March 18, 2023

Following the day-to-day twists and turns of a banking crisis can make us lose sight of the bigger picture. It is tempting to think that the banking authorities are in control, and they will secure the integrity of their commercial banking networks. Unfolding events may or may not prove this to be true.

The bigger picture is that the forty-year decline in interest rates is over, as well as the financial bubble that has built up with it. And we should also be aware that there is a cycle of bank credit, the downturn of which is long overdue. The two have come together to create chaos in credit markets

The reality is that central banks have already lost control over monetary policy and interest rates. Interest rates are now being driven by contracting bank credit, not by monetary policy. The point which is commonly missed is that contracting credit at a time when credit demand is still increasing inevitably leads to higher interest rates and bad debts.

Having lost control over interest rates, the Fed has been forced into its much-heralded pivot, not by reducing interest rates, but by offering to buy Treasury and Agency debt at face value whatever the coupon and maturity. This rescues banks from the immediate fate that collapsed Silicon Valley Bank. And it makes it easier for the US Treasury to fund its deficit while containing borrowing costs.

But it is highly inflationary.

The pivot has now been made. The Fed has decided to rescue financial markets at the expense of the currency. Other central banks can be expected to follow suit to help rescue their banking systems. But in the process, they are writing the death warrants for their fiat currencies.

Introduction

As if there was any doubt, the shock waves from last week's collapse of Silver Valley Bank in the US have exposed how unstable the US financial system has become. The irony in it all is that while Silver Valley was regulated as a bank, the activities which brought it down were not in banking at all. Banks are dealers in credit, creating assets (loans) and matching deposits (liabilities). SVB was taking in deposits and simply investing a large proportion of them in bonds. Allowing for the differences in corporate structure, that is an activity more in character with investment vehicles such as mutual and hedge funds. And in recent years, central banks indulging in quantitative easing have equally been paying top-dollar for government and quasi-government bonds, only to see their balance sheet values collapse into negative equity on a mark-to-market basis.

It is important to remind ourselves that there is an underlying boom-and-bust cycle in bank credit, and it is this cycle which drives the Austrian theory of the business cycle. The boom phase evolves over time before credit contraction creates a more sudden bust. The whole cycle has averaged roughly a decade since the early nineteenth century. When it is moderate, we see interest rates rising as a result of bank credit being restricted when bankers' desire for profit turns to fear of losses. Bond yields rise, a bear market in financial assets follows, unemployment rises, and some businesses fail. When the cycle is more severe, we see bank failures leading to more catastrophic consequences.

The last crisis was marked by the failure of Lehman in August 2008. But there was evidence that the cycle of bank credit was already topping out in September 2007, when a British bank, Northern Rock, faced a run on its deposits forcing it to turn to the Bank of England for liquidity support. That quietened things down for a few months. But I vividly recall visiting RP Martin's dealing room just before Christmas that year. RP Martin are dealers in wholesale money markets. While I was there, the word went out that sterling interbank had stopped trading. No bank appeared to be willing to lend sterling to other banks. Obviously, banker sentiment was very fragile.

Unlike the larger collateralised repo market, the interbank market is the mechanism whereby all banks rebalance their overnight positions. In the entirety of a banking system, banks which have lost deposits will be balanced by those which have gained them, ignoring net changes in public holdings of banknotes. The entire banking system's balance sheet remains balanced, though imbalances arise for individual banks which need addressing on a daily basis. Access to this facility is crucial for any bank, and an exceptional drain on deposits faced by one bank will ring alarm bells in all the others.

That is why a freezing up of interbank markets cannot be ignored. It came despite the Bank of England supporting Northern Rock, which it did until February 2008 when it took the ailing bank into public ownership. It wasn't until September that year that Lehman failed in America, precipitating what many now call the great financial crisis.

It is a mistake to assume that a cyclical banking crisis is defined by one event. It must always be regarded as evolutionary in character. And it is over fourteen years since the great financial crisis, telling us that the next one is long overdue. It has been delayed by inflationary monetary policies, which until recently continued to feed cheap credit into the global banking system. But without a substantial injection of equity capital, the entire US banking system has now run out of balance sheet capacity. It was in addressing this very issue that SVB triggered a run on its deposits by seeking to raise more capital. But SVB's problem is shared with the entire US banking network, which faces the consequences of sharply rising interest rates on fixed interest and other financial investments, both on and off their balance sheets as loan collateral. Furthermore, the prospect of increasing levels of non-performing loans having to be written off against bank shareholders' capital adds to bankers' caution.

