David Stockman's Contra Corner

May 14, 2025

It might be all over except the shouting. We are talking about the last chance to meaningfully curtail the nation's headlong plunge into fiscal disaster. Since the Dems are hideously obtuse and feckless on the fiscal front, the only remaining hope was that the GOP would finally screw-up the courage to take sweeping bites out of Federal spending and borrowing in the process of enacting the Donald's "one big beautiful" reconciliation bill.

But it's now clear that won't happen, either. Not even remotely.

That's because over the weekend the House GOP even threw in the towel on serious Medicaid cuts. Yet Medicaid was the site of the last entitlement stand, so to speak, given that Social Security, Veterans and Medicare had already been given a hall pass by the Donald and the GOP congressional leadership.

So now a real red line has been crossed. That is to say, if the GOP is unwilling to rollback Medicaid to even its 2008 pre-ObamaCare level, then the white flag of fiscal surrender might as well be hoisted.

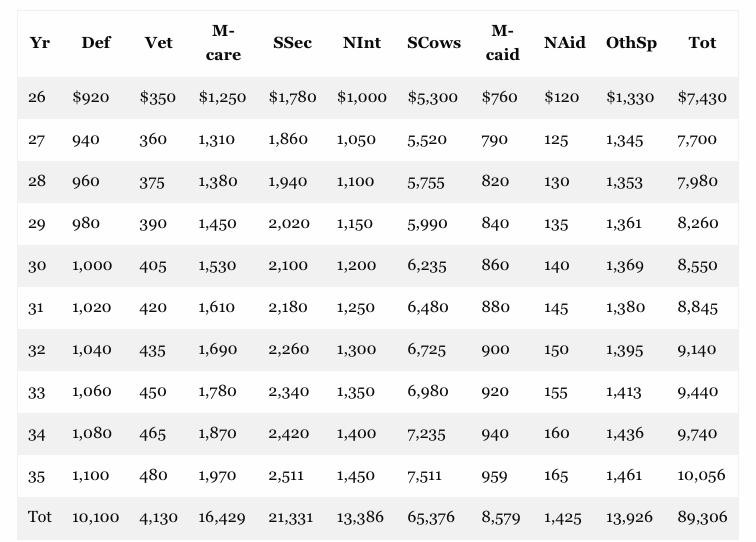

Indeed, the fiscal math is definitive. When you add defense and net interest to the entitlements exempted from the budgetary knife by the Trumpified GOP the result is that nearly three-fourths of the Federal budget has been ring-fenced as "sacred cows".

Moreover, in the case of the defense budget Trump is actually seeking a 13% increase to the already vastly bloated level of baseline spending in order to achieve the first ever $1.0 trillion annual DOD budget for FY 2026. That's twice or $500 billion more than would be needed for a true America First national security policy-based on $75 billion per year for an invincible strategic nuclear deterrent and a couple hundred billion more for an impenetrable conventional defense of the America's shorelines and airspace. All the rest of that great swamp of waste known as the Pentagon budget goes for standing up a Global

Empire and propping up dozens of so-called allies abroad, which we do not need in order to defend the homeland in this day and age of high tech weaponry.

In any event, if you examine baseline spending for the first five columns in the table below-defense, the big entitlements and net interest--which we have summed as "Sacred Cows" in the sixth column, the total off-limits budget components amount to $65.4 trillion over the next decade. That's fully 73% projected baseline spending of $89.3 trillion during the next 10 years.

Moreover, if you move over to the next two columns in the table for Medicaid and Food Stamps/Nutrition programs, respectively, they add another $10 trillion to baseline spending. At this point in the Congressional proceedings, however, we can see honest cuts of no more than $300 billion for Medicaid (see below) and $200 billion for Food Stamps/Nutrition.

Such stingy savings figures would amount to only a 5% cut in these two giant welfare programs. Yet, as a political matter, slashing these programs by five times more-say $2.5 trillion over the next decade-should be a piece of cake for the GOP. After all, precious few food stamp/Medicaid recipients even vote, to saying nothing of voting for Republicans.

