David Stockman's Contra Corner

March 30, 2024

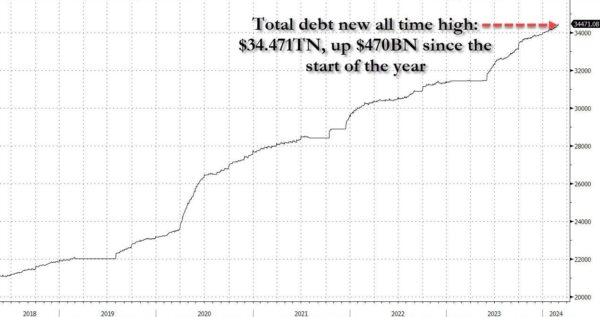

The federal debt has been recently increasing by $1 trillion every 100 days. That's $10 billion per day, $416 million per hour.

In fact, Uncle Sam's debt has risen by $470 billion in the first two months of this year to $34.5 trillion and is on pace to surpass $35 trillion in a little over a month, $37 trillion well before year's end, and $40 trillion some time in 2025. That's about two years ahead of the current CBO (Congressional Budget Office) forecast.

On the current path, moreover, the public debt will reach $60 trillion by the end of the 10-year budget window. But even that depends upon the CBO's latest iteration of Rosy Scenario, which envisions no recession ever again, just 2% inflation as far as the eye can see and real interest rates of barely 1%. And that's to say nothing of the trillions in phony spending cuts and out-year tax increases that are built into the CBO baseline but which Congress will never actually allow to materialize.

So when it comes to the projection that the 2034 debt will come in at just $60 trillion, we'll take the wonders any day of the week. The fact that it will likely be much higher also means that the Washington UniParty's prevailing fiscal policy path will lead to $100 trillion of public debt sometime in the early 2040s. And that means, in turn, that annual interest expense will then be greater than the entire federal budget during 2019.

Needless to say, neither Trump nor Biden has said, "Boo," about this looming calamity. Sleepy Joe has even had the audacity to brag that he has reduced the federal deficit by more than half.

Then again, the starting point for that ludicrous proposition is the Trumpian lockdown/stimmy fueled disaster of 2020 when the deficit hit an astounding 16% of GDP. That figure represented a larger burden on the US economy than the peak WWII deficits when America was actually fighting two real enemies, as opposed to Dr. Fauci's hyped-up super-flu.

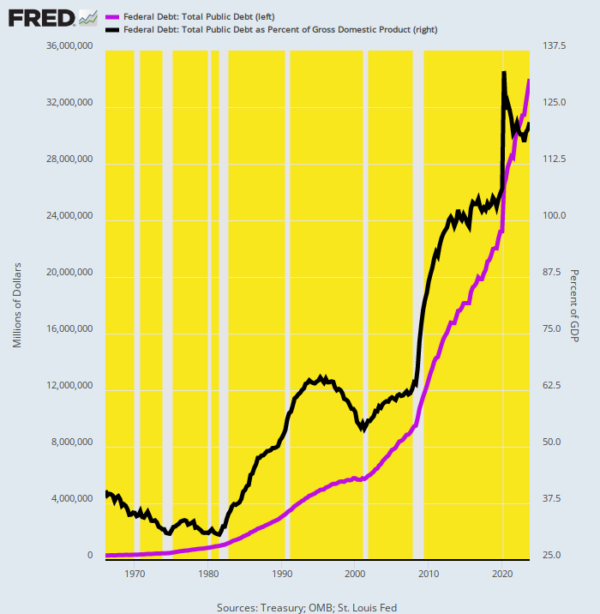

To be sure, ever since Nixon's perfidy at Camp David, when the US dollar's link to gold was canceled, the public debt and its share of GDP has been trending steadily skyward. But now it is literally going parabolic.

In 1970 the figure stood at $378 billion of public debt outstanding, which represented 34.9% of GDP. The latter percentage had peaked at about 120% at the end of WWII but had steadily marched downhill during the quarter century thereafter.

