By David Stockman

David Stockman's Contra Corner

December 10, 2025

Here they go again ! Trump 2.0 is chugging down the same dubious path as Trump 1.0, fixing to shower crony capitalist speculators with massive windfall gains via a public offering of the shares of Fannie Mae and Freddie Mac (GSEs or Government Sponsored Enterprises).

Uncle Sam, of course, is the proud owner of these two economic mutants owing to his insensible $180 billion bailout 17 years ago. So, apparently, the time is long overdue to reverse the trade so that Wall Street can have another joy ride at the taxpayers' expense.

And we do mean at taxpayers' expense. After all, without Federal guarantees these giant mortgage mutants are essentially worth nothing at all, as we amplify below.

President Trump and his appointees have spent months teasing a blockbuster stock offering of Fannie Mae and Freddie Mac that could partially free the mortgage giants from government ownership and reap billions of dollars.

Commerce Secretary Howard Lutnick said the administration is "well down the road on getting a deal done" in a CNBC interview Wednesday.

Still, this development is not surprising. Just like last time, the Donald has filled his second administration with Wall Street speculators the likes of Scott Bessent and Howard Lutnick-neither of which have a clue about the real economic ills (rampant inflation owing to debt and money-printing) that fueled the Donald's fluke return to the Oval Office.

In fact, they are so clueless that they apparently believe that revving Freddie and Fannie will be a boon to homeowners and a blow towards relieving the main street affordability crisis. But their eager championing of a Freddie/Fannie IPO will do nothing of the kind: It's an out-and-out gift to a handful of billionaire speculators and nothing more. It amounts to a crony capitalist stink bomb.

Needless to say, the Wall Street hedge fund buddies of Bessent and Lutnick are surely tickled pink. Ever since they scooped up their shares for pennies on the dollar more than a decade ago after these government sponsored mortgage giants went bust and were bailed out, a posse of hedge fund racketeers led by Bruce Berkowitz of Fairholme Capital, Bill Ackman of Pershing Square, John Paulson, Carl Icahn and several others have been conducting an all-out shakedown campaign to reverse one of the few things that the Obama Administration did correctly.

That is, it had the common sense to recognize that Fannie and Freddie are nothing more than branch offices of the US Treasury and that therefore the wholly artificial "profits" they book are 100% derived from the sovereign credit of the United States government, and therefore such "profits" should be swept periodically and repatriated to the Treasury from whence they originate.

After all, Freddie and Fannie do not generate any true economic value added. To the contrary, they merely package and warehouse privately generated mortgages, while funding these "assets" at the slightly cheaper rates that flow from its US Treasury guarantees. That is, Freddie and Fannie book a simulacrum of economic profits by skimming a tiny spread between the yield on a portfolio of privately issued and priced mortgages and a funding cost based the US Treasury debt yields.

Of course, if they were a regular department of the US government, which bought or guaranteed trillions of the very same private mortgage paper, the very same spread would accrue to the Uncle Sam directly with no muss or fuss about "profits". Indeed, that's why the Obama folks said this spread should be dividended back to the Treasury via a periodic sweep without all of the rigamarole of pretending to be a private company pretending to book real profits.

Nevertheless, the Wall Street hedgies have been sitting for more than a decade upon the common and jr preferred stock they originally scooped up for the aforementioned pennies on the dollar. They have undoubtedly been treating these holdings as a virtually cost-free options to be exercised when a team of either stupid or venal knaves finally arrives in the Oval Office. They were almost there during the first Trump Administration but failed to get the IPO over the finish line, and then struck out completely with the Biden team.

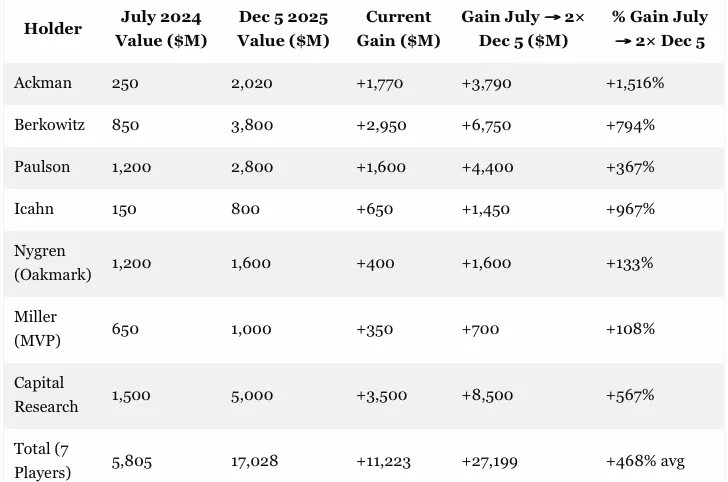

So now they are back for another go-around. As shown in the table below, seven principle speculators owned what was $5.8 billion of combined Fannie/Freddie common and preferred shares as of mid- 2024. But once it became increasingly evident that the Donald might get a second go at the White House, punters began to bid up the shares. And then momentum really traded up big time after January 20th when the Donald chose Wall Street water-carriers to head both the Treasury Department and the Commerce Department.

