By David Haggith

The Great Recession Blog

March 9, 2023

As we've all heard many times, history never repeats exactly. This time around, commercial real-estate is where all the naked swimmers are showing up, and the big reveal has arrived almost overnight like a tsunami, sucking all the water out of the bay. carrying more than a few swimmers out with it.

While home mortgage interest is rising, the rise is having little impact on most Americans because the number of mortgages affected by high rates is only 1%. Ninety-nine percent of US homeowners purchased their homes when rates were extremely low, and the great majority were smart enough to lock into fixed rates. That is a huge safety factor for the overall housing market this time around compared to the last earth-shattering real-estate bust. It means there are far fewer of those adjustable-rate mortgages that turned into time bombs that set off a housing crisis when rates started adjusting upward.

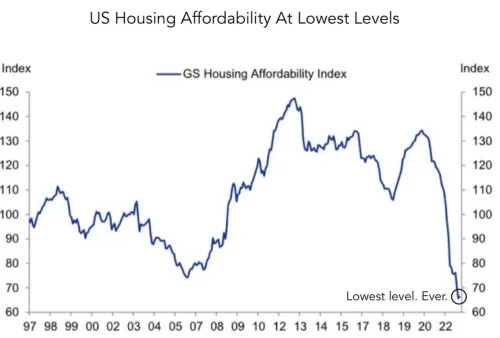

It is a different story, of course, if you recently became a first-time home buyer in search of a home. While housing prices are starting to slide to compensate for rising interest, there is always a long lag between a decline in sales as buyers can no longer afford the growing payments and the willingness of sellers to capitulate by pricing down to where new buyers can begin to afford payments again. As a result, housing affordability (that balance between prices, interest rates and income), according to the following information, has never looked this bad:

If you are a first-time buyer looking for a home, you are better off if you can wait it out until sellers are exhausted and prices bottom. I was able to do that as a first-time buyer last time around. Because all my resort property-management jobs either came with their own home, or I rented, I had no home equity after prices rose. So, I was priced out. I can assure first-time buyers from experience that day when prices become affordable again will come. I was able to move from being someone who had been priced out of the market for years due to the steep rise before the last bust to someone who got in at a great level with good interest rates to ride the next wave up. Later, we were able to sell and downscale from our forty acres to shrink our mortgage and get ready for retirement.

It will, however, likely take this falling market a few years to find its bottom, just as it did last time. Because a house is most people's primary asset, sellers do not reconcile with the need to sell their house for less than it was once worth without being pressed by circumstances to sell. So, it will take patience to wait out the decline in prices and the drop in interest.

Commercial real-estate, on the other hand, is an entirely different story. This is where we have just started seeing the first major signs of a real-estate bust, which began to emerge around the start of this month. The events I'll lay out below reveal conditions are closing in on us quickly now to the time when something big, and perhaps unexpected in real-estate finance, breaks.

This time around, our Lehman moment is going to happen in commercial real estate, rather than in home real estate... at least, in the US. Other housing markets, such as in Canada, face a more perilous looking situation as most homes have to be refinanced every five years in Canada, creating a lot of ticking time bombs down the road as rates scream higher.

Commercial real estate is being swept away

Financing in commercial real estate is riskier, and the impacts of Covid lockdowns broadsided commercial real-estate with a huge negative impact. Even before Covid, major retail space was suffering under the Retail Apocalypse that I covered here a few years back. Then Covid cleaned out office spaces, and little of that has swung positive since reopening from the lockdowns.

The first month or two of lockdowns looked like we'd be facing a disaster for house prices as no one went out shopping for homes. To nearly everyone's surprise - certainly mine anyway - it turned out exactly the opposite. Almost instantly upon reopening, the Covid lockdowns evolved into a huge positive for home prices for reasons related to why the lockdowns became a negative for commercial space. Freed to work from their homes, people began to relocate in droves while home inventory remained fairly scarce, and the Fed and government pumped tons of money into buyers' hands, so prices burst upward like a breaching whale.

