David Stockman's Contra Corner

March 29, 2025

It should be obvious by now that the Donald's north star is "winning" and nothing else, and that he keeps score by whatever metric is handy. On trade, the scorecard is simply the bilateral merchandise trade balance of whichever country comes to mind at any given moment, and, crucially, whether the balance figure has a plus or minus sign in front of it.

That's been the sum and substance of Trump's trade philosophy ever since he started opionating about the issue in the national media in the 1980s. Yet even though "winning" has its virtues in sports, tiddlywinks and many other aspects of life, the bilateral trade balance with each of the 193 countries which buy or sell goods of some type or another in the USA is about the closest thing to meaningless statistical noise as you can find.

For instance, by the Donald's standard the US appears to be beating the shit out of the 20 small countries listed below. In 2023 US exports to this group were 10X larger than imports from them, meaning that America was "winning" big time: The combined trade surplus of +$4.1 billion represented fully 83% of the two-way turnover with these countries.

As is evident in the chart below, however, these "losers" on the Trumpian game board had almost no exports to the US. That's because apparently the American markets for seashells (Micronesia), molasses (Belize), coconuts (Samoa), root crops (Tonga), rum (Barbados) etc. are just not that large.

At the same time, there is also a bit of hidden cheating in the bulging US export stats. To wit, some of these countries appear to have a strong affinity for "buy America" because, well, they are mandated to make purchases exclusively from the US owing to stipulations of the USAID and food for peace programs!

That is, it was US taxpayers who actually bought some of these "exports" in behalf of the 20 small fry listed below.

In any event, the combined $4.1 billion US surplus with these nations amounts to just 0.1% of the $5.1 trillion of total US trade turnover with the world and barely 0.01% of GDP. So that's a "win", but one that is most surely irrelevant to most everything.

U.S. Merchandise Trade with 20 Small Countries, 2023 ($millions)

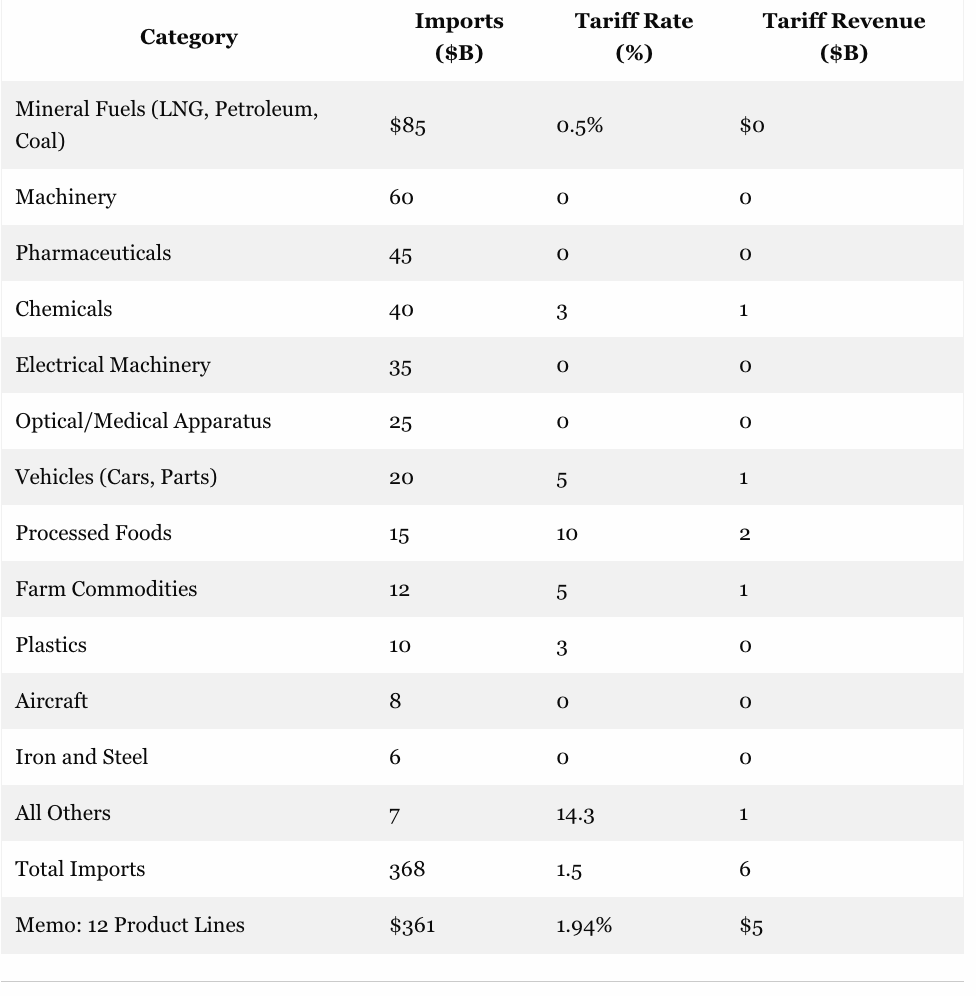

Then again, here is the box score for America's largest 20 trading partners. The total turnover was $4.0 trillion in 2023, representing 77% of America's two-way trade volume with the world. Yet, in Trumpian terms, this group is chock-a-bloc with American trading losses.

In fact, the US had very large trade deficits with 13 of its 20 largest trading partners, with each generating negative balances of $45 billion or greater. These major deficit countries included the EU-27, Mexico, Canada, China, Japan, South Korea, Vietnam, Taiwan and India, and when you add in four more countries with which the US had significant trade deficits in 2023, the total score was decidedly lopsided.

To wit, the 13 large deficit partners sent $2.47 trillion of imports to the US, while buying only $1.27 trillion of exports from America. Consequently, the trade deficit with these 13 nations was $1.20 trillion or fully 32% of the $3.74 trillion of total trade turnover.

By contrast, the seven largest countries with which the US had surpluses didn't amount to that much in the scheme of things. US imports from these countries totaled $88 billion while US exports to them posted at $161 billion.

So that brought about a $73 billion surplus or "win". Yet total trade turnover with these surplus countries amounted to just 4.8% of the US worldwide trade turnover in 2023, while the surplus amounted to just 0.3% of GDP.

Importantly, the "all other" nations category shown below, which represents about 170 smaller countries, also generated a net surplus on the US trade account of $87 billion, representing 11.3% of total trade turnover of $2.16 trillion with these countries.

US Trade With Top 20 Trading Partners and Worldwide In 2023 (billions)

Needless to say, the data in the two tables above raises some fundamental doubt about the Donald's theory that America's giant trade deficits are owing to a world market which is crawling with foreign cheaters and unfair tariffs. It turns out that in one and the same world, the US has giant deficits with essentially a baker's dozen of countries (13) and a modest net surplus with the balance of 180 or so countries with which American companies do business either buying or selling merchandise goods.

In a word, the 13 big deficit countries ($1.2 trillion) accounted for 72% of total US trade turnover (imports + exports). The rest of the world, by contrast, accounted for $1.44 trillion or 28% of US worldwide turnover but generated a $150 billion surplus or 10% of total turnover.

So the question recurs: Are all the Bad Guys that Donald Trump rails about mainly in the 13 biggies listed above, while the balance of the 180 countries of the world are generally fair traders, as measured by the US surpluses (on net) with them? Or is the story considerably more complicated?

We will go with the more complicated route, but do so by dividing the question in two:

- Is the alleged cheating mainly a matter of tariff barriers that could be countered, at least in theory, on a tit-for-tat basis as per Trump's pending April 2nd reciprocal tariffs?

- Or does the problem mainly lie outside of the tariff arena-either in NTBs (nontariff barriers) abroad or counterproductive economic and monetary policies at home?

What we can show below regarding the first question is that whatever the degree of "unfair" trade that may exist in the world market today, it is not owing to tariff barriers. The Donald's rants about 350% dairy tariffs in Canada or 10% automotive tariffs in Europe or 50% motorcycle tariffs in India, are simply a case of "gotcha" argumentation. In fact, these horror stories either do not actually exist or are largely irrelevant to the big picture.

In this context we should also note that "unfair" foreign tariffs would largely impact US exports by pricing US goods out of home markets, whereas unfair NTBs such as lavish government subsidies, tax credits and regulatory protections of domestic exporters would tend to swell US imports from foreign countries.