Yet since the dollar's anchor to gold was severed, the debt spree has been unstoppable. Massive and persistent Fed monetization of the public debt caused interest rates to be deeply repressed and falsified, thereby transforming the partisan battles over public debt that had contained fiscal deficits prior to 1971 into a complacent Uniparty consensus that the public debt doesn't matter much.

Accordingly, since then the public debt (purple line below) has increased by 90X to the aforementioned present level of $34.5 trillion - a gain far higher than the 25X rise of nominal GDP during the last 53 years. The burden on GDP (black line below), therefore, has returned to peak WWII levels, at 120%.

Public Debt Outstanding and % of GDP, 1970 to 2023

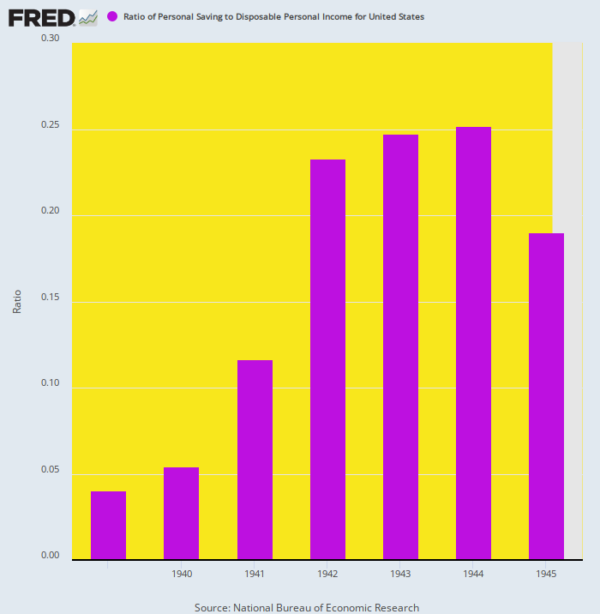

But the hoary idea floating around Washington that we lived to tell about it once, so we can do so again, is utter tommyrot. The great difference is that in 1945 there were virtually no consumer goods or services to buy, owing to the US economy's total mobilization for war. In fact, wartime rationing and conversion of industry to military production resulted in a soaring household savings rate that reached 25% of disposable income during the peak years of the war.

What happened, therefore, is that consumer debt got paid off, dropping by two-thirds during the course of the war. Business debt was also reduced sharply. Consequently, America essentially saved its way through the huge government spending and borrowing increases generated by the war effort.

In all, during the five war budgets of 1942 through 1946, the federal government spent $370 billion in mainly war outlays, of which nearly half or $180 billion was financed by a huge increase in forced savings (aka federal taxation). The federal tax take from national income actually tripled from 8% of GDP to 24% during the course of the war.

On top of that another $110 billion was financed from the huge increase in private savings depicted below and which was channeled into massive war bond sales to the public. Accordingly, just $80 billion or 21% of the massive war budgets were actually monetized by the Fed.