As a result, commercial real estate took the hit. People liked the change, and because many relocated, they resisted returning to the office. Commercial real estate still cannot fill its available spaces, so some gaping cracks are opening up among investment companies that deal in that market. Take, for example, the following major companies that surfaced in a big way in the news in the past week or so, reporting huge problems:

PIMCO hits the ceiling and falls hard at the start of this month:

A Pacific Investment Management Co. office landlord that defaulted on $1.7 billion of mortgage notes sent shockwaves through a troubled part of the real estate market.For years, property owners have been grappling with the rise of remote work - a problem so large that one brokerage estimates roughly 330 million square feet of office space will become vacant by the end of the decade as a result. But low interest rates allowed the investors to muddle along more easily without worrying about the debt.

Now, many office landlords are seeing borrowing costs skyrocket, leading owners such as Pimco's Columbia Property Trust and Brookfield Corp. to default on mortgages. While remote work hurt the office market, rising rates could push landlords, which often use floating-rate debt, closer to a tricky edge.

This is an example of what I wrote about zombie companies some time back - companies that managed to "muddle along" only because low interest rates kept them paying their bills. Companies that were struggling originally because of the retail apocalypse or because of the subsequent Covid lockdowns that drove tenants out of their businesses, managed to keep floating their debt and paying their bills due to extremely low interest rates. As their debt is often short-term, some are now having to refinance, so rising rates are suddenly flushing them out as these mortgage-heavy businesses that are short on customers are no longer able to cover their mortgage payments, so are defaulting. This is the situation Warren Buffet famously described as seeing who is swimming naked when the tide suddenly runs out.

Commercial real-estate loans tend to be more like the Canadian housing market where rates float, sometimes via bonds (bundled into mortgage-backed securities that may soon become a problem, too) that get refinanced as they mature. Now they have to refinance at 2-3 times the interest they were paying. Trouble hits, hard and swift, and is already knocking down major players in a tumult in those markets. Then, suddenly, the water rushes back into the bay and onto the shore, swamping hundreds of gaping bystanders, almost as if permission has been given to just let the market break:

"It's just a group psychology, like, 'Now that one of my peers has done it, everyone's going to do it,' so I wouldn't be surprised over the next six months, if you just saw a wave of defaults and keys getting handed back, because the offices are not getting filled up," said Nitin Chexal, chief executive officer of real estate investment firm Palladius Capital Management. "A lot of these assets will never recover."

The realization hits that this problem is not going to resolve, given that it is taking down the big guys, so might as well clear it out of the way by clearing off a lot of bad debts, taking the bad news now rather than struggling for years to survive. The banks give way to changing terms on defaults faster, too.

The clock is ticking for more office owners with the Federal Reserve on the path to raising its benchmark rate even higher, more than 17% of the entire US office supply vacant and an additional 4.3% available for sublease. Nearly $92 billion in debt for those properties from nonbank lenders comes due this year, and $58 billion will mature in 2024, according to the Mortgage Bankers Association...."It's helpful for me, that we've seen some big players basically give the keys because it makes it easier to negotiate with the banks," Gural said....

The financing challenges are a particular problem for the real estate industry given the proliferation of floating-rate loans, where interest rates reset more frequently. About 48% of debt on office properties that matures this year has a variable rate, according to Newmark Group Inc.

In less than two weeks, the big wave has emerged. It's a tsunami, first taking the tide out so we can start to see who is swimming naked, only to rush back in and drown the lot of them. The false hope of a big market recovery, as was seen immediately in residential real-estate, led major investors to swim out deep in hope of a similar comeback for commercial space, which is now crashing over them:

In 2021, the asset-management firm known as Pimco banked on an office-market comeback. Interest rates were near historic lows, and the economy was humming. Cities were expecting a surge in newly vaccinated workers returning to the office. In September that year, Pacific Investment Management Co. said it was acquiring Columbia Property Trust Inc., which owned 19 office buildings in New York, San Francisco, Washington, D.C., and other cities. The deal valued Columbia at $3.9 billion. "We continue to believe that high-quality office buildings in major U.S. cities offer long-term value," John Murray, Pimco's global head of private commercial real estate, said at the time.The Wall Street Journal via Mint, February 28, 2023

It didn't materialize, and so Columbia has become one of the biggest office defaults to emerge so far coming out of the pandemic period. A number of major players took the wrong side of the bet and are now all on the same side of the boat - the side that has water coming over the gunnels.

