David Stockman's Contra Corner

April 1, 2023

New York District Attorney Alvin Bragg is apparently fixing to become the John Wilkes Booth of the present era. That is, the guy who single-handedly put the wrong man in the Oval Office

To be clear, we have no objection to the Donald's relentless and frequently unhinged attacks on the ruling elites of Washington, Wall Street, the mainstream media and the Fortune 500. Indeed, his one abiding virtue is that he had all the right enemies-the very people who's policies and ideologies threaten the future of America as we have known it.

But while Trump had the right enemies, he was hopelessly wrong on the substance of policy. Indeed, when it comes to the GOP's core mission amidst the on-going tussle of democratic governance- standing up for free markets, fiscal rectitude, sound money, personal liberty and small government-the Donald is not remotely a conservative, let alone even a half-assed Republican.

Yet the situation is now so far gone that the election of a real Republican leader in 2024 is the only hope remaining. Literally, the very future of constitutional democracy and capitalist prosperity in America cannot endure another four years of the Donald in the White House. Nor, worse still, another woebegone Democrat like Joe Biden, elected by default owing to not being Donald Trump.

So the essence of the moment is this: Lock him out of both the nomination and the Oval Office. The future of the Republic depends upon it.

We detail the Donald's miserable record as a big spender, easy money-man, hard-core protectionist, immigrant-basher, militarist and all-around statist below, but we need to puncture divisively the myth of the Great MAGA Economy right up front.

That's because a lot of well-meaning Republicans are willing to overlook all of his egregious egotism and petty bombast and his endless departures from conservative economic principles because he purportedly delivered the Greatest Economy Ever.

In a word, he didn't. Not remotely. On the bread and butter matters of growth and jobs, in fact, his record is among the worst of modern presidents, not the best.

To be sure, the very idea that America's infinitely complex, deeply cyclical and globalized $26 trillion economy can be assessed by statistical outcomes realized during the arbitrary 48 calendar months of a presidential term is deeply faulty. Because economic cycles and trends begin and end on calendars wholly unrelated to presidential terms, the overwhelming bulk of economic policy claims by all presidents amount to partisan talking points, not credible economic analysis.

For instance, years of bad Fed policy brought the US economy into a thundering tailspin in 2008. So any statistical measure of results for George W. Bush's tenure have a dismal end-point, which was largely not his doing.

In fact, the overwhelming bulk of economic outcomes during these four-year intervals reflect the combined action of tens of millions of workers, entrepreneurs, managers, investors, consumers, savers and speculators operating on the free market, even as compromised as it has become owing to government intervention and central bank manipulation.

Indeed, when it comes to the big picture, "presidential policy" is way, way over rated. And in the particular period of 2017 thru 2020 the Donald inherited trends and a ripening business cycle that were overwhelmingly not his doing.

Nevertheless, the facts leave little room for doubt. Real economic growth averaged just 1.52% per annum during Trump's 48-months in the Oval Office. Literally, you can't find anything that weak in the data since the Korean War!

Of course, circumstances, cycles and even demographics change so much over long periods of time that reaching way back for comparisons has its limits. Still, real growth over the 62-years between 1954 and 2016 averaged 3.04% per annum. That's exactly twice-to the second decimal point- what materialized during the Donald's term.

As it happened, that extended interval encompassed 9 recessions, 11 presidents, numerous wars and a goodly number of domestic and international crises. So it's a fair representation of modern history, not distorted by short-run fluctuations owing to cyclical timing factors or aberrations like the Great Financial Crisis (GFC).

And yet, and yet. The Donald's ballyhooed MAGA economy grew at just half the rate of what might fairly be called the modern growth norm.

Moreover, when we dial in closer to the present time during which both demographics and long-term policy constraints (see below) have weakened the underlying growth trend, the most apt comparison of the Trump years is with Obama's second term. The latter and Trump's time in the White House were all part of the extended post-GFC recovery cycle, and occurred under a monetary and regulatory regime that was broadly continuous over the eight years in question.