So when we said it's all over except the shouting, we were not indulging in hyperbole. It's hard core fiscal math: When you get over to the "N'aid" (nutrition programs) column of the table (8th column) you have encompassed 84% of the entire Federal budget and $75 trillion of spending over the next decade. Yet if the GOP manages to come up with even the aforementioned $500 billion of Medicaid/Foods Stamps savings in their current Reconciliation bill mark-up process we'd be pleasantly surprised.

That is to say, the so-called conservative party-the only hope left-can apparently manage to come up with savings of just 0.6% of built-in spending for the big components of the Federal budget. Looking $75 trillion of spending square in the face as they craft the Trump economic plan, the GOP is whiffing entirely, and pathetically so.

Never mind, of course, that these cats never stop giving speeches about runaway Federal spending and decrying the the soaring public debt. These ills they are pleased to blame on the "Joe Biden" entity and the Big Spending Dems.

So what a joke. After all, the built-in baseline deficit for the next decade is nearly $22 trillion, given that baseline spending will total $89.3 trillion, whereas revenues are estimated by CBO at just $67.5 billion.

Accordingly, if the GOP majorities blow on defense, veterans and border control increases the pitiful $500 billion savings from entitlements for poor people now pending, the public debt will hit nearly $58 trillion by 2035 or 135% of GDP.

In turn, even at today's blended average yield on the public debt of 4.3%, annual interest expense at the end of the 10-year window would be a staggering $2.5 trillion per year!

Baseline Federal Budget Outlays, FY 2026-2035 ($Billions)

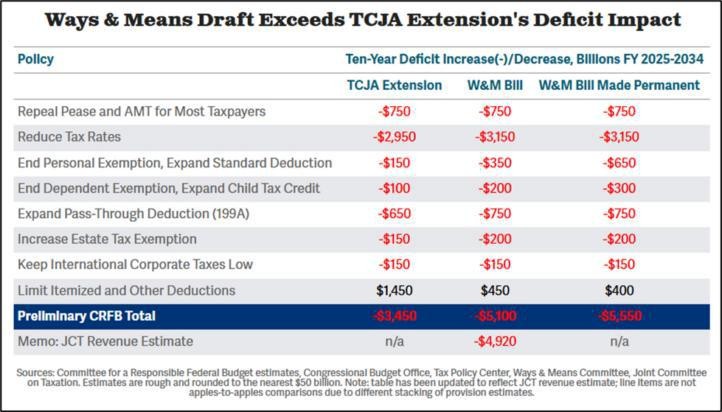

And yet and yet. The CBO revenue baseline assumes all of the 2017 Trump tax cuts are allowed to expire, thereby adding upwards of $5 trillion relative to the tax code in effect during FY 2025. In fact, however, the Trumpified GOP is determined come hell or high war to extend the 2017 tax cuts for another decade. So here is the latest estimates of the revenue cost of the tax bill pending in the House Ways and Means Committee. It would actually reduce the CBO revenue baseline by in excess of $5 trillion over FY 2026-2035 or to barely $62 trillion-resulting in Uncle Sam borrowing 30 centson every dollar spent.

The crucial point to note based on the most recent estimates by the good folks the Committee for a Responsible Budget (sic) is that a pure mechanical extension of the 2017 tax act (TCJA) would cost a net of $3.45 trillion over the decade. So the GOP tax writers have already added more than $1.5 trillion to the revenue cost-and that's before a single dime of revenue loss from cutting taxes on tips, overtime and Social Security, as the Donald promised during the campaign.

Still, there is no mystery as to the difference between the first column and the second column of the table below. Aside from some slightly more generous rate cuts and other personal income tax items, the big change is on the so-called "payfor" line, which is dominated by the current SALT cap (deductibility of state and local taxes) of $10,000 for joint filers. Extending the current SALT caps would generate a revenue offset of $1.26 trillion over the 10-year period, thereby reducing the net cost of extending the tax rate cuts (37.0% top rate versus 39.6%), child credit increases from $1,000 to $2,000 and the 22% business income pass-thru deduction.

Again, the GOP delegations in the high tax states like New York and California have threatened to fall on the sword if the SALT cap is not raised dramatically. The current working target, therefore, is $62,000 for single filers and $124,000 for joint filers. Alas, that would make it easier for Blue State legislatures to keep income taxes sky high, but would also reduce the revenue offset by nearly $750 billion to just $500 billion over the decade. That retreat, in turn, accounts for the preponderant share of the shrinkage in the "line itemized and other deductions" line of the chart below.