Household Savings as % of Disposable Income, 1939 to 1945

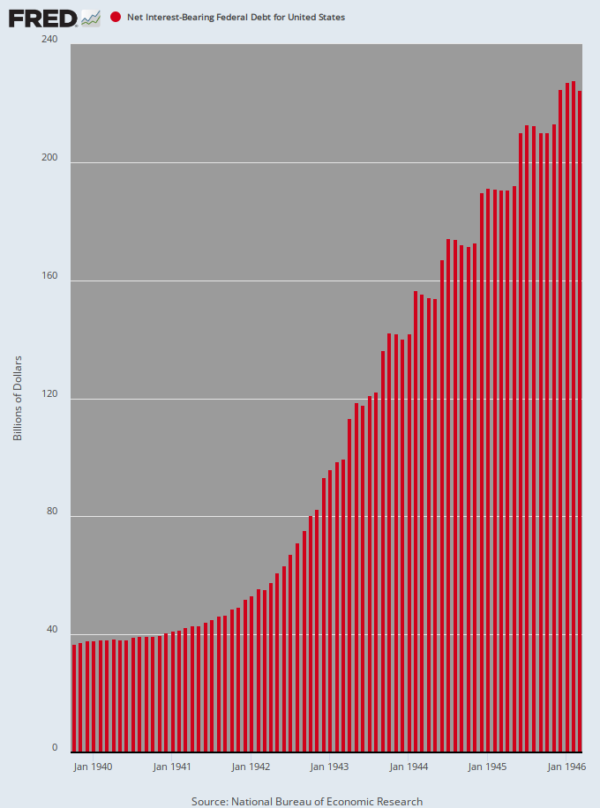

As a result of these factors, the $180 billion increase in war debt during 1939 to 1946 was accompanied by a virtual financial miracle. That is to say, the ratio of total public and private debt-to-GDP stood at 210% in 1938 but by the end of the war it had actually shrunk considerably to just 190% of GDP.

That's right. The greatest government borrowing spree in history until then was accomplished with an actual reduction of the debt burden on the US economy!

What happened, of course, was that wartime economic controls caused enormous amounts of private debt to be paid off, leaving immense headroom for absorption of the public debt by private savers.

Specifically, household debt shrunk from 60% of GDP in 1938 to just 20% by 1945, while corporate business debt dropped from about 90% of GDP to 40%. In all, therefore, private debt vacated a huge space on the national balance sheet, dropping from 150% of GDP in 1938 to only 60% by the end of the war.

And that's how the war debt was financed without massive monetization of the public debt. It was a one-of-a-kind wartime feat that is utterly irrelevant in today's financial setting.

Growth of Federal Debt During WWII

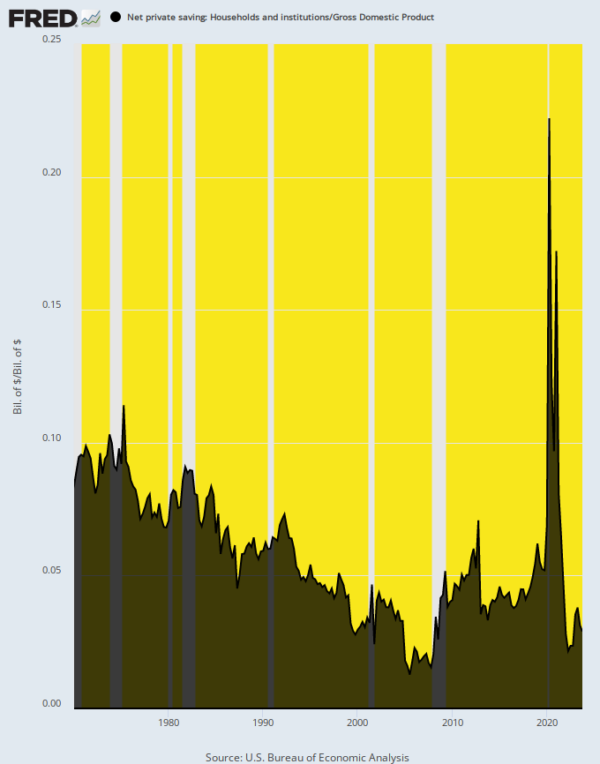

Compared to the WWII savings spree, America's current economy is actually built on the opposite - endless and rising accumulation of debt in all economic sectors. Among households, for instance, the savings rate is now at a rock-bottom post-war level of just 2.9% of GDP.

Aside from the aberration of the pandemic lockdown/stimmy period in 2020-2021, when households were flooded with government cash but had limited venues to spend it, the current savings rate is barely one-third of the level that prevailed prior to 1980.