The economic growth rate during Obama's second term wasn't anything to write home about, either. But it still computed to 2.18% per annum-a rate 40% higher than that on the Donald's watch.

In this analysis we are using real final sales of domestic product as a proxy for economic growth. That's because it has the analytical virtue of removing short-term inventory fluctuations that are irrelevant to growth over any reasonable period of time, but can badly distort beginning and end points when measuring growth rates via the conventional real GDP series.

With the economic growth data smoothed in this manner, there is no room for doubt. If you want to brag about outcomes during the artificial interval of a presidential term, the Donald and his MAGA partisans should remain as quiet as church mice. They have the worst record ever compiled!

Per Annum Change In Real Final Sales Since 1954:

- Kennedy/Johnson 1960-1968: 4.97%;

- Clinton 1992-2000: 3.75%;

- Reagan 1980-1988: 3.44%;

- Carter 1976-1980: 3.37%;

- Eisenhower 1954-1960: 2.92%;

- Nixon/Ford 1968-1976: 2.73%;

- George H.W. Bush 1988-1992: 2.22%;

- George W. Bush 2000-2008: 2.00%;

- Obama 2008-2016: 1.74%;

- Trump 2016-2020: 1.52%.

- All Presidents, 1954-2016: 3.04%

Trump's defenders, of course, will claim that the great Covid pandemic knocked his record into a cocked hat, and that he shouldn't be tagged with the economic plunge of 2020 that originated in China. You can get that argument from the Donald's own tweet of August 2020 after the economy had been flushed into the ditch by the lockdowns and White House fueled Covid hysteria:

....My Administration and I built the greatest economy in history, of any country, turned it off, saved millions of lives, and now am building an even greater economy than it was before. Jobs are flowing, NASDAQ is already at a record high, the rest to follow. Sit back & watch!

We refute that bit of nonsense below but suffice it to note here that the economic contractions of 2020 were due to the sweeping Washington-imposed lockdowns, not the virus itself. And as it happened, the Donald was the very author of those lockdowns and the related self-quarantining of a frightened population. All this disruptive Washington interference with normal economic function was announced and promoted week-after-week from the White House bully pulpit.

Even then, you still can't make an economic silk purse out of the sow's ear which was the MAGA economy. Measured thru Q1 2020 before the big April-June GDP plunge, the average economic growth rate during the Donald's term computes to just 2.10%, a figure still near the bottom of the above rankings.

Nor does the claim that the Donald was a great jobs creator wash, either.

For crying out loud, presidents don't create jobs-capitalists and businessmen do. And while most presidents are unwilling to give the free market its due, the egomaniacal package known as Donald Trump was especially eager to hog the credit.

Except, except-there was actually no credit to boast about. There were 145,400,000 NFP jobs in December 2016 and just 142,475,000 in December 2020. The Donald's term, therefore, encompasses the only time when the number of jobs in the US economy actually shrank-and by 3 million jobs- during a president's tenure in office. Well, at least since Herbert Hoover!

Again, defenders will blame it on the pandemic, but that doesn't hold up, either. Even if you assume that the Donald's term ended in February 2020 the contrast with Obama's comparable second term is not flattering. Trump's adjusted monthly jobs growth number was actually 33% smaller than Barry's.

NFP Job Change Per Month:

- Obama December 2012 to December 2016: +215,300;

- Trump: December 2016 to February 2020: +145,000

When you translate these jobs numbers to annual growth rates, the story is much the same as it was for real economic growth. During the 12 presidencies between 1945 and 2016, the annualized jobs growth rate computes to 2.14% per annum, a figure nearly 44% higher than the 1.49% annualized gain during Trump's term through February 2020.

In the longer sweep of history, the MAGA economy ended up in the bottom half of the jobs league tables, even when you excise from the record the 10 million jobs lost during the Donald's last 10 months in the Oval Office. So the truth of the matter is that when it comes to jobs and economic growth, the Donald was the Greatest Boaster Ever, not a superlative generator of economic prosperity.