So, there is no surprise that the Blue State Republicans are getting their way. An initial proposal to raise the cap on joint filers to $30,000 was shot down in no uncertain terms. And with a one-vote margin the House, every caucus of squeaky wheels is getting to name the price of their votes.

"It's not just insulting-it risks derailing President Trump's One Big Beautiful Bill," Reps. Elise Stefanik (R-N.Y.), Andrew Garbarino (R-N.Y.), Nick LaLota (R-N.Y.) and Mike Lawler (R-N.Y.) wrote in a statement.

Indeed, the squeaky wheel factions and caucuses are the reason there are no meaningful spending cut, either, and most especially with respect to the hideously bloated, out-of-control Medicaid program. Or as the GOP chairman of the House committee handling the bill admitted,

"I think that the people who will have the most difficult time with it would be that it doesn't go far enough," Guthrie said in an office boardroom lined with the committee's policy staffers. "We're going to go as far as we can go to get 218 votes."

To be sure, House Republicans are largely on board with imposing work requirements on able-bodied Medicaid recipients, but that would only save $190 billion over 10-years because the GOP work requirements are loophole ridden. Likewise, there is broad support for barring those who entered the country without authorization, but it will be a stretch and then some to save another $100 billion from this restriction because Medicaid expenditures for illegal aliens are not nearly what the hype suggests.

By the same token, what would save material Medicaid dollars is going back to the lower Federal matching rates (see below) which prevailed before ObamaCare and the Trump-COVID bailouts of 2020. But as Speaker Johnson told reporters recently a proposal to directly reduce the enhanced federal match for states that expanded Medicaid, known as the Federal Medical Assistance Percentage (FMAP), was off the table.

Likewise, a common sense proposal to include per capita caps on Medicaid expansion enrollees (i.e. ObamaCare) is another hard "no" among GOP RINOs. So the Speaker told reporters this week "I think we're ruling that out."

If this sound like the squeaky wheels are ruling the roost, that's exactly the case. In fact, Congressman Mike Lawler is the very poster boy. When he is not carrying water for Netanyahu he is running for governor of New York State. And as it happens, New York state gets $45 billion per year of matching payments for Medicaid from Uncle Sam, but only $27 billion of this is from the traditional Federal matching rate. The balance is owing to the above mentioned FMAP expansions from ObamaCare and the pandemic add-ons.

"I've said very clearly, I do not support any change to FMAP, I don't support per capita caps," Rep. Mike Lawler (R-N.Y.) said this week, even as he was also insisting that any revenue offsets from a meaningful SALT cap be eliminated from the tax portion of the bill, as described above.

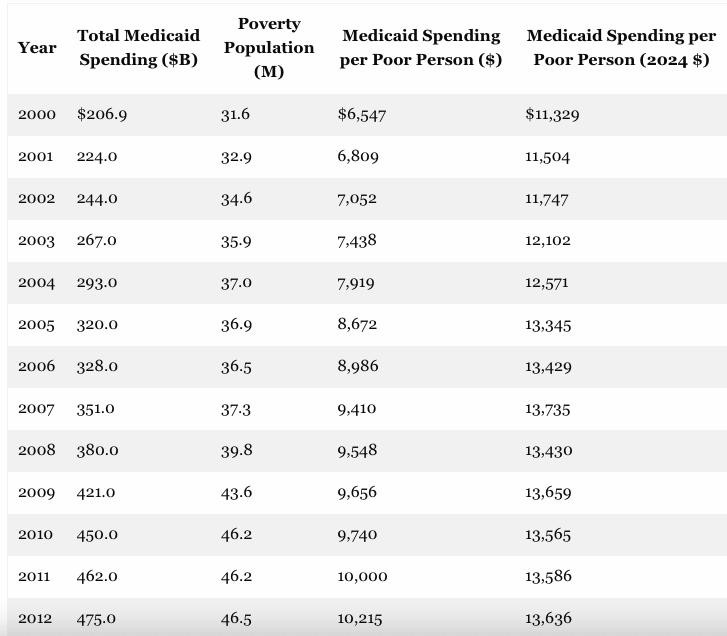

For want of doubt, however, here is what Lawler and the RINO faction of the House GOP are defending. That is to say, an explosive growth of Medicaid spending per poor person in the US that has doubled in constant dollars-from $11,329 per capita in 2000 to $24,837 per capita in 2024.