To minimise the impact of maturity mismatching, in the past banks have restricted their bond purchases to short maturities. The SVB failure revealed holdings with considerably longer maturities, presumably acquired at a time when short term rates were minimal, and longer maturities offered a decent pickup in yield. Presumably, they were not alone in this bet, that interest rates were totally under the control of the Fed, and they would never rise again. The temptation then is to use balance sheet leverage to turn a two per cent yield differential into to a twenty per cent gross return on the bank's capital.

While falling bond values create difficulties for the balance sheet, at the same time rising interest rates increase the cost of funding. Across the combination of a bank's profit and loss account and its balance sheet, the Fed's sudden increase in interest rates last year has acted like a boa constrictor, squeezing profitability out of the entire commercial banking system.

Being a wake-up call and for this reason, the initial reaction to the Silicon Valley Bank news was for bank shares to fall sharply everywhere. Two other Californian banks have collapsed, Signature and Silvergate, completing a trio of tech and crypto focused lenders, and the shares of some other regional banks were hit especially hard. And in the wider financial universe, we have already seen one global systemically important bank (G-SIB) in trouble: a rescue package for Credit Suisse has been insufficient to restore confidence in it, with depositors reportedly still fleeing to other banks, and its principal backer backing out.

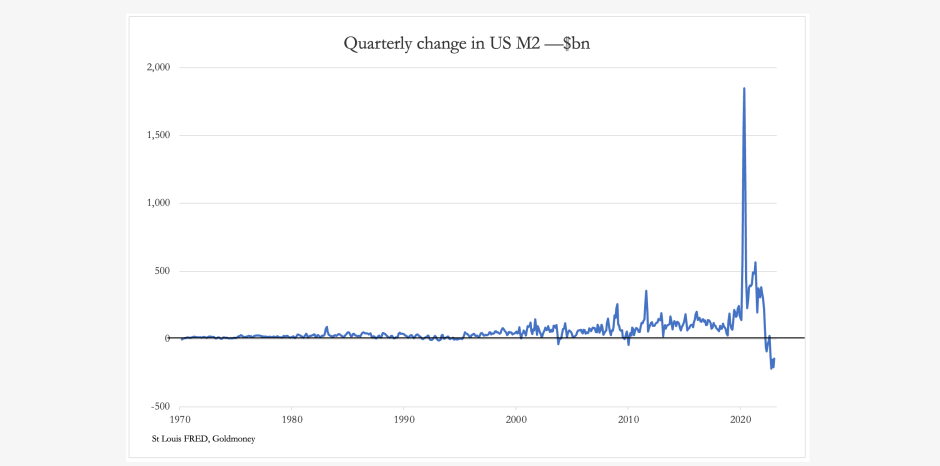

It appears that not only is the cycle of global bank credit turning down with an unexpected violence, but it has long outlasted its ten-year cyclical framework. And all the signs of an exceptionally severe downturn are there: the chart below shows how US broad money, which is about 90% bank deposits, is already contracting at a record rate for the fiat dollar regime.

This contraction is not trivial, and we had an early warning of it when Jamie Dimon told delegates at a banking conference that he was upgrading his forecast of an economic storm to a hurricane. That was last June. It amounted to the clearest signal we have ever seen from the world's leading commercial banker, that the credit cycle was about to turn down. And it was delivered at a time when the quarterly change in US M2 in the chart above was just turning negative.

The SVB failure, which was rapidly followed by Signature Bank, quickly turned the initial bail-in approach announced they the US authorities back to the normal bail out procedure. Instead of deposit compensation up to $250,000 being protected by the FDIC while larger deposits would be only entitled to the spare change (if any) left from a liquidation, it rapidly became apparent that a bail-in would only spread the crisis. The Bank of England/UK Treasury rapidly followed the Fed/US Treasury lead, so it is reasonable to expect the other shoes yet to drop at the Bank of Japan and at the euro system will similarly ignore bail-in legislation and attempt to stand behind their entire banking systems.

Bail-in procedures were conceived by politicians in the emergency G20 meeting following the Lehman failure. There, it was agreed that "taxpayers would no longer pay the price of banker greed and their failure", an emotive response to the cyclical downturns of bank credit. It ignored practicalities, for the fact remains that it is the overriding duty of a modern central bank to ensure the integrity of the commercial banking system in its bailiwick, despite protestations of moral hazard.

The consequences for future interest rates

We have become accustomed to interest rates not being set in markets but being firmly under the thumb of central banks. We tend to forget that the rate of interest is an agreement between a bank and a borrower, determining a condition of a loan, and that the rate is set by mutual agreement. With respect to deposit rates, no doubt the banking cohort will happily go along with a monetary policy which lowers deposit rates so long as it improves lending margins, but that is about as far as official monetary policy goes. Beyond this point, if the central bank supresses rates severely enough and lending margins compress, commercial banks will naturally restrict their lending activities.

