En attendant la deuxième partie de notre étude sur le EU DisinfoLab (un peu plus longue que prévue...)...

Source : Le Trends, Arnaud Martin, 19/03/15

C'est ce qu'a découvert un chercheur Belge du MIT. Selon Yves-Alexandre de Montjoye, il serait judicieux de repenser la façon dont les bases de données transactionnelles sont utilisées.

/ © istock

L'étude menée par le Massachussetts Institute of Technology (MIT) et publiée dans la prestigieuse revue Science révèle des résultats plutôt inquiétants. Sur base de quatre transactions réalisées par carte de crédit, il est possible d'identifier n'importe qui dans une base de données apparemment anonyme. Par anonyme, on entend une base de données " brutes ", de laquelle on a retiré toutes les informations privées concernant les titulaires de cartes de crédit (nom, prénom, adresse, numéro de compte, etc.) permettant de les identifier.

Comment est-ce possible ? " C'est assez simple en fait, explique Yves-Alexandre de Montjoye, le chercheur à la base de l'étude. Un schéma de quatre transactions différentes est 90% du temps unique. Ce qui fait qu'on parvient presque à chaque fois à retrouver la personne. Le fait de retirer les noms et prénoms des gens, leur adresse ou encore leur numéro de compte des bases de données n'est donc pas suffisant pour leur garantir leur anonymat. "

Métadonnées

Un fait d'autant plus inquiétant que le nombre de bases de données ne cesse d'augmenter (carte bancaire, de fidélité, téléphone..). L'ensemble de la population se retrouve en fait consignée dans un nombre assez restreint de bases de données. " Par exemple, un pays va rassembler tous ses utilisateurs de téléphones portables dans seulement trois ou quatre bases de données (qui correspondent au nombre d'opérateurs) ", pointe le chercheur d'origine liégeoise.

Une fois le profil repéré parmi toutes les métadonnées, il est possible de mettre un nom sur la personne, en croisant les données anonymes récoltées avec d'autres bases de données, publiques cette fois, où les noms et prénoms sont indiqués. " On peut par exemple utiliser une plateforme comme Foursquare, où les gens laissent des commentaires sur des restaurants et des bars, ou même Facebook", explique Yves Alexandre de Montjoye.

Pour effectuer ses recherches, l'équipe de chercheurs a mené son étude sur une base de données de 1.1 millions de personnes, récoltées sur trois mois. " Elle nous a été fournie grâce à un partenariat avec une banque pour cette étude ", précise le chercheur belge.

Identifiable même avec des données peu précises

Retrouver quelqu'un est encore plus facile si le montant approximatif de la transaction est connu. Le taux de réidentification atteint alors les 94% et seules trois transactions sont nécessaires.

L'étude va encore plus loin. Selon les chercheurs, l'identification reste encore largement possible même si les informations sont moins précises. " Avec cinq ou six transactions, on parvient à obtenir des résultats équivalents avec des données moins précises, comme simplement une zone d'achat ou un délai de quelques jours plutôt qu'une date précise ", assure Yves-Alexandre de Montjoye.

Les résultats ont également pu permettre d'observer que les femmes sont environ 20% plus facilement identifiables que les hommes. Les hauts revenus sont, eux, 75% plus souvent retrouvés. "On ne l'explique pas. Il faudrait d'autres études pour comprendre pourquoi ces différences existent ", précise le chercheur.

L'anonymat parfait ? Impossible

Pour le scientifique, l'étude montre qu'il est probablement nécessaire de repenser la législation qui entoure la collecte et l'usage des données. Yves-Alexandre de Montjoye estime aussi qu'il est nécessaire de clairement expliquer non seulement les risques mais aussi le potentiel que représentent les bases de données. " D'un côté, on prouve qu'un anonymat parfait est quasiment impossible à obtenir dans les bases de données transactionnelles. D'un autre côté, ces bases de données peuvent s'avérer très utiles : elles sont par exemple utilisées pour combler les lacunes de certains pays d'Afrique en matière de recensement de la population, ou encore pour améliorer la lutte contre le virus Ebola".

Pour le chercheur, il existe toutefois des solutions pour utiliser ces bases de données tout en respectant la vie privée des gens. L'idée est de ne jamais travailler avec les données " brutes " (comme c'est souvent le cas aujourd'hui) mais plutôt de permettre à des entreprises d'utiliser des données " filtrées " par une interface de questions-réponses appelée SafeAnswers. Les entreprises qui voudraient l'utiliser auraient alors à leur disposition uniquement les " réponses " utiles à leurs demandes.

" Ce schéma de questions-réponses permet de transformer un problème de protection de la vie privée en un problème de sécurité de base de données, en limitant, par exemple, le nombre de questions que peut poser une entreprise ", conclut le chercheur.

Retrouvez notre dossier complet sur La fin de la vie privée dans le magazine Trends-Tendances de cette semaine.

Arnaud Martin

Source : Le Trends, Arnaud Martin, 19/03/15

Voir aussi : Unique in the shopping mall : On the reidentifiability of credit card metadata

Unique in the shopping mall: On the reidentifiability of credit card metadata, by Yves-Alexandre de Montjoye

Source : Science mag, Yves-Alexandre de Montjoye, 30-01-2015

Large-scale data sets of human behavior have the potential to fundamentally transform the way we fight diseases, design cities, or perform research. Metadata, however, contain sensitive information. Understanding the privacy of these data sets is key to their broad use and, ultimately, their impact. We study 3 months of credit card records for 1.1 million people and show that four spatiotemporal points are enough to uniquely reidentify 90% of individuals. We show that knowing the price of a transaction increases the risk of reidentification by 22%, on average. Finally, we show that even data sets that provide coarse information at any or all of the dimensions provide little anonymity and that women are more reidentifiable than men in credit card metadata.

Large-scale data sets of human behavior have the potential to fundamentally transform the way we fight diseases, design cities, or perform research. Ubiquitous technologies create personal metadata on a very large scale. Our smartphones, browsers, cars, or credit cards generate information about where we are, whom we call, or how much we spend. Scientists have compared this recent availability of large-scale behavioral data sets to the invention of the microscope ( 1). New fields such as computational social science ( 2 - 4) rely on metadata to address crucial questions such as fighting malaria, studying the spread of information, or monitoring poverty ( 5 - 7). The same metadata data sets are also used by organizations and governments. For example, Netflix uses viewing patterns to recommend movies, whereas Google uses location data to provide real-time traffic information, allowing drivers to reduce fuel consumption and time spent traveling ( 8).

The transformational potential of metadata data sets is, however, conditional on their wide availability. In science, it is essential for the data to be available and shareable. Sharing data allows scientists to build on previous work, replicate results, or propose alternative hypotheses and models. Several publishers and funding agencies now require experimental data to be publicly available ( 9 - 11). Governments and businesses are similarly realizing the benefits of open data ( 12). For example, Boston's transportation authority makes the real-time position of all public rail vehicles available through a public interface ( 13), whereas Orange Group and its subsidiaries make large samples of mobile phone data from Côte d'Ivoire and Senegal available to selected researchers through their Data for Development challenges ( 14, 15).

These metadata are generated by our use of technology and, hence, may reveal a lot about an individual ( 16, 17). Making these data sets broadly available, therefore, requires solid quantitative guarantees on the risk of reidentification. A data set's lack of names, home addresses, phone numbers, or other obvious identifiers [such as required, for instance, under the U.S. personally identifiable information (PII) "specific-types" approach ( 18)], does not make it anonymous nor safe to release to the public and to third parties. The privacy of such simply anonymized data sets has been compromised before ( 19 - 22).