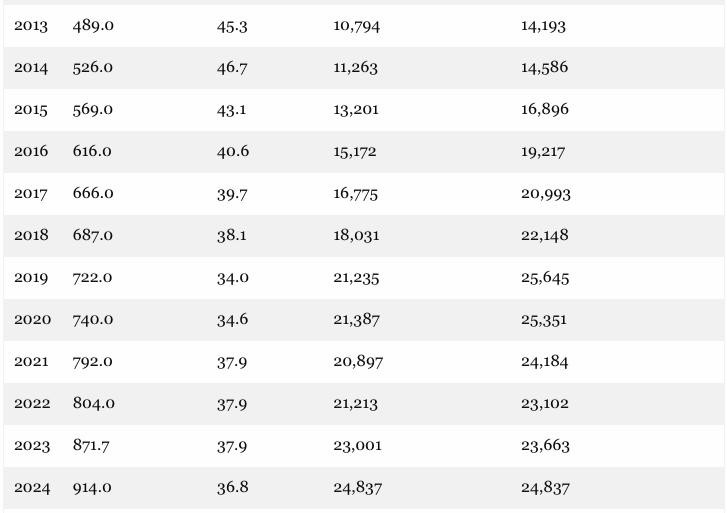

Medicaid Spending and Poverty Population (2000-2024)

As shown above, total medicaid spending has increased by 340% since the year 2ooo- from $207 billion per year to $914 billion in 2024. However, during the same 24-year interval the poverty population grew by only 16%, rising from 31.6 million at the turn of the century to 36.8 million in 2024.

Accordingly, Medicaid spending per poor person has soared. The $6,547 per capita figure in 2000 was actually $24,837 in 2024. And as indicated above, even when you adjust for inflation, constant dollar Medicaid spending per poor person (2024$) has risen by nearly 120% since 2000.

There is no mystery as to why we have 18% more poor people in the US over the last quarter century, even though real Medicaid spending per poor person has more than doubled. To wit, the UniParty spenders in Washington has simply opened the Medicaid flood-gates to a larger and larger share of the US population, reaching far beyond the poverty population.