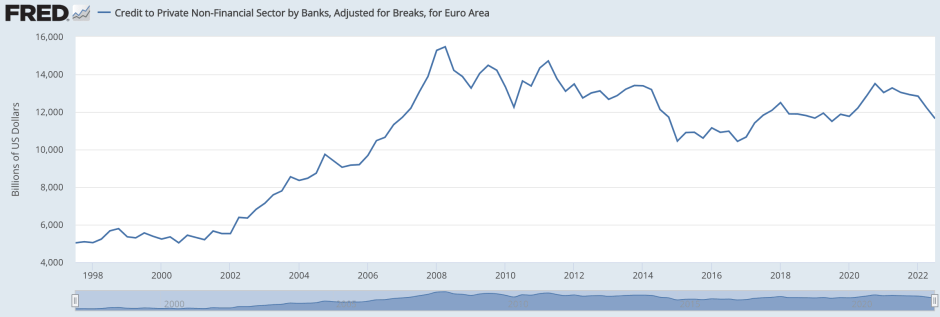

Negative interest rates in Japan and the Eurozone amount to a tax on bank reserves, discouraging credit expansion. This is evident in our next chart, of bank lending to businesses and consumers in the Eurozone.

The all-time lending peak was in 2008, when it stood at €15,468bn and the ECB's deposit rate facility stood at 3.25%. Supposedly, that was the time when the ECB pulled out all its stops to encourage growth in GDP, which is no more than bank credit expansion aimed at the non-financial economy. But by the fourth quarter of 2016, non-financial lending had declined by a third to €10,433bn, and the ECB's deposit rate facility had also declined to a heavily suppressed minus 0.4%. While there was some subsequent recovery in bank lending, particularly to support businesses and consumers through covid lockdowns, bank lending is noticeably declining again.

So much for the common belief that a central bank can manage economic outcomes by manipulating interest rates. The question now arises as to whether a policy pivot away from pricing money as the principal means of tackling inflation, to saving the banking system, will achieve its objectives. But that is to misinterpret the problem. Irrespective of what central banks do with interest rates, they cannot escape the fact that the cycle of bank credit is accelerating into a downturn phase, and there are good reasons for a banker in the face of increasing counterparty risks to reduce his credit exposure.

All bankers are now aware that their business is increasingly being driven by fear of losses. It comes in three forms: there is the fall in financial asset values, which led to SVB's bankruptcy, there is lending risk exacerbated by high balance sheet leverage, and there is now counterparty risk in the clearing system.

It is widely expected that the Fed will abandon inflation targeting and interest rate increases, perhaps even cutting them slightly. That would certainly help with commercial bank funding on the deposit side and lessen the losses on fixed interest debt. But for how long? As we can see from the foregoing, that won't stop the slide in bank credit, unless the cohort of lending officers can be persuaded to stop thinking about risk. So, for all practical purposes bank credit will still contract and banks will likely grasp the opportunity to liquidate assets when they can, and they will be quick to liquidate collateral against loans as well. As the chart below illustrates, credit contraction for financial assets is already well underway.

Trying to turn the tide in credit is like standing in the path of a runaway train. The track is set, and the shortage of bank credit will increase. If the availability of credit is restricted while demand continues, then the interest cost of borrowing rises. And if the cost of borrowing rises, it would be fruitless to expect bond yields to sustain a decline. Rather, the spread between government and corporate bond yields will widen. And any fall in government bond yields from domestic investors seeking them as a safe haven increases the risk relative to the return for foreign holders of financial assets.

As a cohort, foreign holders of financial assets are among the first to liquidate their positions, driven by the twin fears of falling asset values and the consequences for the currency's exchange rate. Undoubtedly, suppressing interest rates to restore systemic order can only be a temporary bandage on a haemorrhaging financial system. It amounts to a choice being made to protect the financial system and its values at the expense of the currency.

The backstop guarantee is worthless

Financial markets hang on every word emanating from central bank governors and monetary policy committees. In earlier times, perhaps sacrifices would have been made to appease these market deities. Yet, like their heathen forbears today's policy makers have delivered nothing positive which can be attributed to their intervention. Worse, their meddling leaves a catalogue of failure and decline which would embarrass their pagan predecessors. But like all dogmas, there comes a time when they are discredited, and we can be sure that the contradictions in modern macroeconomics will lead to its demise as well.