Annualized Rate Of Nonfarm Jobs Growth:

- Kennedy/Johnson 1960-1968: 3.22%;

- Carter 1976-1980: 3.11%;

- Clinton 1992-2000: 2.43%;

- Truman/Eisenhower 1945-1960: 2.14%;

- Reagan 1980-1988: 2.04%;

- Nixon/Ford 1968-1976: 1.89%;

- Obama 2nd Term 2012-2016: 1.86%;

- Trump Dec. 2016 Thru February 2020: 1.49%;

- George H.W Bush 1988-1992: 0.60%;

- George H. Bush/Obama 1st Term 2000-2012: 0.15%;

- All Presidents 1945-2016: 2.14%.

This get us to the great MAGA excuse--the economic collapse after March 2020. But there is no way that the Donald gets a free hall pass for the Washington instigated economic mayhem that transpired thereafter.

Donald Trump's original sin was his whole-hearted embrace from the bully pulpit on March 16th of the "two weeks to flatten the curve" scheme, which was actually never about two weeks.

It is now evident that Fauci's deputy came back from China in February 2020 singing the praises of its brutal lockdowns in Wuhan. Consequently, Washington's incipient Virus Patrol was quickly assembled by Fauci et. al. out of the bowels of the Deep State and set about imposing "non-pharmaceutical" policy interventions -that is, statist control schemes-across the length and breadth of the land.

However, unlike any actual Republican who might have occupied the Oval Office at this crucial moment-even a RINO like George Bush Sr.-the Donald was constitutionally incapable of resisting the sweeping implementation and indefinite extension of Fauci's two-weeks ploy for an overwhelming reason. To wit, these devastating assaults on personal liberty and private property could never have happened in the absence of massive fiscal and monetary stimulus/bailouts-actions which were an anathema to conservative doctrine but right up the middle of the Donald's philosophical fairway.

In fact, the record leaves no doubt that he never cared a whit about Federal spending and borrowing; had rarely, if ever, mentioned the words liberty and limited government in his adult life; had been a crude, anti-market protectionist since the 1970s; and had an abiding fondness for easy money because he had literally gambled his way to (dubious) paper wealth in the real estate sector via massive accumulation of cheap debt fostered by the Fed after the mid-1990s.

In a word, without the Fed's printing press, the Donald would have never gotten out of Fred Trump's bailiwick in Queens, nor have remotely gained the opportunity to betray the GOP's core principles on Federal spending and borrowing.

As it happened, of course, the Donald had quickly blown his dad's fortune by the early 1990s on his New Jersey casino ventures. It was only the cheap money of Alan Greenspan and his heirs and assigns in the Eccles Building that rescued the Donald from a one-way trip to the bankruptcy courts, thereby eventually making possible his false claims to be a successful businessman who knew how to fix what ailed the American economy.

The economic fixer claim is what lead to his freakish ascent to the Oval Office. And we do mean freakish, as in utterly unlikely.

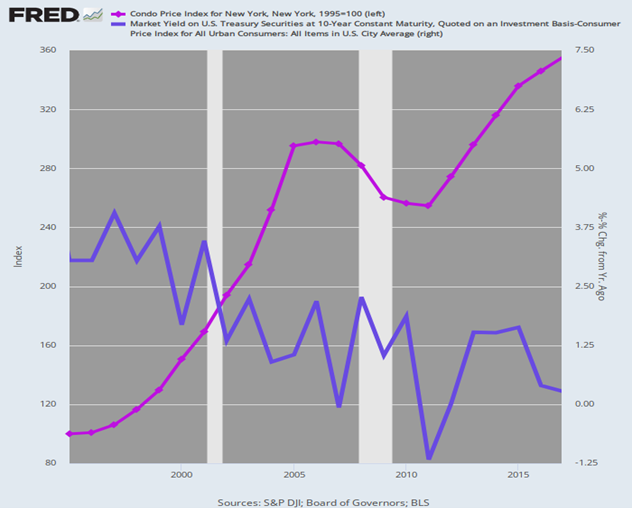

Thus, between 1995, after the Donald got out from under his casino disasters, and 2016, the price of New York real estate (purple line) rose by nearly 250%. At the same time, the inflation-adjusted cost of benchmark debt (10-year UST) plunged from more than 4.0% to barely 0.4%. (dark blue line). So if you were speculating with tons of debt-what was not to like about the lowest interest rates that the world have ever seen for an extended period of time?

Indeed, the Donald became a rabid "low interest man" for no better reason than it had conferred upon him fabulous paper wealth for essentially doing nothing more than building monuments to his own insatiable ego. That is, he learned something during 1995-2016 but it was the very opposite of what the GOP's historic sound money principles were based on.

Index Of New York Real Estate Prices Versus Inflation-Adjusted Yield On 10-Year UST, 1995-2016

Artificially cheap debt, of course, is the mortal enemy of capital markets efficiency, productive investment on main street and sustainable growth of middle class prosperity and living standards. But it is also toxic to the financial culture, leading egomaniacal blowhards like Donald Trump to believe that they are economic geniuses.

Accordingly, "Trump-O-Nomics" was mostly about the Donald's ego-generated whims: Tax cuts one day, spending boondoggles the next, a great Mexican Wall to keep out willing workers and protectionist assaults on "Chiiina" for good measure.

Consequently, in March 2020 the Donald was not about to see the greatest ever "Trump economy" go up in smoke, so he quickly embraced what should have been the unthinkable for any red-blooded conservative. To wit, what soon amounted to $6 trillion of Covid relief bailouts, $5 trillion of balance sheet expansion at the Fed and tens of billions of payments moratoriums for students, renters and mortgage borrowers.

And there is no way that the Donald should be let off the hook, even for the last $2 trillion of this spending bacchanalia ponied up by Joe Biden as the American Rescue Plan. After all, the heart of it was completion of another $2,000 per family stimmy grant which had first been advocated by the Donald himself in the run-up to the November election.

In a word, Trump-O-Nomics heavily mortgaged future taxpayers in order to buy-off what would otherwise have been a fierce political reaction to the Lockdowns. Laid-off workers with a family of four, for instance, easily collected $30,000 to $40,000 in stimmy checks, $600 per week unemployment toppers and tax breaks over the subsequent 18 months. Likewise, nearly 12 million small businesses and self-employed entrepreneurs collected upwards of $800 billion in PPP (paycheck protection program) loans, of which $740 billion was forgiven!

And that's to say nothing of nearly $2 trillion which was parceled out to state and local governments, education institutions, health care agencies and non-profits of every way, shape and form. The amount of political acquiescence which was ultimately paid for with Uncle Sam's credit card and the Fed's printing press money, therefore, was truly staggering. They involved orders of magnitude greater fiscal handouts and pork barrels than had ever before been contemplated.

What this folly also did was drastically distort, mis-shape and yo-yo the American economy in ways that will cause difficulties for years to come. And that disaster, which is the source of the present financial and economic turmoil, is the real legacy of Trump-O-Nomics, as we will amplify in Part 2.

In the meantime, the GOP needs to either throw in the towel on its traditional principles and just became the second "government party", or run like hell from Donald Trump and the baleful record of his term in office.

Part 2

Harry Truman famously had a sign on his desk which read "the buck stops here". The Donald probably never heard of it, but that doesn't exempt him from its truth.

The most outrageous break-out of statist excess in US history happened on Donald Trump's watch with his full complicity. In turn, these Covid-lockdown assaults on normal economic function transformed what was a mediocre economic record during his first 38 months in office into a complete disaster during the last 10 months.