To be sure, foreign export enhancing NTB's could in theory be compensated for by quantifying their value to foreign exporters and adding that to the Trumpian reciprocal tariff, as some in the administration have suggested. Yet attempting to quantify and defend the incorporation of NTBs in the reciprocal tariff levies would be a process nightmare of epic proportions, even as it would fill the Swamp with massive new opportunities for corrupt lobbying and grift.

For present purposes, however, we can start with the tariff practices of the 13 bad guys in the table above. In 2023 the US had exceedingly large deficits with two of the biggest, Mexico and Canada, where the combined trade deficit was a staggering $321 billion or 22% of the $1.45 trillion of total trade turnover with the two countries on America's border.

Then again, the case that these unbalanced outcomes were NOT caused by tariff barriers is straight-forward and totally undebatable. To wit, owing to the Donald's own USMCA (nee NAFTA) not one dime of tariff was levied by Canada or Mexico on the $564 billion of US exports to these countries.

So, yes, there was a huge trade imbalance, but tariffs have absolutely nothing to do with it-even as the Donald never stops ranting about Canada's 150% to 350% dairy tariffs, for instance. But for want of doubt, here again is the information on the dairy TRQs that govern the export of US dairy products to Canada.

In 2024 Canada did not collect one single Canadian dollar or US dollar or even plug nickel of tariff revenue from US dairy exporters of the four leading dairy export products-fluid milk, butter, cheese and skim milk powder.

That's right. The tariff on US dairy exports of these four products was zero, nichts, nada and nothing, respectively.

And the reason for that lies in the so-called TRQs (tariff rate quota) that the Donald himself negotiated with the Canadians in the course of attaining his ballyhooed USMCA deal in 2020.

These TRQ arrangments, of course, are Rube Goldberg devices of the kind that anti-free market govenrment bureaucrats love to tinker with, and the Donald's were no exception. So what they negotiated was a "tariff free" amount of US dairy export volumes up to a specified quota level, after which the huge Canadian dairy tariffs the Donald keeps referencing in his trade rants would become effective.

These TRQs, in turn, were to be phased in over six year-so by 2024 they were almost fully effective. Yet on the four leading dairy products listed in the table below, US export volumes did not reach the quota level in any of them. Therefore, no tariff was applied to nearly 71 million pounds of US dairy exports to Canada last year, meaning that the Donald keeps ranting about a problem that he had already fixed himself!

For instance, consider the largest category, which is fluid milk right off the cows' teats: The Trump quota was 91.9 million pounds but US exports in 2024 amounted to only 34.7 million pounds or 37.7% of the allowable amount that can come in tariff-free. And in the case of cheese, the ratio was much closer at 95.6%, but still no tariff cigar; and so on for butter and skim milk powder, as well.

In all, the Donald's own quota amounted to 136.9 pounds in 2024, but US exports only reached 70.5 million pounds or half of the quota on these four products. So the remaining headroom under the quota for Wisconsin or New York state dairy farmer supporters, as the case may be, is considerable.

2024 Application of Trump's TRQ Deal To Four Leading US Dairy Exports to Canada

And yet, this isn't even the half of it. As it happens, the average value of these US dairy exports in 2024 ranged between $0.50 per pound for fluid milk, to $1.20/lbs for SMP, $2.00/lbs for cheese and $2.50/lbs. for butter. The long and short of the math, therefore, is that America's tariff-free dairy exports to Canada in these four categories amounted to $83.7 million in 2024, which, in the scheme of things, is not even a fly on old Bessy's ass.

As it happens, during 2024 US goods exports to Canada totaled $349 billion and goods imports from Canada were $413 billion, leaving a merchandise trade deficit of $63 billion. So the dairy piece of the picture is a mere pimple. The export figure for the four products analyzed above amounted to just 0.02% of total US exports to Canada.

The story is nearly the same on the next biggie-the $158 billion US deficit with the EU in 2023, which deficit amount to 21% of the $750 billion of two-way trade with Europe. Here again, the Donald rails about the 10% EU tariff on autos and farm products, but, alas, that's only part of the picture.

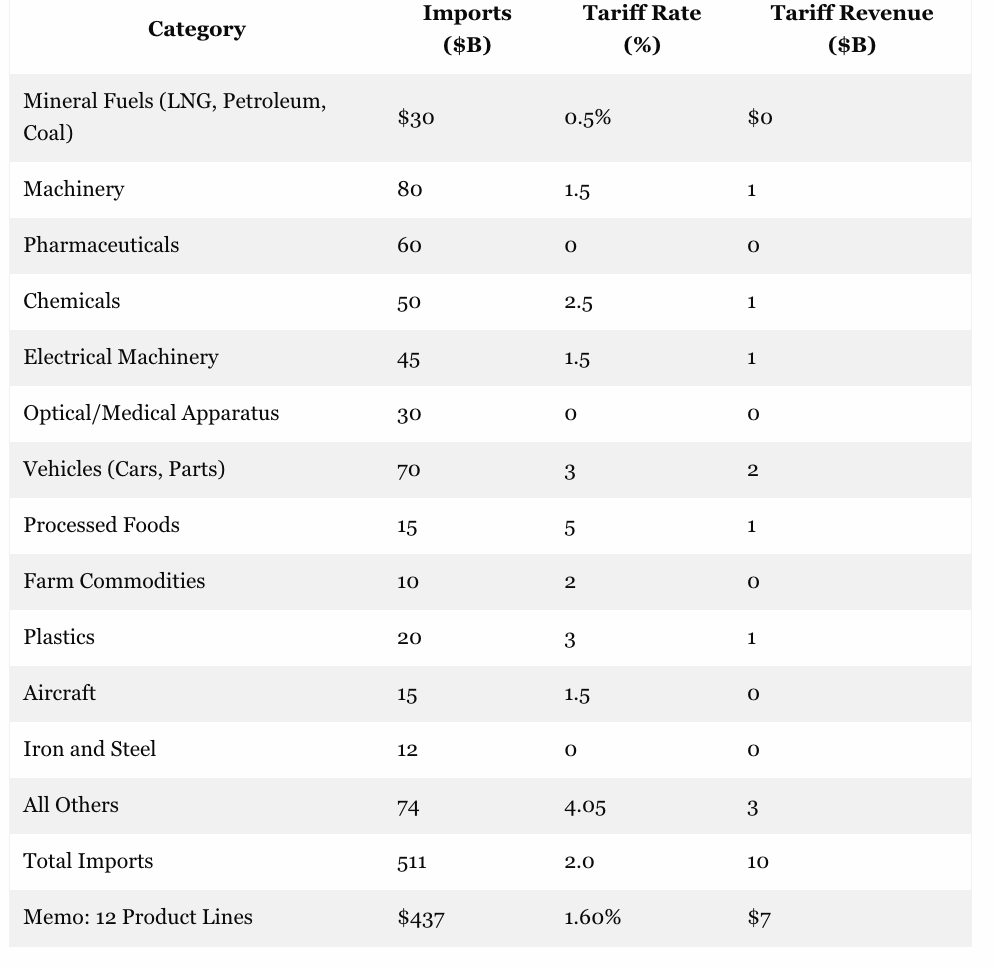

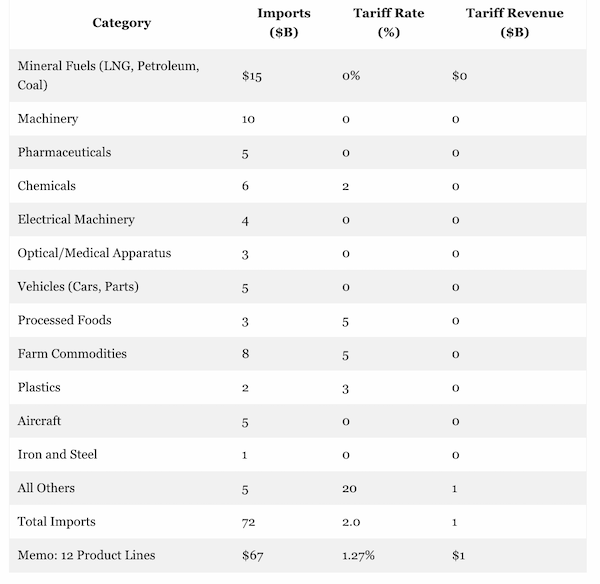

On an overall basis, in fact, the average EU tariff rate on imports from the US was just 1.5%. That's because in the largest categories of imports from the US-LNG, petroleum, coal, machinery, pharmaceuticals, electrical machinery, and optical/medical equipment- tariff rates are essentially zero.

Even in the case of the $20 billion of "vehicle" imports from the US it turns out that the average tariff rate for this product class was just 5%, not the 10% that the Donald is always ragging about. That's because other items recorded under the "vehicles" heading-auto parts, trucks etc-have modest tariffs of 2-4%.

Likewise, in the scheme of things US processed food and farm commodity exports to the EC are not large at $27 billion or 7.3% of total imports from the US, albeit the tariff levels are 10% and 5%, respectively.

Still, on the $368 billion of EU imports from the US in 2023 import duties amounted to just $6 billion--a figure which can hardly be considered a serious "tariff barrier" to US exporters.

EU Imports from the United States, 2023 (Billion $)

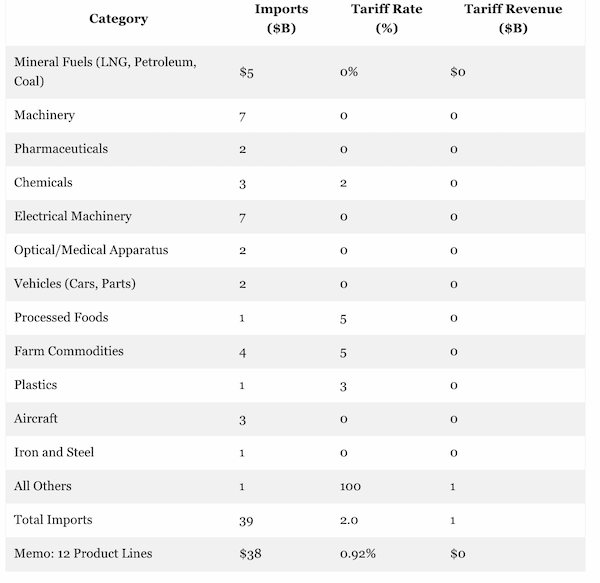

The table below shows the same 12 product categories for US imports from Europe, which in total amounted to $511 billion in 2023. Again, much of the trade was taxed at zero or negligible levels, including farm commodities at an average of 2.0%.

The only significantly higher US tariff is the 25% duty on pick-up imports, which still result in an average vehicle category tariff of 3% owing to the fact that passenger cars are tariffed at 2.5% along with low charges for auto parts, as well. Consequently, the average US tariff on imports from Europe was 2.0%, which generated about $10 billion of duty collections.

The most salient feature of the two charts, however, is the average for the 12 itemized product categories. That is, the 1.94% average tariff imposed by the EC on imports from the US (shown above) was barely a tad higher than the 1.60% average tariff (see below) imposed by the US on the identical slate of products coming in from Europe.

U.S. Imports from Europe, 2023 (billions $)

Needless to say, any notion of a reciprocal tariff with the EC wouldn't amount to a hill of beans based on the above numbers. For instance, if the levy were based on all imports, the US would actually owe the EC a payment equal to 0.5% or $2.5 billion on EU imports into the US of $511 billion. Or if it were imposed only on the 12 identical products, Europe would owe a reciprocal fee of 34 basis points or $1.2 billion.

Either way, of course, these figures amount to nothingburgers. Indeed, the whole idea of a reciprocal tariff is pure nonsense if applied to the actual tariff rates of major trading partners. Indeed, even in the case of the mercantilist oriented partners in Asia, there simply isn't any factual basis for the Donald's misbegotten tariff-barriers theory.

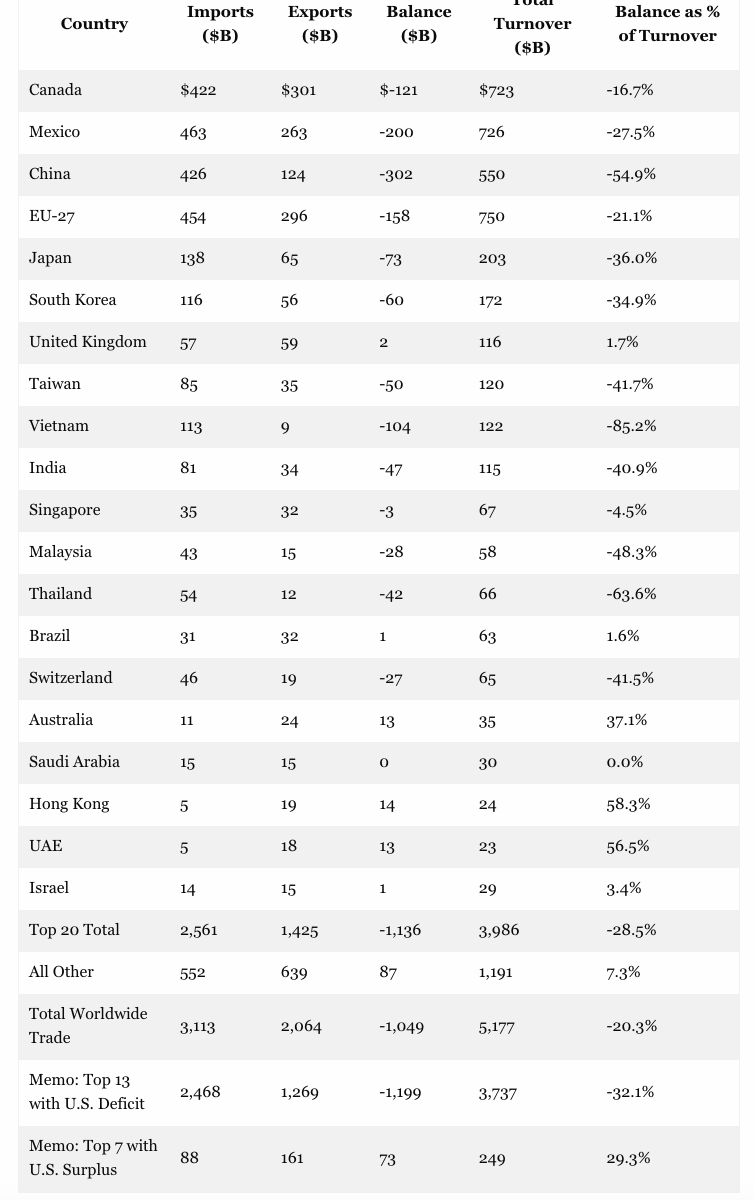

For instance, here is the data for Japan's imports from the USA. Most of these imports are tariffed at zero, and average 1.5% across all commodities. Again, processed foods and farm commodities are a bit higher at 5% and 10%, respectively, but the weighted average of 1.5% for all products is actually lower than the average US rate of 2.0%.

Still, the loud White House squawking about Japan's 700% tariff on rice is largely irrelevant. It's a sore thumb aberration owing to Japan's rice culture and the dominance of agricultural interests in its political system. But the rice tariff and a few other outliers on import volumes too small to even show up in the table below do not remotely account for the chronic US trade deficits with Japan.

Japan Imports from the United States, 2023 (Billion)

Nor is Japan an aberration among the so-called mercantilist exporters of East Asia. In the case of South Korea, the same pattern prevails: Most of the $72 billion of imports purchased from US suppliers was tariffed at a zero rate, with a 5% rate for farm commodities and foods.

Again, were the Donald's reciprocal tariff to be applied on the entire slate of merchandise trade, the US would owe an equalization fee to South Korea. Based on the numbers for 2023 for the 12 common categories, that would amount to 33 basis points or the trivial sum of $0.2 billion.

South Korea Imports From The United States. 2023 (billions $)

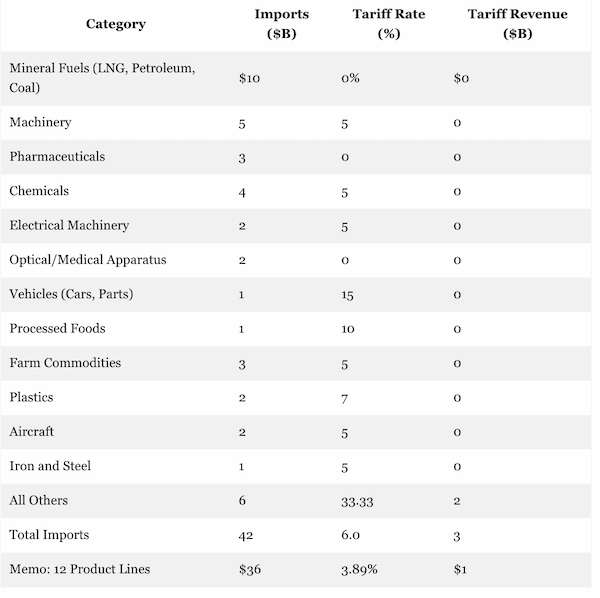

The chart for Taiwan below, reinforces the pattern. The only material tariff on the 12 major product lines is, again, that on farm commodities and processed foods.

Overall, therefore, the effective Taiwanese tariff on the $39 billion of imports purchased from US suppliers was 2.0%, which is exactly the same rate as the US applies to its foreign imports. Of course, no reciprocal tariff would be owed by either side under the Donald's impending new global trade regime.

Taiwan Imports From the United States, 2023 (billions $)

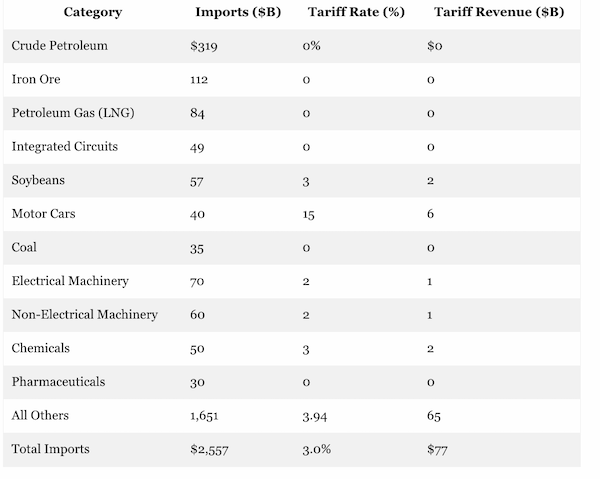

In the case of India's $42 billion of imports from the US in 2023, the tariff rate was slightly higher than the global norm, posting at 6.0% for all products and 3.89% on the 12 common product categories used in this analysis.

In this context it needs be noted that the ballyhooed 50% India tariff on motorcycles doesn't make any difference to the overall two-way trade, where India's exports to the US at $81 billion tower far above the $42 billion of imports from the US shown below.

The fact is, the motor cycle markets are vastly different between the two countries and the US just doesn't make rides that are suited to the large India market. That is to say, a high tariff on products that US based factories do not make is not a cause of the 2:1 import/export imbalance in the US trade accounts with India.

As it happens, India's motorcycle market is the world's largest by volume, with around 17-20 million units sold annually. It's dominated by small-displacement bikes (100cc to 250cc), which are affordable, fuel-efficient, and suited to India's infrastructure and consumer needs.

This 100cc-150cc market it dominated by Hero Splendor and Bajaj Pulsar, which make lightweight bikes in the 100-150 kg weight range-with 10-25 horsepower, top speeds of 80-120 km/h and mileage of 50-70 km/liter. These are commuter-focused bikes which are priced in the $1,000-$2,000 USD range and mass-produced locally in India based on vast economies of scale.

By contrast, the U.S. market is much smaller (547,000 units sold in 2023) and skewed toward larger, premium bikes and "hogs". These rides come with 600cc-1800cc engines (e.g. Harley-Davidson Street Glide, Indian Chief). The typical bike weigh 3-4X more than India's bikes, sports 70-120 horsepower and is built for highways and leisure.

These American bikes also get far lower lower mileage at 15-20 km/liter; cost 10-15X more at $10,000-$30,000 USD; and target leisure-time enthusiasts, not mass commuters. The principal US manufacturers- Harley-Davidson (Wisconsin), Indian Motorcycle (Polaris, Iowa/Minnesota), and smaller players like Zero (electric, California)-simply have no product offering suitable for the India market, high tariff or not.