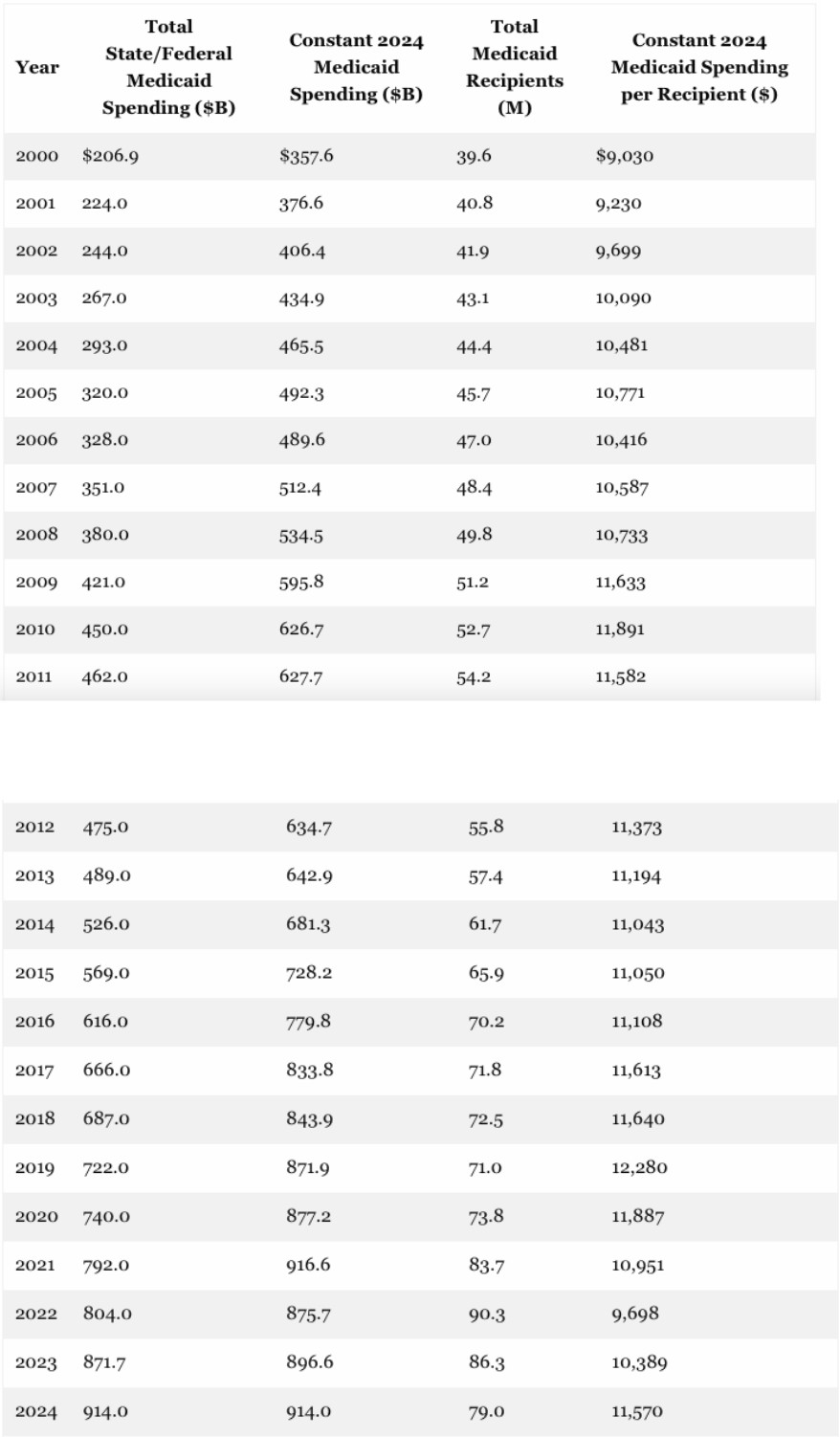

Thus, in the year 2000 there were 39.6 million Medicaid recipients and constant dollar Medicaid spending (2024$) was $358 billion. Fast forward to FY 2024, however, after the huge ObamaCare expansion and then the Trump-expansion during the 2020 pandemic free-stuff blow-out, and constant dollar spending was 2.6X higher at $914 billion.

As is evident from the table, however, a good share of that enormous real dollar gain was owing to the soaring Medicaid enrollments, which reached 79 million in 2024. That is to say, whereas 14% of the US population was on Medicaid in the year 2000 that figure now stands at nearly 24%.

So the question recurs: Why is the Congressional GOP in the year 2025 hesitant to sharply rollback Medicaid eligibility and spending when as recently as the turn of the century Medicaid coverage level of about 40 million was barely half of today's nearly 80 million. Yet the Bill Clinton Dems then in power were not screaming to high heaven that needy people were being left out in the cold.

In fact, when you combine the Medicaid population with Medicare and the ObamaCare insurance subsidy population and eliminate the dual and triple eligibles, the combined enrollment in government-funded medical insurance programs is 141 million. That's 41% of the entire US population.

So the fact is, the House reconciliation bill cut of maybe $300 billion in Medicaid is occurring in a context in which nearly half of the US population is already in a socialist medical care pool. If the GOP can't find its way clear to even a tiny $300 billion 10-year cut in that context, they should literally throw-in the towel on fiscal restraint. They would be tantamount to useless.