Accordingly, Fannie/Freddie holdings of the seven hedge funds had reached$17.028 billion by December 5th, representing a cool 193% gain since Joe Biden fell asleep at the mic during this TV debate with the Donald. Moreover, if as part of a highly promoted IPO the Freddie/Fannie stock doubles again from here, the gain among the seven hedge funds would amount to a staggering $27.2 billion.

That would amount to a 468% increase in barely two years if the IPO were to occur next spring, and amount to windfalls of the following amounts for the major billionaire speculators in these securities:

- Ackman: +$3.8 billion.

- Berkowitz: +$6.8 billion.

- Paulson: +$4.4 billion.

- Icahn: +$1.5 billion.

We'd dare say that if this were to become known, the universal chorus rising up from MAGA Hat land would be something different than "we voted for this!"

Prospective Windfall Gain From Fannie/Freddie IPO Top Seven Hedge Fund Speculators.

Notes:

- All $ values combine common shares + junior preferred shares (Fannie Mae + Freddie Mac) for each holder, based on Q3 2025 estimates and Dec 5, 2025 OTC pricing.

- July 2024 JPS (junior preferred stock prices were much lower (~$3-6/share avg), contributing to the explosive gains.

- The "Gain July → 2× Dec 5" assumes both common and JPS prices double from Dec 5 levels (conservative, as JPS often trade closer to par on strong news).

Of course, we don't object to anyone making a multi-billion profit if it is earned honestly on the free market and comes from generating the economic value added that is a necessary condition for market rewards of that magnitude. But the windfalls at hand are the very opposite: they are the rotten fruit of crony capitalist corruption of the public purse based on the typical statist nonsense that the US home mortgage market would not provide 30-year mortgages to middle class homeowners at a fair price without the guarantees provided by these GSEs.

The truth is, there never was any good reason for the $188 billion bailout back in 2008 by the earlier Goldman fraudster, Treasury Secretary Hank Paulson. Both companies should have been bankrupted and liquidated at the time, and their preferred and common equity should have been dropped into the paper shredder.

The fact that these so-called GSEs have been booking billions of accounting profits ever since they were nationalized has absolutely nothing to do with capitalism, value-added or business acumen. Freddie and Fannie make money because they get to use the taxpayers credit card practically free of charge, and then conduct one of the most blatant arbitrage cons ever invented.

To wit, they stamp what amounts to a government guarantee on trillions of mortgages and then collect a fee for doing nothing except putting taxpayers in harm's way. Likewise, they also borrow massive amounts of money in the bond market at virtually the US Treasury's "risk free" borrowing rate, reinvest the proceeds in higher yielding packages of securitized mortgages and then pocket the spread as "profit".

C'mon. Anyone not bamboozled by beltway cant regarding the purported elixir of subsidized home mortgages can see that if Uncle Sam wants to play hedge fund speculator then at least he should collect the "profits" from trading on his own credit. Even Obama figured that out.

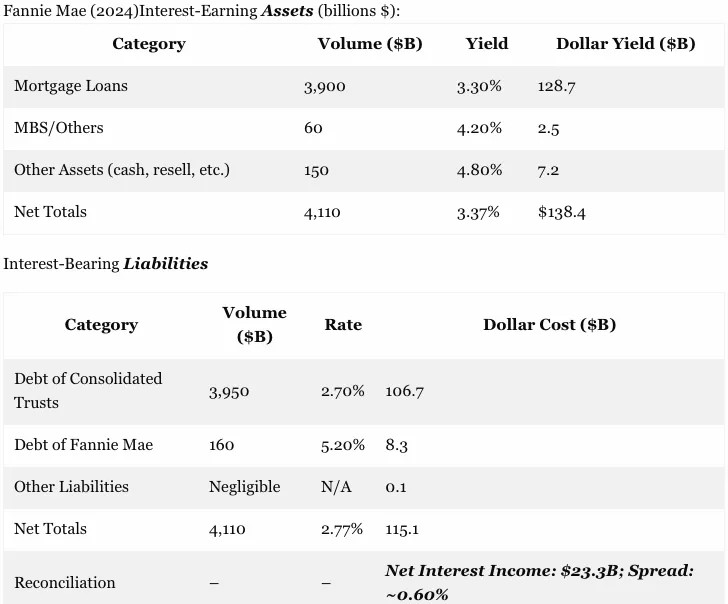

For want of doubt, here is a summary of the massive balance sheets of Freddie and Fannie and the interest earnings on the mortgages and mortgage-backed securities they scoop up, one the one hand, and the interest expense they incur on borrowings that track the US treasury yields nearly to the basis point save for a tiny GSE premium, on the other.