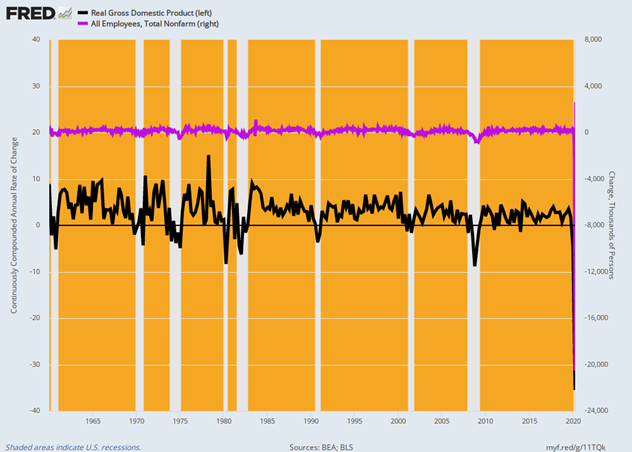

Indeed, nothing like these cliff-dives in economic activity and employment had ever occurred in all of US economic history. Thus, during April 2020 nonfarm payroll employment (purple line) plunged by 20.5 million jobs, while Q2 real GDP (black line) contracted at a 35% annualized rate.

Self-evidently, these declines were literally off the charts of history.

Change In Real GDP and Nonfarm Employment, 1960 to 2020

And it didn't end there, either. The imbalances, excesses, distortions and malinvestments introduced into the US economy owing to the lockdowns, mandates and Covid hysteria, and then the brobdingnagian monetary and fiscal stimmies designed to relieve these dislocations, plague us to this very day. That is, the long-term trend toward deep impairment of the engine of capitalist prosperity was already bad enough before the Donald's arrival in the Oval Office, and then Trump-O-Nomics drove the final nail in the coffin.

All of this means, of course, that "the Covid did it" excuse doesn't wash. Not only did four years of the MAGA economy amount to the worst growth and jobs results since WWII, but the stagflationary blow-off stage now engulfing the US economy is every bit a legacy of Trump-O-Nomics. The Donald inherited an economic mess, and then made it incredibly worse.

So we needs repair to the beginning. The sweeping set of non-pharmaceutical interventions unleashed by the Trump Administration in March 2020 and thereafter constituted a grave affront to constitutional liberty and capitalist prosperity. In a just world, those responsible would be exposed, hounded and shamed, and prosecuted where warranted, so that future power-grabbers would forever be reminded that tyranny cannot be imposed with impunity.

Indeed, if some intrepid prosecutors really wanted to bring Trump to justice, they would pursue the grotesque violations of law and the constitution authorized by the Donald after March 16th rather than the tawdry Stormy Daniels affair for which the Donald has already received the appropriate punishment-a fulsome measure of public ridicule.

And the parallel excuse that "the staff made me do it" doesn't let him off the hook, either. If Donald Trump had even a minimal regard for constitutional liberties and free market principles he would never have green-lighted Dr Fauci and his Virus Patrol and the resulting tyranny they erected virtually overnight. And most especially he would not have tolerated their continuing assaults as the lockdowns dragged into weeks and months.

In this context, the one thing we learned during our days in the vicinity of 1600 Pennsylvania Avenue is that any president, at any moment in time, and with respect to any issue of public import, has call on the best experts in the nation, including those who might disagree with each other vehemently.

Yet the record makes clear that in the early days of the pandemic-when the Virus Patrol's terrible regime was being launched-the Donald was entirely passive, making no effort at all to consult experts outside of the narrow circle of power-hungry government apparatchiks (Fauci, Birx, Collins, Adams) who were paraded into the Oval Office by his meretricious son-in-law and knucklehead vice-president.

From the very beginning of the pandemic, in fact, there were legions of pedigreed epidemiologists and other scientists-many of who later signed the Great Barrington Declaration-who correctly held that viruses cannot be extinguished via draconian quarantines and other clumsy one-size-fits-all public health interventions; and that when it came to corona-viruses in particular, it was doubtful whether even vaccines-which had never been successful with coronaviruses-could defeat the latter's natural propensity to mutate and spread.

From day one, therefore, the logical course was to allow the virus to spread its own natural immunity among the public at large, and to focus available resources on the small minority that owing to age, compromised immune systems or comorbidities were vulnerable to severe illness.

