By David P. Goldman

Asia Times

March 27, 2023

NEW YORK - The US banking system is broken. That doesn't portend more high-profile failures like Credit Suisse. The central banks will keep moribund institutions on life support.

But the era of dollar-based reserves and floating exchange rates that began on August 15, 1971, when the US severed the link between the dollar and gold, is coming to an end. The pain will be transferred from the banks to the real economy, which will starve for credit.

And the geopolitical consequences will be enormous. The seize-up of dollar credit will accelerate the shift to a multipolar reserve system, with advantage to China's RMB as a competitor to the dollar.

Gold, the "barbarous relic" abhorred by John Maynard Keynes, will play a bigger role because the dollar banking system is dysfunctional, and no other currency-surely not the tightly-controlled RMB-can replace it. Now at an all-time record price of US$2,000 an ounce, gold is likely to rise further.

The greatest danger to dollar hegemony and the strategic power that it imparts to Washington is not China's ambition to expand the international role of the RMB. The danger comes from the exhaustion of the financial mechanism that made it possible for the US to run up a negative $18 trillion net foreign asset position during the past 30 years.

Germany's flagship institution, Deutsche Bank, hit an all-time low of 8 euros on the morning of March 24, before recovering to 8.69 euros at the end of that day's trading, and its credit default swap premium-the cost of insurance on its subordinated debt-spiked to about 380 basis points above LIBOR, or 3.8%.

That's as much as during the 2008 banking crisis and the 2015 European financial crisis, although not quite as much as during the March 2020 Covid lockdown, when the premium exceeded 5%. Deutsche Bank won't fail, but it may need official support. It may have received such support already.

This crisis is utterly unlike 2008, when banks levered up trillions of dollars of dodgy assets based on "liar's loans" to homeowners. Fifteen years ago, the credit quality of the banking system was rotten and leverage was out of control. Bank credit quality today is the best in a generation. The crisis stems from the now-impossible task of financing America's ever-expanding foreign debt.

It's also the most anticipated financial crisis in history. In 2018, the Bank for International Settlements (a sort of central bank for central banks) warned that $14 trillion of short-term dollar borrowings of European and Japanese banks used to hedge foreign exchange risk were a time bomb waiting to explode ( "Has the derivatives volcano already begun to erupt?", October 9, 2018).

In March 2020, dollar credit seized up in a run for liquidity when the Covid lockdowns began, provoking a sudden dearth of bank financing. The Federal Reserve put out the fire by opening multi-billion-dollar swap lines to foreign central banks. It expanded those swap lines on March 19.

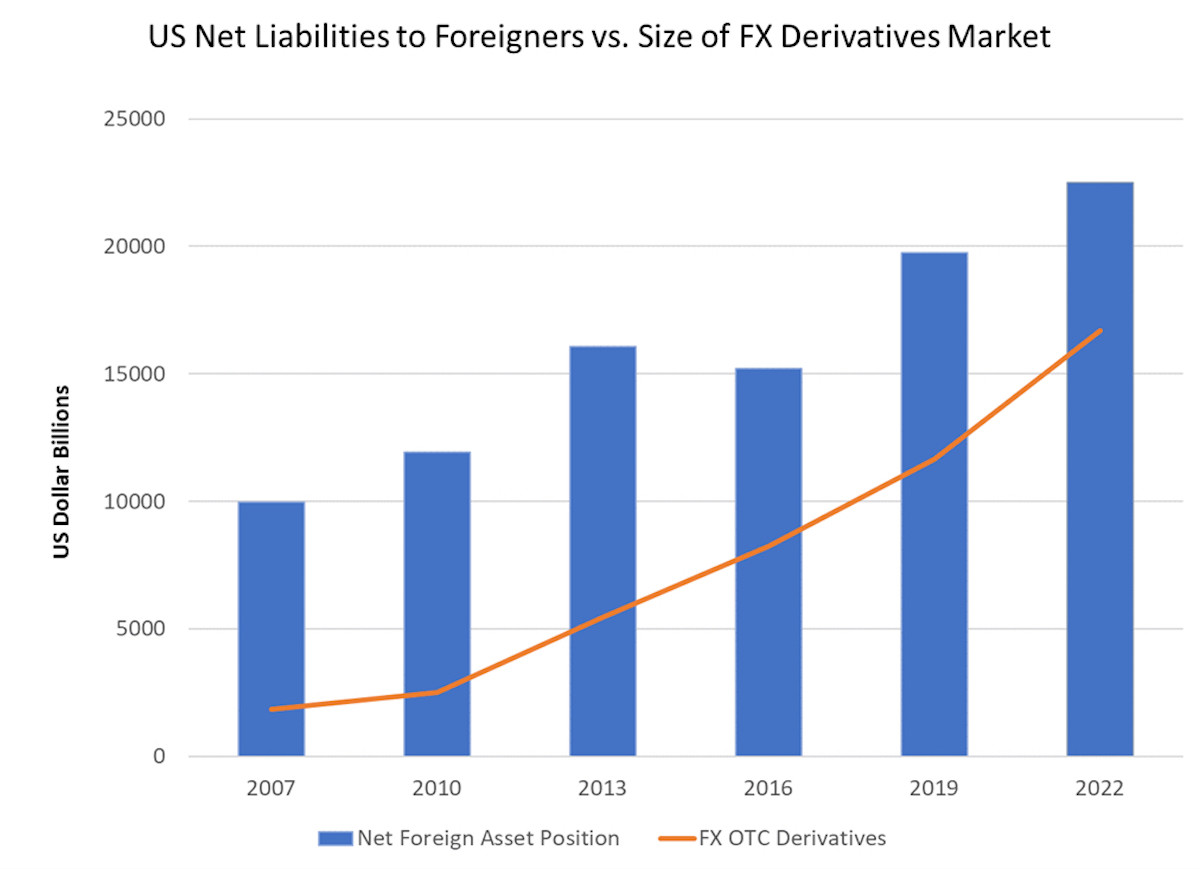

Source: US Bureau of Economic Analysis, Bank for International Settlements

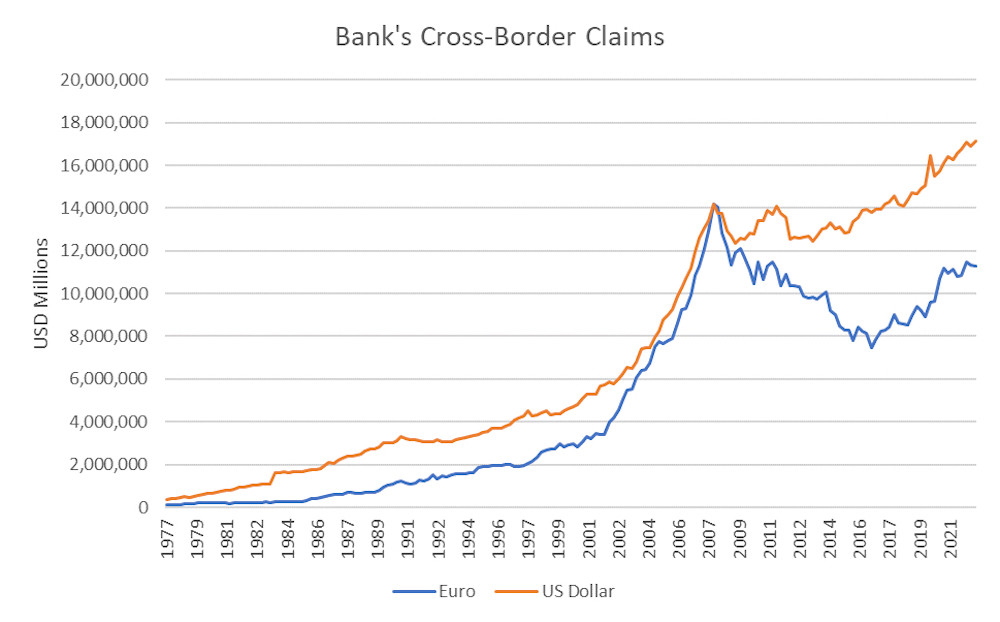

- Correspondingly, the dollar balance sheet of the world banking system exploded, as gauged by the volume of overseas claims in the global banking system. This opened up a new vulnerability, namely counterparty risk, or the exposure of banks to enormous amounts of short-term loans to other banks.

Source: Bank for International Settlements

- America's chronic current account deficits of the past 30 years amount to an exchange of goods for paper: America buys more goods than it sells, and sells assets (stocks, bonds, real estate, and so on) to foreigners to make up the difference.

America now owes a net $18 trillion to foreigners, roughly equal to the cumulative sum of these deficits over 30 years. The trouble is that the foreigners who own US assets receive cash flows in dollars, but need to spend money in their own currencies.

With floating exchange rates, the value of dollar cash flows in euro, Japanese yen or Chinese RMB is uncertain. Foreign investors need to hedge their dollar income, that is, sell US dollars short against their own currencies.

That's why the size of the foreign exchange derivatives market ballooned along with America's liabilities to foreigners. The mechanism is simple: If you are receiving dollars but pay in euros, you sell dollars against euros to hedge your foreign exchange risk.

But your bank has to borrow the dollars and lend them to you before you can sell them. Foreign banks borrowed perhaps $18 trillion from US banks to fund these hedges. That creates a gigantic vulnerability: If a bank looks dodgy, as did Credit Suisse earlier this month, banks will pull credit lines in a global run.

Before 1971, when central banks maintained exchange rates at a fixed level and the United States covered its relatively small current account deficit by transferring gold to foreign central banks at a fixed price of $35 an ounce, none of this was necessary.

The end of the gold link to the dollar and the new regime of floating exchange rates allowed the United States to run massive current account deficits by selling its assets to the world. The population of Europe and Japan was aging faster than the US, and had a correspondingly greater need for retirement assets. That arrangement is now coming to a messy end.

One failsafe gauge of global systemic risk is the price of gold, and especially the price of gold relative to alternative hedges against unexpected inflation. Between 2007 and 2021, the price of gold tracked inflation-indexed US Treasury securities ("TIPS") with a correlation of about 90%.

Starting in 2022, however, gold rose while the price of TIPS fell. Something like this happened in the aftermath of the 2008 global financial crisis, but the past year's move has been far more extreme. Shown below is the residual of the regression of the gold price against 5- and 10-year maturity TIPS.