An earlier version of Keynesianism was in the theories of John Law, who inflated a financial bubble in France in 1717-1720. While the Mississippi bubble was inflating, Law was regarded as a genius. Like Keynes, he had theorised that an economy needed the stimulus of credit, produced not from an independent banking system driven by market factors, but managed by a centralised, statist bank. Hence, his Banque Generale become the Banque Royale, a central bank with a mandate to pay down the King's debts.

But as Law with his proto-central bank was to discover, when a state-driven bubble deflates, it takes down the entire financial system and the currency with it. This was evident in the contrast between the Mississippi bubble and the contemporaneous South Sea bubble in London, where the Bank of England which was the government's bank did not get involved. When the South Sea bubble imploded, the Bank of England survived and continued to back its banknotes with specie. When Law's bubble and his livres were imploding, he resorted to violently extracting specie and valuables from anyone suspected of possessing them. His venture survived the debacle, but the currency did not.

By following similar statist theories of credit, our contemporary equivalents of the Banque Royale have fostered a global, longer-lasting version of the Mississippi bubble. In addition to issuing credit to fund statist deficits, modern central banks have aggressively supressed interest rates. Consequently, and aided by international cooperation, today's global bubble knocks Law's into a cocked hat. Like John Law's greed-driven speculators, today we make the same mistake of not recognising the credit bubble for what it is, and investors make the mistake of committing themselves to it absolutely. Worse still, global coordination ensures that the gatekeepers for all the major currencies are bound together by groupthink into committing the same fatal errors.

When the stimulus of lower interest rates was not enough, our central banks all simultaneously began to print credit under the fancy name of quantitative easing. Unlike commercial bank credit, the expansion of central bank credit has proved impossible to reverse, as we are now finding out. The Fed tried briefly to do so in 2019, which led to a collapse in share values with the S&P 500 Stock Index falling by a third between February and March the following year. The bubble then had to be reinvigorated by increasing QE massively, an action justified by the covid pandemic.

In 2022, the fiat currencies of the western nations began to lose purchasing power at an accelerating rate, and interest rates which were no longer under firm central bank control began to rise. And with rising interest rates, the value of government and quasi-government bonds bought in the market as the counterpart of QE began to collapse. The upshot is that central banks are all in negative equity, which more bluntly stated is that they are technically bust.

Like John Law's livres, dollars, euros, yen, and pounds are fiat currencies. It is with reference to them that all credit in their respective jurisdictions is measured. For their value they depend entirely on the public's confidence in incorporeal debt, not corporeal specie. We now face the prospect of that confidence being undermined by the central banks' inability to stabilise the purchasing power of their credit which is anchored to nothing.

The Fed's Bank Term Funding Programme

While all the major central banks are technically bust, they are still responsible for maintaining credit systems which have become victims of state induced bubbles. While commentators point to the moral hazard of commercial banks being rescued to protect depositors, it is a fact that central banks have a prime duty to ensure the integrity of the commercial banking system. Consequently, they will do whatever it takes to discharge this obligation. And it is this obligation which drives the dark side of the credit bubble - the value of the fiat currencies themselves measured not against each other, but in goods and services.

We must not underestimate the vested interests of both the monetary authorities and major banks to ensure that the current system, with all its flaws, survives. We have already seen the Fed offer to take in bonds as collateral in a new loan facility (the Bank Term Funding Program - BTFP) at face value for one year. For instance, a ten-year maturity Treasury bond issued at par with a 0.5% coupon in August 2020 will be accepted as collateral at par with no haircut, despite it being valued in the market currently at $77.90, a discount of 22.1% to redemption value.

In its news release, the Fed stated that it does not anticipate having to draw on a facility created for this purpose with the Exchange Stabilisation Fund. But the apparent hope that banks taking up this facility will be limited is a cover for its real purpose, which is to ensure that enforced bank liquidation of government and other bonds does not drive yields higher. But rather like QE which has proven to be impossible to reverse, this new BTFP could become an albatross round the Fed's neck. After all, any bank which has a loss on its bond investments can now get a hundred cents on the dollar, deferring its loss for year. And we all know that at the end of a year, the Fed will have to renew the facility, rather than withdraw it and precipitate a crisis which it has only deferred.

For commercial banks, this is truly wonderful, even assuming they don't try to game the system by buying bonds in the market for a balance sheet uplift courtesy of the Fed's BTFP facility. That becomes a mouth-watering opportunity when it is realised that the Fed's one-year loan facility is effectively perpetual.

This will almost certainly lead to the Fed expanding its balance sheet by whatever is submitted by the banks under this facility. According to the Fed's Form H.8, commercial banks have $4,532bn in Treasury and Agency Securities and a further $2,732bn in mortgage-backed securities. Most, if not nearly all of these bonds will be under water, the depth to which depends on their coupon and maturity. This generous offer will surely lead to substantial submissions of bonds for central bank credit.