India Imports From The US, 2023 (billions $)

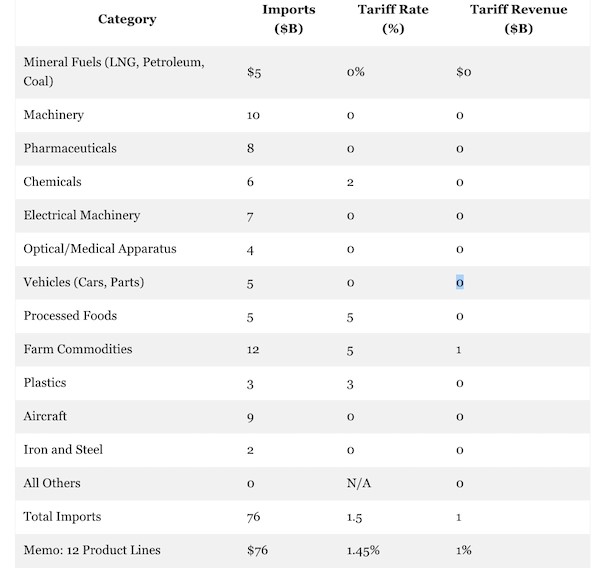

Finally, even in the case of China there is undoubtedly a whole lot of communist economics-based cheating going in its trade imbalance with the US, but its not owing to tariffs on US imports to China.

The only thing that China tariffs heavily is motor cars, but given the immense size of the local market, neither the US Big Three, the European majors or Elon Musk have attempted to import their way into this giant market. Instead, from the get go they have chosen to build locally owing to cheap labor, adjacency to the retail market and communist manipulation of the retail licensing and sales process.

But that's not a tariff barrier, either. The very different problem of trading with a state-dominated communist economy won't be solved by reciprocal tariffs in any event.

China Imports from Worldwide Trade, 2023 (Billion)

So, hey, folks get ready for either a trade Demolition Derby or a giant fissile on April 2nd. That's when the Donald's swell new plan for a "reciprocal tariff" with our trading partners is slated to be implemented, but as evident in the above the loudly mentioned skipping of the April Fools date for its inception may prove to have been driven by a lot more than PR or superstition.

Indeed, the Donald's whole enchilada of "reciprocal trade" has surely arisen out of ignorance of the facts and a twisted view of global trade. As we indicated at the start, Trump erroneously believes that the trade balance with any country is a measure of winning or losing, and that a deficit proves nefarious actions and cheating by the other side-so, not surprisingly, his press secretary was hammering away again yesterday at this false theme:

"If you look at the rates of tariffs across the board that Canadians have been imposing on the American people and our workers here, it is egregious," said White House Press Secretary Karoline Leavitt in response to reporters claiming the tariff threats coming from President Trump are 'egregious.'

Referring to a tariff chart, Leavitt went on to highlight how American cheese and butter already face a nearly 300% tariff, and further referred to other countries like India imposing a 150% tariff on American alcohol. Japan imposes tariffs on rice at a shocking 700%.

"President Trump believes in reciprocity and it's about dang time that we have a president who actually looks out for American business and workers," she furthered. "All he's asking for at the end of the day is fair and balanced trade practices and unfortunately Canada has not been treating us fairly over the last several decades."

Needless to say, the Trump fanboys are repeating the same erroneous refrain, as per below from Jesse Waters at Fox News:

Trump is purposely being unpredictable. He's trying to throw off trading partners to keep them on the defensive so they don't know where he's coming from and come to the negotiating table faster."

It appears that his chief economic adviser, Kevin Hassett, and others successfully lobbied Trump to abandon his campaign pledge for an across-the-board tariff on all U.S. trading partners, and to opt instead for reciprocal trade plan that would allow room for other nations to negotiate lower tariffs with the U.S., according to people familiar with the discussions.

But pursuit of reciprocal trade would be a giant waste of time and completely unimplementable in the real world. It would likely just incite a global trade war and economic demolition derby beyond imagination.

Actually, if the Donald is bound and determined to have a tariff, then he should go back to an across-the-board levy on all imports from anywhere on the planet and call it a "Revenue Tariff" just like those of the 19th century.

Reprinted with permission from David Stockton's Contra Corner.