In many cases, upping the rent to compensate for higher refinancing costs is not an option because of the lack of demand by tennants. In others, the rental rates were unwisely locked in while the mortgage rates were not, setting up a situation where the tsunami that drains the water out of the bay can swamp the boat suddenly:

Even for owners who haven't defaulted, the math has become a lot more complicated. Blackstone Inc.'s Willis Tower in Chicago, for example, has roughly $1.33 billion of commercial mortgage-backed securities and has seen monthly payments on that debt jump nearly 300% in February from a year earlier, according to data compiled by Bloomberg. A Blackstone spokeswoman said the building is highly occupied with long lease terms.

And Blackstone's problems were not just held in Chicago or even the US:

Blackstone Inc. defaulted on a €531 million ($562 million) bond backed by a portfolio of Finnish offices and stores as rising interest rates hit European property values. Blackstone, which acquired landlord Sponda Oy in 2018, sought an extension from holders of the securitized notes to dispose of assets and repay the debt.... Bondholders voted against a further extension....Bloomberg, March 2, 2023

Obviously, the problems are going to vary greatly from market to market, from the size of one investor to another and according to how deep they are in a particular market compared to another, etc. In Blackstone's case with its European properties, the Ukraine war played a role in its struggles with the property portfolio. Not so, in the case of its Chicago property. However, with interest rates rising everywhere, properties with differing problems or portfolios loaded with such properties are now emerging naked from the receding water in a hurry.

Two office landlords defaulting may be just the beginningBut the financing fallout has spread across the US. The default by Columbia Property Trust, which was bought in 2021 by funds managed by Pimco, involves seven properties, ranging from a Manhattan tower that used to house the New York Times, to a San Francisco building that's battling Elon Musk's Twitter over some missed rent payments. One building in the group of properties, 245-249 W. 17th St., is also seeing Twitter, a key tenant, look to sublease its space at the building.

Different problems entirely for different properties, but rapidly rising interest rates are the falling tide for all of them that is revealing their shortcomings. The defaults, of course, have their knock-on effects with other investors, who suddenly find themselves short on funds due to the defaults, creating a new wave of financial problems that can ripple through markets everywhere in completely unpredictable ways.

Blackstone Inc said... it had blocked investors from cashing out their investments at its $71 billion real estate income trust (BREIT) as the private equity firm continues to grapple with a flurry of redemption requests. BREIT said it fulfilled redemption requests of $1.4 billion in February, which represents only 35% of the approximately $3.9 billion in total withdrawal requests for the month....Reuters via US News, March 1, 2023

Not only do people in the fund get locked out of their money, but the event impacts the wealth of those who own stocks in the company that runs the fund, too:

Credit Suisse downgraded its rating of Blackstone's stock to underperform in November partly because of the rise in investor redemptions from BREIT. Blackstone's shares were down 0.25% at $90.57 per share in afternoon trading on Wednesday. The stock lost 43% of its value last year.

Obviously, the more the Fed has to raise interest rates to quell relentless inflation, the larger the spread of companies that will be affected. However, even if the Fed stopped raising rates right now, this problem is a time bomb with thousands of independent timers - each loan with its own set time for refinancing under the recently raised rates. We have barely begun (particlulary in the last week or two) to see some of the big boys who are swimming naked at today's rates, and there will be many more to show in the next couple of years as more and more mortgages roll over even if rates rise no further:

"It's going to be a very tough two years until the market finds an equilibrium," said Ran Eliasaf, founder of investment firm Northwind Group. "In the meantime, there's going to be a lot of hurt and unfortunately, a lot of money lost."

If the Fed has to keep raising rates to fight inflation (as it will have to do), that problem only gets compounded. This is one of many reasons I have been saying all along that anyone who thinks we get through this interest-hiking phase with a "soft landing" is nuts. My basis for saying that doesn't come from knowing all the problems that are hiding beneath the water's surface right now. It comes from knowing what anyone can see - from knowing the massive amount of speculative debts that have been taken out when rates were as easy as a few percent that are now being repriced. At those starting rates, it does't take much to double the cost of carrying that massive speculative debt. Foreseeing the huge problem that will emerge when so many companies have gone long on speculation is a common-sense deduction from seeing the kinds of risks investors everywhere have been willing to gamble on because the Fed had their back... until it didn't. The Fed lured them with absurdly low rates into high-risk behavior.