In a word, from its earliest days, there was no reason for a sweeping intervention by the public health apparatus at all. Nor for the coercive one-size-fits all, state-driven mobilization of quarantines, lockdowns, testing, masking, distancing, surveilling, snitching and ultimately mandated mass vaxxing. In fact, the experimental drugs developed under the Donald's multi-ten billion dollar government subsidy scheme called Operation Warp Speed represented what was probably the most insidious statist measure of all.

That these truths were known from the earliest days was especially the case because in addition to decades of scientific knowledge about the proper management of virus based pandemics, there existed the screaming real time evidence from the stranded Diamond Princess cruise ship. The 3,711 souls (2,666 passengers and 1,045 crew) aboard skewed heavily to the elderly, but the survival rate known in mid-March 2020 was 99.7% overall, and 100% for those under 70 years of age.

That's right. As of March 10, 2020, shortly before the Donald elected to impose Chicom-style lockdowns on the US, the ship had already been quarantined for more than three weeks and the passengers systematically tested and tracked.

At that point, 3,618 passengers and crew had been tested multiple times. Among that population, 696 had tested positive for Covid, but 410 or nearly 60% of these were asymptomatic. Among the 8% (286) who were ill, the overwhelming share were only mildly symptomatic. At that point just 7 passengers-all over 70 years old --had died, a figure which grew only slightly in the months ahead.

In short, just 0.19% of an elderly skewed population had succumbed to the virus. These facts, which were known to the White House or certainly should have been, made absolutely clear that the Covid was no Black Plague type threat. In the great scheme of history, Trump authorized lockdowns amounted to tearing up the constitution and ripping apart daily economic life for a public health matter that did not remotely approach the status of an existential threat to society's survival.

To the contrary, from the beginning it was evident to independent scientists that the Cov2-19 spread was an intensive but manageable challenge to America's one-at-a-time doctor/patient health care system. The CDC, FDA, NIH and state and local public health departments were only needed to dispense solid information per their normal education role, not orders and sweeping regulatory interventions into every nook and cranny of the nation's economic and social life.

And yet, and yet. The buck stops with Donald Trump because he could have stopped this regulatory carnage at any moment, including before it was actually launched.

But the Donald choose another even more destructive route that compounded immeasurably the harm wrought by these sweeping public health interventions. To wit, Trump unleashed the Virus Patrol boot heels on the American public, and then embraced a fiscal and monetary compensation strategy that in essence said, "shut it down, lock them up, pay them off".

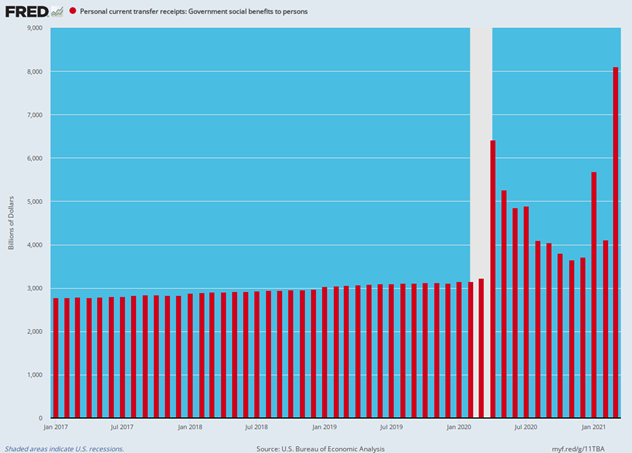

As it happens, the government data series for personal transfer payments is posted monthly and captures a large share of the expenditures funded by the $6 trillion of Covid bailouts between March 2020 and March 2021. And there is literally nothing like the eruption of these payments in all of US history.

The annualized run rate of government transfers, including the state and local matching portions, posted at a normal level of $3.145 trillion in February 2020, but then erupted to a $6.418 trillion rate in April pursuant to the first $2 trillion relief act that the Donald enthusiastically signed.

