used bad models and worse logic.

There are no single-independent variables in these models.

They are all interconnected in ways that are not knowable. Period.

So, everyone runs around (including me) with the pretense of knowledge, as Hayek put it, and tries to make sense of the data without the cognitive discipline or intellectual humility to sift out the signal from the noise.

No, they just grep some data, torture the rules of algebra to isolate a variable by making assumptions that are not valid, produce an equation based on this, and then 'slide the bar all the way to the right."

Et Voila! Instant propaganda.

Just add Doompr0n.

And since there is comfort in presenting graphs, charts, and numbers - because numbers give the imprimatur of solidity to this pure windbaggery - too many people rely on them to beg their hypothesis and end up with the worst kind of tautology, one that confirms their bias.

We're all guilty of it, including me.

All I try to do is keep reminding myself of this possibility, and look at things from as many angles as possible while giving the players at the table the benefit of the doubt that they aren't slavering morons.

The Humble Pie Equation

In watching the market gyrations since Wednesday's FOMC I can tell you that I'm really not surprised by the market's memetic collapse on Friday in response to the 'shocking' and 'goalseeked' Labor data.

Gold down $100+

Silver down $2.00

The euro collapsed from a high of $1.10 to threatening to violate $1.07

The US 10 year note up nearly 30 basis points off last week's low.

Equity markets churning without direction

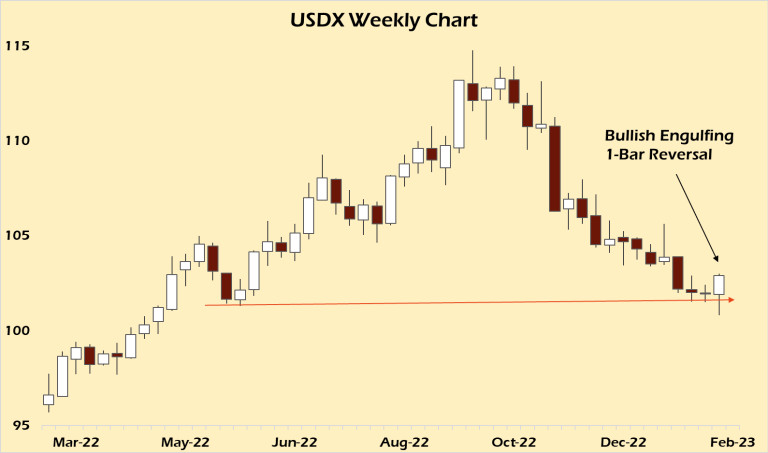

The USDX putting in a very strong one-bar, engulfing bullish reversal. 15 week downtrend, blitzed!

So, while Powell was thought to be dovish on Wednesday, the markets took a longer look at Christine Lagarde and the ECB on Thursday and finally started seeing things more clearly. Yes, there are real problems with the US. But, on the one hand we had Powell looking fairly confident that Fed policy to this point had performed well.

On the other we had Lagarde take back a future 50 bp rate hike while still at around -6% real yields, announce with a straight face that they would be ending sovereign debt QE in May while starting up corporate debt buying for ESG-favorable investments.

Powell is slowly handing risk assessment back to the private capital markets while Lagarde, having destroyed both the euro (with NIRP) and the euro-zone sovereign debt markets (QE), now is getting ready to destroy the corporate bond markets.

Hmmm, I'm just a hick from North Florida, but those don't look like the same policy trajectories.

Once the Labor data came out of the US, what began as rumblings in the Eurodollar markets on Wednesday turned into an avalanche by Friday afternoon and carried over today.

It's a bloodbath.

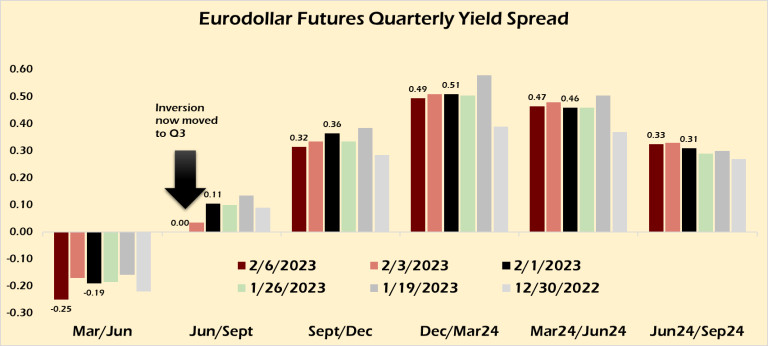

For the first time the Eurodollar futures inversion moved out to between the June and September 2023 contracts. After being convinced for months that the Fed would 'pivot' off rate hikes by the June meeting at 5%, now this 'all-powerful' market is repricing itself violently. By next week we could be looking at 5.5% or higher.

For years I've heard all that matters is what the Eurodollar markets think. They are the real monetary authorities because they have all the power. Well, as I discussed last week I think that's another hypothesis which needed testing:

But did those "Eurodollar events," as {Jeff} Snider calls them, occur because of the power of the Eurodollar markets (which now Snider says aren't even dollars anymore, just credit claims to dollars) or because Bernanke and Yellen are tied to the globalist cabal that built the Eurodollar system in the first place during the rebuilding of Europe under the Marshall Plan?This "Shadow Banking" system became the tail wagging the Fed's dog. It was only because of entrenched market structures that supported and perpetuated this perceived power. In other words, was Snider's Eurodollar thesis built on an independent or dependent variable? And is all he's done is rightly described market conditions of a past that no longer exists today?

Because of this inherent bias in the data (one where Eurodollars are supported by LIBOR and a willing Congress/FOMC) it has trained a whole lot of investors to analyze markets based on that assumption and believing it is a FACT incapable of change.

Then someone please explain why the Eurodollar futures curve just pushed 25-35 basis points in three trading days?

Still waiting.

The only thing in Lagarde's favor is that US/German spread widened back out to -132 bps after flirting with -119. But, as always, she had to sacrifice the euro, which she did in grand fashion.

The US 2/10 spread continues to be heavy at -74 bps, to which a lot of 'bond gurus' look at and scream at Powell for. But that can easily be explained by US Treasury Secretary Janet Yellen, right now the most powerful person in the US government, putting her thumb on the scale of the yield curve by selling the US 2-year and buying the 10-year with the Treasury's General Account.

What if that 'data' is just as corrupt as the BLS's 517,000 new jobs? What if the market really does want to normalize the yield curve but Yellen won't let it, just like she won't let the world buy/trade Russian oil above $60 per barrel?

It's not like there isn't precedence for this stuff. But, no, that cannot possibly be, she wouldn't be that stupid.

Really. Janet. Yellen.

I told you there would be a rate shock at some point. I thought it would be on a big surprise rate hike from the FOMC after markets mispriced themselves into a corner.

I was wrong about that.

The Payroll Number is the data point that clearly has the markets waking up to the idea that they are mispriced. The US economy is not in a coma. It may fall into one later this year and likely only to be expressed in the 2024 data, but for now, the market is acknowledging that Powell's 'resting hawk face' should be the default position.

Bless My Data, Bless My Data!

This is what I came to understand in all of my explorations of these events over the past week. Salt this conclusion to taste:

As opposed to overplaying his hand, which is what 50 bps would have done, thanks to the benefit of hindsight, Powell slow-played his hole cards. He gave the markets exactly what they wanted.

And that brings to mind yet another obscure pop culture reference that regularly springs up out of the depths of my twisted mind:

This page from Dave Sim's Cerebus: Church and State tells the entire story here.

{editor's note: This, btw, is just one of the acts of depravity that Cerebus pays dearly for as the story goes on, for those interested. Cerebus is a monumental achievement of independent publishing and storytelling. A true masterpiece of the form.}

As opposed to preaching to the markets what he already knew Powell allowed the markets to think they were smarter than him and he waited for the data to come to him.

They are in shock today. The 'recession is inevitable' narrative that drove the mania for the Fed to slow down collapsed with one number, no matter how 'goalseeked' that number. The important thing to remember is that nearly all the numbers are 'goalseeked' to fit someone's preferred narrative.

This is why in this environment I focus more on policy than data. The data is close to useless unless you understand its political importance.

Given the depth of the bloodletting of the past few days I would say we finally got that moment where a whole new tranche of the market moved down to the next step in the Kubler-Ross model about the Fed and it's desire to end the days where it is the risk markets.

If you compare Powell's comments and policy projections with Lagarde's you will see the entrenched ideological split between them.

Powell is absolutely committed to returning risk assessment to the private economy through the banking sector. He may be close to done with rate hikes, though I sincerely doubt it, but he's only just getting started with QT (shrinking the Fed's balance sheet).

And now he has a blow off top in US 10 year debt with this week's big round trip in yields with which to actively sell into and begin shrinking the 2/10 spread, once Yellen runs out of money. The market now has data it can use as an excuse to believe Powell about the economy and shift its thesis.

It gives him, as I said in a Patron-only Market Report on Wednesday, optionality in March to go 25 again and show confidence in the economy or go 50 and really force the Eurodollar system into submission.

Game, Set, Match, Powell.

As electrons swimming in a sea of countervailing forces, we crave certainty by fixing ourselves to an idea or a position. Once you do that, however, it becomes that much easier for you to be observed and fixed by those who are the real threat to you. Staying nimble intellectually makes it easier to remain calm emotionally.

The real lesson here isn't Cerebus' note about regretting what you wished for, but rather having high expectations of low quality data obtained within artificial boundary conditions which can't hold back the truth.

Reprinted with permission from Gold Goats 'n Guns.