Net Household Savings Rate, 1970 to 2023

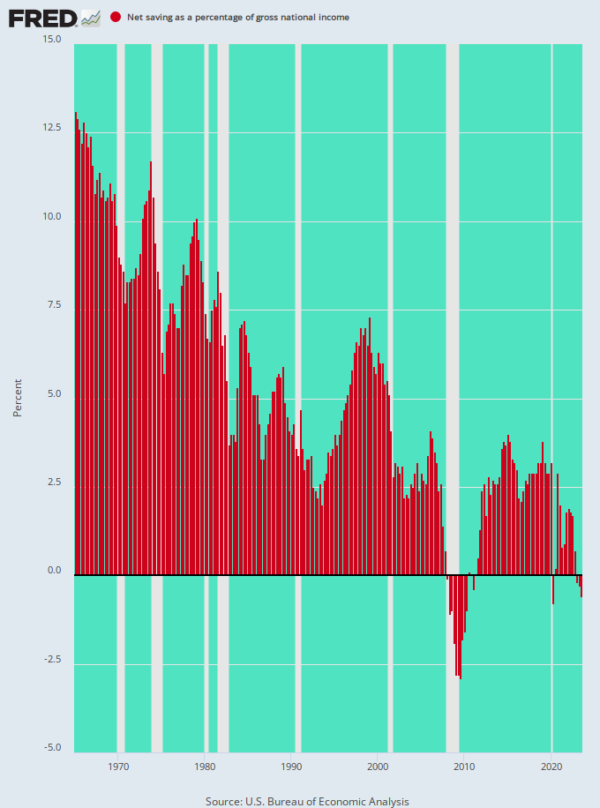

Needless to say, when private savings are falling and government deficits are continuous and rising, you can't escape the devastating math. To wit, the net national savings rate (private savings minus government borrowing) has been negative for the past three quarters, and will likely get far worse from here as annual government deficits once again head back toward the $3 trillion to $4 trillion mark.

Stated differently, unlike WWII, there is no headroom available on the nation's balance sheet to accommodate further chronic and large-scale increases in the public debt. And unlike during the early post war years when the net national savings rate was 10-12%, and thereby accommodated robust increases in private investment and real GDP growth, there is no chance whatsoever of "growing out" of current soaring deficits and debt.

Instead, what we have amounts to a financial doom-loop of ever lower economic growth and ever rising public debts from which there is no escape. And yet for all intents and purposes, that is the implicit fiscal policy of Washington's sleep-walking UniParty.

Net National Savings Rate, 1965 to 2023

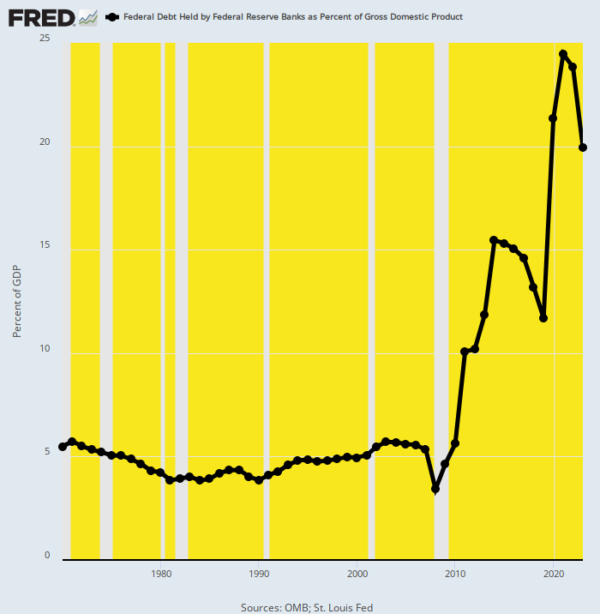

Of course, the sleepwalkers assume that there is an escape route via a restart of massive Fed monetization of the public debt. As the chart below shows, that is precisely what has delayed the day of reckoning for the past decade, as the Fed's balance sheet erupted from a historical 5% of GDP to upwards of 25%.

Alas, old-fashioned sound-money folks long ago warned that such an experiment in boundless money printing was certain to fail. Both asset inflation on Wall Street and goods-and-services inflation on Main Street, they reminded, would eventually get out of hand.

This surely has happened. In spades. The days of US Treasury borrowing on the cheap and easy, therefore, are over and done. The current drift toward relentlessly rising real interest rates and falling real growth means that a financial train wreck lies directly ahead.

Unless.... Unless the electorate comes to its senses in the next eight months and sends the UniParty and its pathetic presidential candidates packing next November.

In short, there is no way out of the current fiscal calamity unless the Empire is brought home and crony capitalist domination of the agencies of government - and most especially the Fed - is decisively ended.

Public Debt Held by the Federal Reserve as a % of GDP, 1955 to 2023

Reprinted with permission from David Stockman's Contra Corner.