The Fed's balance sheet assets must reflect these BTFP loans, and they cannot be shunted off into a new Maiden Lane-like facility. The take-up is likely to become considerable, rapidly taking the Fed's balance sheet to well over $10 trillion and beyond

The real purpose behind the BTFP facility appears to be that the Fed now has a mechanism to ensure that the values of all financial assets linked to bond yields are secured, a vital objective if economic confidence is to be maintained. Having lost control of interest rates, it is now attempting to control bond yields. And an important step has also been taken to ensure that the expense of federal Government funding is contained.

Consequences for the dollar

The commitment to an acceleration of credit inflation at the central bank level is bound to undermine the dollar's purchasing power even further than has been attributed to recent events, such as covid, supply chain disruption, and blowback from sanctions against Russia.

In the first instance, this matters hugely to foreign holders of the dollar, who will almost certainly be more sensitive to these issues than domestic American investors. Furthermore, there is a stubborn assumption that interest rates are under the control of the Fed when recent events have shown that not to be the case - otherwise with its insistence that consumer price inflation is transitory, like the Bank of Japan it could have just sat on rates at or close to the zero bound.

Not only will further contraction of bank credit drive up interest rates, irrespective of the demands of monetary policies, but a new round of credit inflation by the Fed leads inevitably to higher rates demanded in the market to compensate for the loss of purchasing power entailed. With roughly $12 trillion of foreign owned portfolio assets in US equities, a further $4 trillion in corporate bonds, $7.6 trillion in Treasury and Agency bonds, and a further $7.5 trillion in short-term assets such as bills and bank deposits, there is enormous scope for foreign liquidation of dollars and dollar assets, once the initial effects of a Fed rescue of the failing financial system wears off.

That a run on a currency starts with foreign liquidation is perfectly normal, as those with long experience of sterling will confirm. For too long, US nationals have become accustomed to continual foreign buying of dollars and dollar assets, despite its fiat currency status, and despite US trade and budget deficits. The destruction of this confidence is now bound to follow.

Banking solvency problems are everywhere

The situation facing the other major fiat currencies differs mainly in the detail. Given the group thinking common to central banking policy makers, the temptation for other jurisdictions to follow the Fed's trailblazing BTFP may prove irresistible.

So far, with the exception of Credit Suisse's widely publicised problems, the focus has been on the US banking system and the authorities' immediate response. It is a sad fact that Basel regulations have addressed balance sheet liquidity problems but failed to control excessive expansion of bank credit relative to shareholders' capital. Consequently, regulators in the Eurozone and Japan have tolerated asset to equity ratios of over twenty times for their global systemically important banks, when in the past ratios of ten to twenty times were deemed to be high. The contraction of bank credit is likely to be more catastrophic in these jurisdictions than in the US, where ratios for G-SIBs are commonly less than twelve times.

Estimating balance sheet ratios does not tell the whole story. There are off-balance sheet factors as well, principally liabilities in regulated and over the counter markets, which for the G-SIBs are larger than their entire balance sheets combined. According to the Bank for International Settlements, open interest in regulated futures totalled $36.6 trillion in end-2022, and in June last year, the notional value of OTC derivatives stood at an additional $632.2 trillion, giving us an approximate total of $670 trillion. Banks, insurance companies, and pension funds are the counterparties in these transactions, and the failure of a significant counterparty acting in these markets could bring down the entire western financial system.

The big picture is of an asset bubble which has come to an end. And by any standards, this one is the biggest in recorded history. The situation is likely to be made more immediate for us by a new factor of nearly four billion people rapidly industrialising under the leadership of China and Russia. The evidence strongly suggests that they see monetary matters similarly to the author of this article, and that they are now prepared to act to protect themselves from an impending collapse of their western enemies' currencies.

We have yet to hear the details, but the Asian hegemons are designing a new trade settlement currency most likely based on gold. The prospect of the Asian hegemons securing credit values to legal money, being gold, which is corporeal and has no counterparty risk is bound to draw attention by contrast to the weaknesses and fallacies behind fiat currencies.

For those of us under the yoke of fiat credit detached from any corporeal values, there is only one escape from a banking system which is now imploding. And that is to possess legal money as much as possible, which by both longstanding law and human habit is gold in bar and coin form. Physical silver is the money for smaller purchases. That is why Goldmoney was founded over twenty years ago, with the objective of providing a safe haven from a monetary system that was eventually bound to collapse. That moment has now arrived.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated.