An outsize CBOE Volatility Index options trade could signal the return of "50 Cent," an investor who earned the moniker for a proclivity to buy cheap options in large amounts.

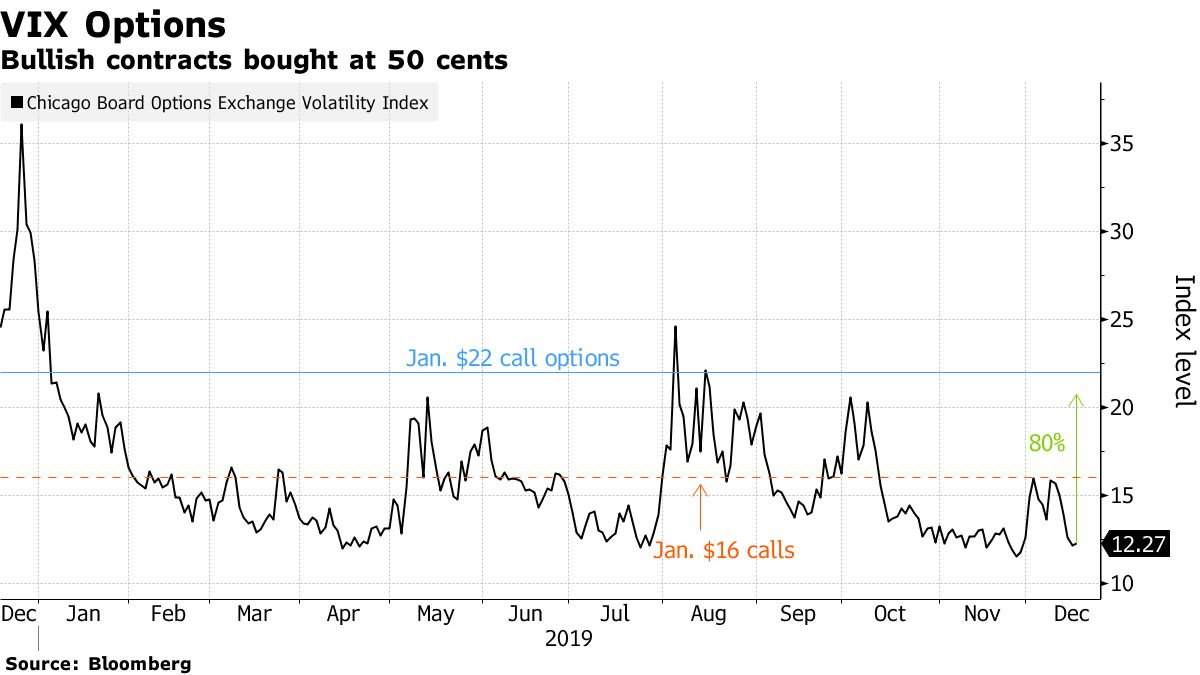

Someone snapped up roughly 130,000 January $22 calls on the index for about 50 cents each Tuesday, contracts that would pay off if the volatility gauge almost doubles from its current level. The trade came as the S&P 500 Index climbed toward a record for the fourth session in a row and the VIX, which tracks the 30-day implied volatility for stocks in the benchmark gauge, hovered near its lowest level of the year.

Bullish contracts bought at 50 cents

The familiar price point for buying VIX calls "will certainly lead to investors believing '50 Cent' is back," Chris Murphy, the co-head of derivatives strategy at Susquehanna Susquehanna Financial Group, said in a research note.

"50 Cent" first came to the market's attention by buying huge amounts of VIX calls during the market turmoil through 2017 and early 2018. The trading pattern reappeared last August as the S&P 500 was locked in a trading range with implied volatility trading around its highest levels of the year.

Buying patterns for "50 Cent" suggest that he or she could be seeking to hedge portfolio risk, not making bets on specific events that could take down U.S. equities.

Still, there are potential catalysts on the horizon, including the partial U.S.-China trade deal falling apart or negative headlines coming out of the World Economic Forum at Davos, according to Murphy. The options set to expire on Jan. 22 could also be used to protect around some headlines heading into Brexit or simply be taking advantage of the recent pullback in volatility, he said.

Murphy prefers using a call spread strategy on the VIX to hedge an increase in volatility over buying call options outright and recommends buying January $16 calls and selling the $26 calls for close to $1. That strategy offers a 9 times payout if the VIX spikes above $26 and will be $4 in-the-money if the index trades near $20 close to expiration, he said.