Unicity quantifies the intrinsic reidentification risk of a data set ( 19). It was recently used to show that individuals in a simply anonymized mobile phone data set are reidentifiable from only four pieces of outside information. Outside information could be a tweet that positions a user at an approximate time for a mobility data set or a publicly available movie review for the Netflix data set ( 20). Unicity quantifies how much outside information one would need, on average, to reidentify a specific and known user in a simply anonymized data set. The higher a data set's unicity is, the more reidentifiable it is. It consequently also quantifies the ease with which a simply anonymized data set could be merged with another.

Financial data that include noncash and digital payments contain rich metadata on individuals' behavior. About 60% of payments in the United States are made using credit cards ( 23), and mobile payments are estimated to soon top $1 billion in the United States ( 24). A recent survey shows that financial and credit card data sets are considered the most sensitive personal data worldwide ( 25). Among Americans, 87% consider credit card data as moderately or extremely private, whereas only 68% consider health and genetic information private, and 62% consider location data private. At the same time, financial data sets have been used extensively for credit scoring ( 26), fraud detection ( 27), and understanding the predictability of shopping patterns ( 28). Financial metadata have great potential, but they are also personal and highly sensitive. There are obvious benefits to having metadata data sets broadly available, but this first requires a solid understanding of their privacy.

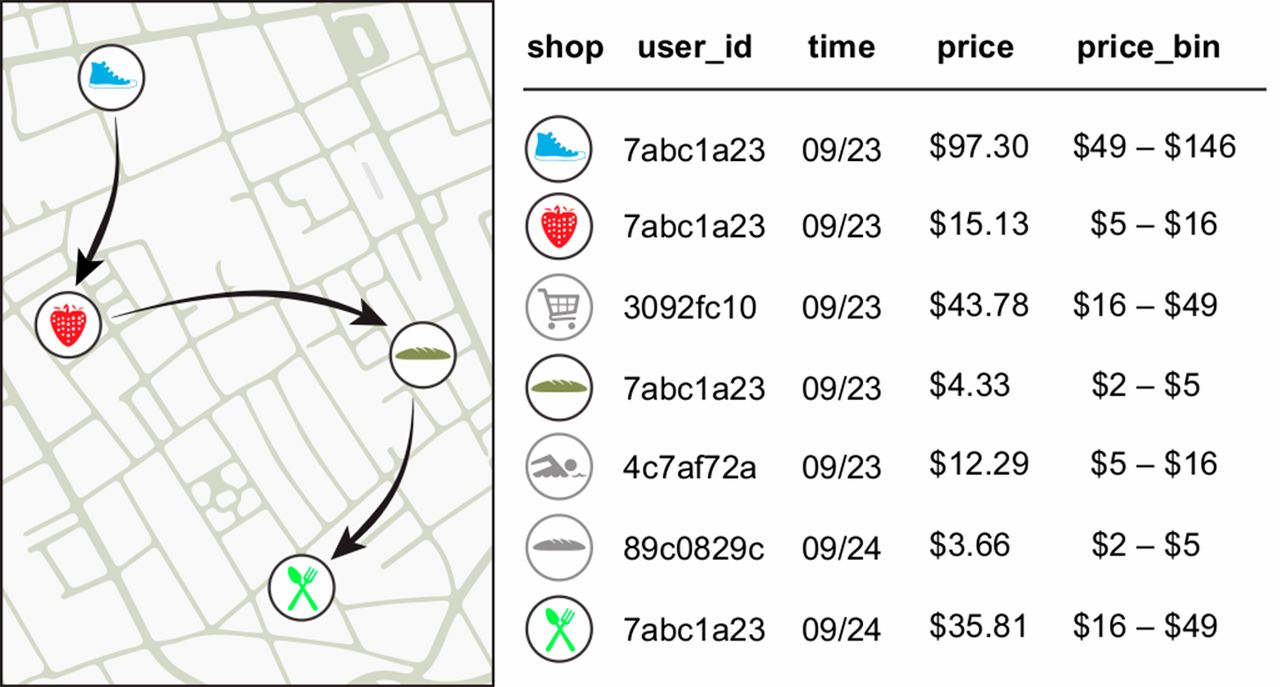

To provide a quantitative assessment of the likelihood of identification from financial data, we used a data set D of 3 months of credit card transactions for 1.1 million users in 10,000 shops in an Organisation for Economic Co-operation and Development country ( Fig. 1). The data set was simply anonymized, which means that it did not contain any names, account numbers, or obvious identifiers. Each transaction was time-stamped with a resolution of 1 day and associated with one shop. Shops are distributed throughout the country, and the number of shops in a district scales with population density (r2 = 0.51, P < 0.001) (fig. S1).

Financial traces in a simply anonymized data set such as the one we use for this work.

Arrows represent the temporal sequence of transactions for user 7abc1a23 and the prices are grouped in bins of increasing size (29).