Total Federal/State Medicaid Spending and Recipients, 2000-2024

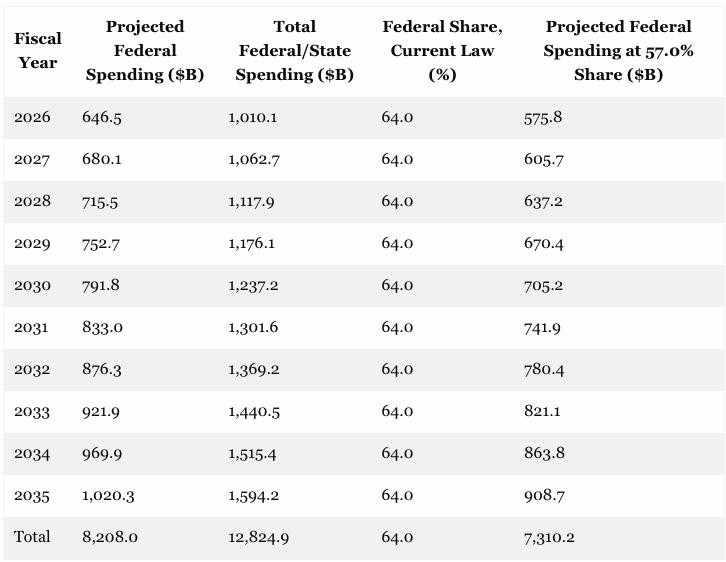

For want of doubt, here is a table showing the impact of merely capping Federal reimbursement at the 57% rate that prevailed under Bill Clinton's auspices as recent as the year 2000. It shows that the Federal share of Medicaid spending could be cut by $900 billion over the period or three times more than is likely to happen-just by going back to the Clinton standard for Medicaid cost-sharing with the states.

Unfortunately, the RINO's in the GOP House and Senate caucuses have already ixnayed any material roll-back in the above documented explosion of Medicaid enrollments and spending.

Table: Medicaid Spending Projections (FY2026-2035)

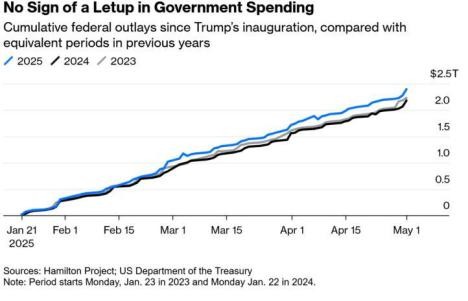

Needless to say, even as the GOP slouches toward adding $5 trillion to the $22 trillion of baseline deficits already built-in for the next decade, the Washington spending machine rolls on-the DOGE boys to the contrary not withstanding. In fact, spending during FY 2025 through the first six months of the fiscal year is already running 10% above last year's Biden level.

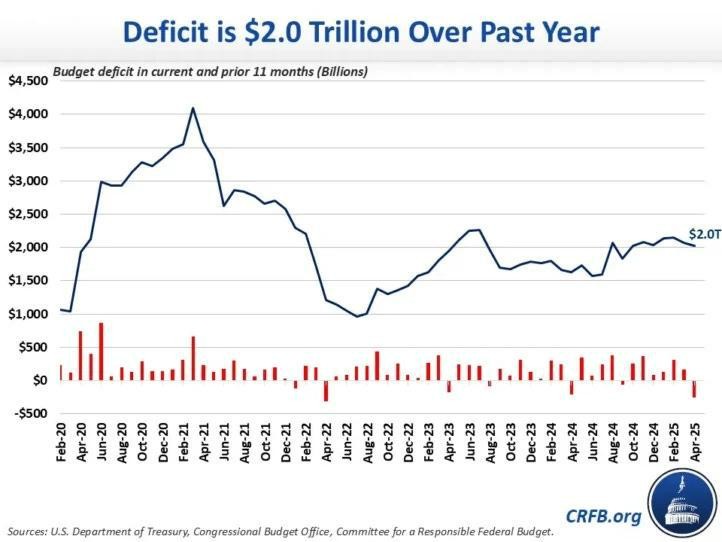

As a result, the 12-month rolling deficit total is back above the $2 trillion level, and will be headed sharply higher if the GOP Congressional majorities can manage to confect a big beautiful reconciliation bill that buries the nation in upwards of $30 trillion of additional public debt over the decade ahead.

The Donald, of course, has promised a new Golden Age of Prosperity. But based on what the Trumpified GOP is now cooking up we are more likely to get a Fiscal Armageddon like never before.

Reprinted with permission from David Stockton's Contra Corner.