To summarize the tables below, Freddie and Fannie on a combined basis held about $7.412 trillionof whole mortgages and (mainly) mortgage-backed securities in 2024, which earned a weighted average yield of about 3.46% or $256 billion.

That's right. These mortgage paper warehouses are so gigantic that even at a niggardly yield of 346 basis points they took in gross interest income of more than one-quarter of a trillion dollars!

At the same time, or course, their combined debts on the mortgage-backed securities and GSE debt issued to fund whole loans and other assets amounted to $3.354 trillion or 99.2% of their assets. These liabilities therefore generated $213. 2 billion of combined interest expense (Fannie=$115.1 billion, Freddie-$98.1 billion) or an average of 2.90%.

Accordingly, these giant mortgage warehouses earned a net interest spread of $23.3 billion and $19.7 billion, respectively, for a total of $43 billion. That spread, in turn, amounted to just 0.58% on more than $7 trillion of mortgages that fund upwards of 50 million owner occupied homes from coast-to-coast.

Stated differently, this is just a giant shell-game. The underlying market for home mortgages, funded one at a time, is the local bank and mortgage lending sector. Warehousing these trillions of debts from normal banking activities does nothing for the real output or wealth of the US economy. It's essentially a backdoor route to ever so slightly subsidizing the middle class homeowners because if local mortgage-making banks had to sell their loans to securtizing warehouses which weren't guaranteed by the US treasury, they would have to charge slightly higher mortgage rates to homeowners to earn a profit on their loans.

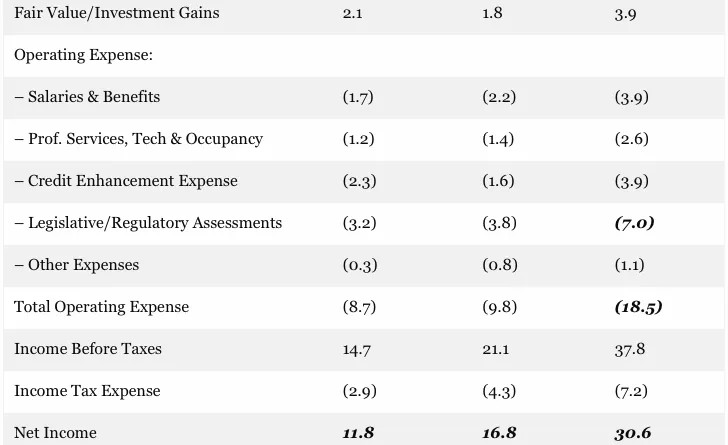

Needless to say, the income statements of Freddie and Fannie further expose the shell game. Over against their combined $52.7 billion of operating income in 2024, Uncle Sam levied charges of $16.6 billion for regulatory fees and the Federal income tax provision. Accordingly, the actual cash expense for payroll and staff ($3.9 billion), occupancy and outside services ($2.6 billion) and third party credit enhancement services ($3.9 billion) were the only real cost-added of their operations.

Stated differently, pretax profit would have been about $42 billion in 2024, representing a 57 basis points against the $7.4 trillion of assets. On the other hand, without Uncle Sam's sovereign credit rating Freddie and Fannie would easily pay 50 to 100 basis points more than the 2.90% they paid on its interest-bearing liabilities in 2024.

After all, at the present time the AAA corporate yield is 110 basis points higher than the 10-year US and 140 basis points higher than the AA corporate yield. It is highly unlikely, therefore, that a private mortgage warehousing operating at the scale of Freddie and Fannie would earn even a AAA corporate rating.

Accordingly, the implication is inescapable. To wit, a private home mortgage warehousing operation at the scale of Fannie and Freddie would be unprofitable on a pre-tax basis because its market-based interest margin would be far lower than the current 71 basis points of net revenue ($52.7 billion) and therefore would hardly even cover it modest operating expense of about 15 basis points ($10.4 billion).

In a word, the GSE's are a New Deal invention from the 1930s that would never work on a true free market basis. There simply isn't enough vigorish in the interest rate market to both cover the overhead cost of warehousing home mortgages and also provide even a scant subsidy margin to home-mortgage borrowers.