We quantified the risk of reidentification of D by means of unicity ε ( 19). Unicity is the risk of reidentification knowing p pieces of outside information about a user ( 29). We evaluate εp of D as the percentage of its users who are reidentified with p randomly selected points from their financial trace. For each user, we extracted the subset S(Ip) of traces that match the p known points (Ip). A user was considered reidentified in this correlation attack if |S(Ip)| = 1.

For example, let's say that we are searching for Scott in a simply anonymized credit card data set ( Fig. 1). We know two points about Scott: he went to the bakery on 23 September and to the restaurant on 24 September. Searching through the data set reveals that there is one and only one person in the entire data set who went to these two places on these two days. |S(Ip)| is thus equal to 1, Scott is reidentified, and we now know all of his other transactions, such as the fact that he went shopping for shoes and groceries on 23 September, and how much he spent.

Figure 2 shows that the unicity of financial traces is high (ε4 > 0.9, green bars). This means that knowing four random spatiotemporal points or tuples is enough to uniquely reidentify 90% of the individuals and to uncover all of their records. Simply anonymized large-scale financial metadata can be easily reidentified via spatiotemporal information.

ig. 2The unicity ε of the credit card data set given p points.

The green bars represent unicity when spatiotemporal tuples are known. This shows that four spatiotemporal points taken at random (p = 4) are enough to uniquely characterize 90% of individuals. The blue bars represent unicity when using spatial-temporal-price triples (a = 0.50) and show that adding the approximate price of a transaction significantly increases the likelihood of reidentification. Error bars denote the 95% confidence interval on the mean.

Furthermore, financial traces contain one additional column that can be used to reidentify an individual: the price of a transaction. A piece of outside information, a spatiotemporal tuple can become a triple: space, time, and the approximate price of the transaction. The data set contains the exact price of each transaction, but we assume that we only observe an approximation of this price with a precision a we call price resolution. Prices are approximated by bins whose size is increasing; that is, the size of a bin containing low prices is smaller than the size of a bin containing high prices. The size of a bin is a function of the price resolution a and of the median price m of the bin ( 29). Although knowing the location of my local coffee shop and the approximate time I was there this morning helps to reidentify me, Fig. 2 (blue bars) shows that also knowing the approximate price of my coffee significantly increases the chances of reidentifying me. In fact, adding the approximate price of the transaction increases, on average, the unicity of the data set by 22% (fig. S2, when a = 0.50, 〈Δε〉 = 0.22).

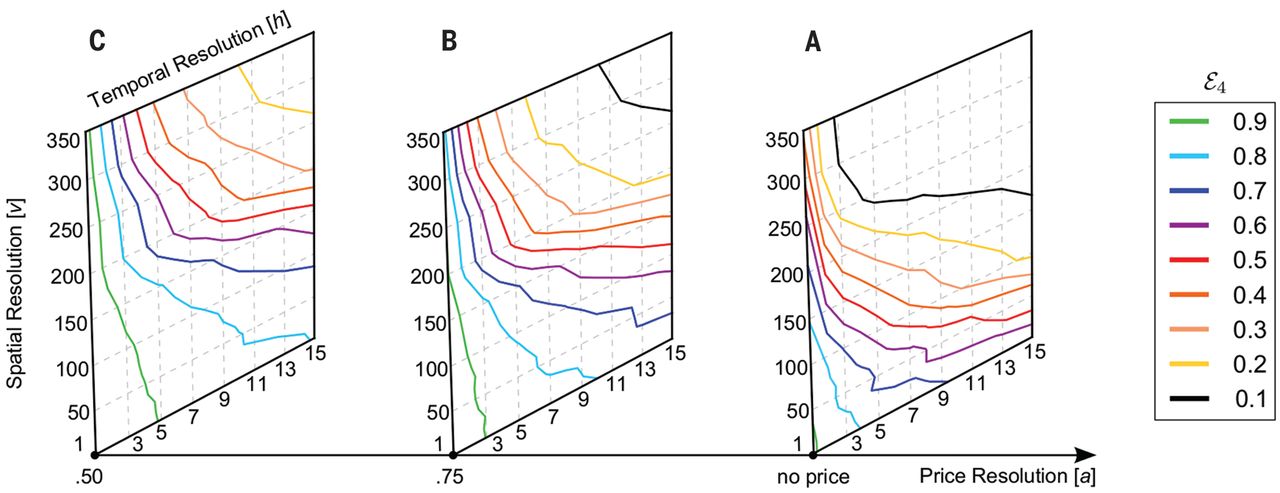

The unicity ε of the data set naturally decreases with its resolution. Coarsening the data along any or all of the three dimensions makes reidentification harder. We artificially lower the spatial resolution of our data by aggregating shops in clusters of increasing size v based on their spatial proximity ( 29). This means that we do not know the exact shop in which the transaction happened, but only that it happened in this geographical area. We also artificially lower the temporal resolution of the data by increasing the time window h of a transaction from 1 day to up to 15 days. Finally, we increase the size of the bins for price a from 50 to 75%. In practice, this means that the bin in which a $15.13 transaction falls into will go from $5 to $16 (a = 0.50) to $5 to $34 (a= 0.75) (table S2).

Figure 3 shows that coarsening the data is not enough to protect the privacy of individuals in financial metadata data sets. Although unicity decreases with the resolution of the data, it only decreases slowly along the spatial (v), temporal (h), and price (a) axes. Furthermore, this decrease is easily overcome by collecting a few more points (table S1). For instance, at a very low resolution of h = 15 days, v = 350 shops, and an approximate price a = 0.50, we have less than a 15% chance of reidentifying an individual knowing four points (ε4 < 0.15). However, if we know 10 points, we now have more than an 80% chance of reidentifying this person (ε10 > 0.8). This means that even noisy and/or coarse financial data sets along all of the dimensions provide little anonymity.

Fig. 3Unicity (ε4) when we lower the resolution of the data set on any or all of the three dimensions; with four spatiotemporal tuples [(A), no price] and with four spatiotemporal-price triples [(B), a = 0.75; (C), a = 0.50].

Although unicity decreases with the resolution of the data, the decrease is easily overcome by collecting a few more points. Even at very low resolution (h = 15 days, v = 350 shops, price a = 0.50), we have more than an 80% chance of reidentifying an individual with 10 points (ε10 > 0.8) (table S1).

We also studied the effects of gender and income on the likelihood of reidentification. Figure 4A shows that women are easier to reidentify than men, whereas Fig. 4B shows that the higher somebody's income is, the easier it is to reidentify him or her. In fact, in a generalized linear model (GLM), the odds of women being reidentified are 1.214 times greater than for men. Similarly, the odds of high-income people (and, respectively, medium-income people) to be reidentified are 1.746 times (and 1.172 times) greater than for low-income people ( 29). Although a full causal analysis or investigation of the determinants of reidentification of individuals is beyond the scope of this paper, we investigate a couple of variables through which gender or income could influence unicity. A linear discriminant analysis shows that the entropy of shops, how one shares his or her time between the shops he or she visits, is the most discriminative factor for both gender and income ( 29).

Fig. 4Unicity for different categories of users (v = 1, h = 1).

(A) It is significantly easier to reidentify women (ε4 = 0.93) than men (ε4 = 0.89). (B) The higher a person's income is, the easier he or she is to reidentify. High-income people (ε4 = 0.93) are significantly easier to reidentify than medium-income people (ε4 = 0.91), and medium-income people are themselves significantly easier to reidentify than low-income people (ε4 = 0.88). Significance levels were tested with a one-tailed t test (P < 0.05). Error bars denote the 95% confidence interval on the mean.

Our estimation of unicity picks the points at random from an individual's financial trace. These points thus follow the financial trace's nonuniform distributions ( Fig. 5A and fig. S3A). We are thus more likely to pick a point where most of the points are concentrated, which makes them less useful on average. However, even in this case, seven points were enough to reidentify all of the traces considered (fig. S4). More sophisticated reidentification strategies could collect points that would maximize the decrease in unicity.

Fig. 5Distributions of the financial records.

(A) Probability density function of the price of a transaction in dollars equivalent. (B) Probability density function of spatial distance between two consecutive transactions of the same user. The best fit of a power law (dotted line) and an exponential distribution (dot-dashed line) are given as a reference. The dashed lines are the diameter of the first and second largest cities in the country. Thirty percent of the successive transactions of a user are less than 1 km apart (the shaded area), followed by, an order of magnitude lower, a plateau between 2 and 20 km, roughly the radius of the two largest cities in the country. This shows that financial metadata are different from mobility data: The likelihood of short travel distance is very high and then plateaus, and the overall distribution does not follow a power-law or exponential distribution.

Although future work is needed, it seems likely that most large-scale metadata data sets-for example, browsing history, financial records, and transportation and mobility data-will have a high unicity. Despite technological and behavioral differences ( Fig. 5B and fig. S3), we showed credit card records to be as reidentifiable as mobile phone data and their unicity to be robust to coarsening or noise. Like credit card and mobile phone metadata, Web browsing or transportation data sets are generated as side effects of human interaction with technology, are subjected to the same idiosyncrasies of human behavior, and are also sparse and high-dimensional (for example, in the number of Web sites one can visit or the number of possible entry-exit combinations of metro stations). This means that these data can probably be relatively easily reidentified if released in a simply anonymized form and that they can probably not be anonymized by simply coarsening of the data.

Our results render the concept of PII, on which the applicability of U.S. and European Union (EU) privacy laws depend, inadequate for metadata data sets ( 18). On the one hand, the U.S. specific-types approach-for which the lack of names, home addresses, phone numbers, or other listed PII is enough to not be subject to privacy laws-is obviously not sufficient to protect the privacy of individuals in high-unicity metadata data sets. On the other hand, open-ended definitions expanding privacy laws to "any information concerning an identified or identifiable person" ( 30) in the EU proposed data regulation or "[when the] re-identification to a particular person is not possible" ( 31) for Deutsche Telekom are probably impossible to prove and could very strongly limit any sharing of the data ( 32).

From a technical perspective, our results emphasize the need to move, when possible, to more advanced and probably interactive individual ( 33) or group ( 34) privacy-conscientious technologies, as well as the need for more research in computational privacy. From a policy perspective, our findings highlight the need to reform our data protection mechanisms beyond PII and anonymity and toward a more quantitative assessment of the likelihood of reidentification. Finding the right balance between privacy and utility is absolutely crucial to realizing the great potential of metadata.

Source : Science mag, Yves-Alexandre de Montjoye, 30-01-2015

Nous vous proposons cet article afin d'élargir votre champ de réflexion. Cela ne signifie pas forcément que nous approuvions la vision développée ici. Dans tous les cas, notre responsabilité s'arrête aux propos que nous reportons ici. Lire plus