Combined Freddie/Fannie Income Statement (2024, $ in billions)

This point also makes clear that the Obama Administration's so-called dividend sweep of the GSEs was itself a fiscal con job. It is essentially amounted to borrowing off-budget via Freddie/Fannie's cheap borrowing cost and then depositing the resulting GSE "profits"as an off-setting revenue at the US Treasury. Alas, it you tried that in the private sector the US attorney for the Southern District of New York would be warming up a berth for you at one of Uncle Sam's hospitality suites.

Yet that's why the Trump 1.0 and hedge fund campaign to end the US Treasury sweep and "privatize" Fannie and Freddie was so galling. These shameless crony capitalists were hell bent on collecting the skim for themselves!

And since, the sweep was ended in September 2019, the prize has been steadily expanding. The retained earnings of Freddie and Fannie will have grown from zero in September 2019 to an estimated $180 billion by the end of 2025. Yet these GSE's don't really need any net worth because their debts are guaranteed by Uncle Sam and the 2008 bailout proves beyond a shadow of doubt that the politicians will not allow them to go under owing to unexpected or unplanned losses in the home mortgage markets.

So its doesn't take a tin foil hat or conspiracy theory to understand why the left-for-dead stock of Freddie and Fannie have been soaring since Mid-2024. There is $180 billion of accumulated profits sitting on the stump waiting to be distributed to shareholders after the IPO, and that's to say nothing of the on-going stream of phony profits which would accrue as far as the eye can see.

That's right. When the Treasury ended the Sweep under Trump 1.0, the phony "profits" of Freddie and Fannie per the analysis above became available to distribute to shareholders, causing the worthless paper issued at the time of the housing bust to rise to the levels seen in the OTC markets during 2024.

The only thing needed now, therefore, is a public offering of the shares and a release to allow Fannie and Freddie to distribute the profits that have been accumulated since the Obama Sweep ended. That is to say, Wall Street is breathing heavily for the hand-off of yet another sweetheart deal from Washington to speculators. That is, bald-faced gamblers who are pleased to call themselves turnaround artists and vulture capitalists-who then ride the next bubble with Federal guarantees, bailouts and junk debt-until they can cash-in on the comparatively meager capital they originally ponied up for the trade.

This has been going on for 30 years-since the S&L bust and subsequent windfall gains reaped by speculators who feasted on the flotsam and jetsam of Uncle Sam's $200 billion loss.

That is, a taxpayer enabled perpetuation of institutions that have no reason whatsoever for existing in the first place.

The simple economic truth is that government should be indifferent as to whether American families own or rent their castles. The decision to own or rent would be made by 115 million American households based on their best lights, not the inducements and favors of the state.

Markets would clear the interest price of mortgage debt and set credit terms and maturities consistent with the risks involved. Undoubtedly, rates would be a few hundred basis points higher and 30-year fixed-rate mortgages quite rare, and the Donald's idiotic idea of 50-year home mortgages even rarer than the proverbial white buffalo.

Likewise, homeownership rates might end up far different than the 69% level reached during the heyday of the mortgage boom or even the current post-crisis level of 63%.

In fact, in the prosperous land of Germany homeownership currently stands at just 53%, and in the equally affluent precincts of Hong Kong and Switzerland it is 51% and44%, respectively.

So what ? The true wealth and prosperity of society is not a function of the homeownership rate, and especially not one selected by pandering politicians of the type who pinned the disastrous 70% ownership goal on the wall during the Clinton-Bush era.

At the end of the day, having 40 million renter households and 25 million mortgage-free owner households provide (in their capacity as taxpayers) trillions of subsidized credit to upward of 50 million mortgage-encumbered households is unfair and arbitrary in the extreme.

This perverse arrangement, of course, is just another expression of the capricious and random shuffling of income among American citizens that is the trade craft of the Washington puzzle palace. If you want to drain the swamp in the present instance, therefore, there is a simple answer.

Kill Freddie and Fannie dead and allow contractual servicers to run-off their existing portfolios until the last GSE guaranteed mortgage has been repaid. If there is actually an economic need for a secondary mortgage market and securitization packager in the American economy, real capitalist entrepreneurs will invent it and charge market-clearing mortgage rates without any help from the nation's already burdened taxpayers.

So here is some unvarnished truth: The only "safe" Fannie is a dead Fannie.

We'd bet the Donald might actually understand that if he weren't surrounding himself with crony capitalist speculators like Bessent and Lutnick.

Reprinted with permission from David Stockman's Contra Corner.

Copyright © David Stockman