Thereafter a second wave surged to a $5.682 trillion rate in January 2021 owing to the second relief act signed by the Donald in December, followed by a final $8.098 trillion burst in March owing to Biden's American Rescue Act.

But even in the case of the latter, the driving force was completion of the $2,000 per person stimmy that the Donald had advocated in the run-up to the election and which had been only partially funded in the December legislation-along with extension of unemployment toppers and other expenditures that had been originated in the two earlier Trump signed measures.

In a word, this was the very worst kind of government spending explosion imaginable. That's because transfer payments are inherently inflationary poison when funded with Uncle Sam's credit card, as these clearly were, since they goose spending without adding an iota to supply.

None of this fiscal madness, of course, would have been even purportedly necessary without the utterly unnecessary lockdowns, but even then no Republican worth his salt would have signed legislation authorizing such massive transfer payments if they were to be funded with borrowing and money-printing.

The Donald did so, of course, and there is no mystery as to why. Trump has no fiscal policy compass at all, so it was a good way to quiet what otherwise would have been a fatal political uprising against his administration during an election year.

That's the real irony of the story. When it comes to the core matter of fiscal discipline, the Donald was no disrupter at all. He was actually the worst of the lot, and by a long shot, too.

Annualized Rate Of Government Transfer Payments, 2017 to 2021

For want of doubt, here is a longer-term perspective, reflecting the year-over-year rate of change in govenrment transfer payments going back to 1970. That was shortly after the Great Society legislation had kicked off today's $4 trillion per year flood of transfers.

To appreciate the veritable fiscal shock that issued from the Donald's pen, it needs be noted that in the last quarter of 2019 the Y/Y gain in government transfer payment spending was about $150 billion, which was consistent with the long-term trend.

However, by Q1 2021 that Y/Y gain had soared to $4.9 trillion. And, again, that was the delta, not the absolute level. It was 33X larger than the pre-Covid norm!

And, no, you can't blame this inflationary time-bomb on Biden as the MAGA partisans insist, although Biden would surely have signed the two early COVID-bailout measures had he been in the Donald's shoes during 2020.

But that's just the point--the Donald is a paid-up member of the Washington uniparty when it comes to government spending. All of the hideous excesses of the Covid bailouts were launched on his watch, signed into law with his pen and legitimized with the imprimatur of an ostensible Republican president.

These include the $2,000 stimmy checks to 90% of the public, the $600 per week unemployment toppers, the massive Payroll Protection Program (PPP) giveaways and the flood of money into the health, education, local govenrment and non-profit sectors. Sleepy Joe just signed the bill that provided the final one-third increment of funding to the Trump Express-a runaway fiscal locomotive that was already barreling down the tracks.

Y/Y Change In Government Transfer Payments, 1970-2021

Needless to say, the COVID-bailouts were not the Donald's only fiscal sin. When you compare the constant dollar growth rate of total Federal spending during his four years in the Oval Office with that of his recent predecessors it is evident that the Donald was in a big spenders league all of his own.

In constant 2021 dollars, for instance, the Federal budget grew by $366 billion per annum on the Donald's watch, a level 4.3X higher than the big spending years of Barrack Obama, and nearly 11X higher than the 1993-2000 period under Bill Clinton.

The same story holds for the annual growth rate of inflation-adjusted Federal spending. At 6.92% per annum during Trump's sojourn in the Oval Office it was 2X to 4X higher than under all of his recent predecessors.

At the end of the day, the historical litmus test of GOP policy was restraint on government spending growth, and therefore the relentless expansion of the Leviathan on the Potomac. But when it comes to that standard, the Donald's record stands first among no equals on the wall of shame.

Federal Spending: Constant 2021 Dollar Increase Per Year:

- Trump, 2017-2020: +$366 billion per annum;

- Obama, 2009-2016: +$86 billion per annum;

- George Bush the Younger, 2001-2008:+$136 billion per annum;

- Bill Clinton, 1993-2000:+$34 billion per annum;

- George Bush the Elder, 1989-1992: +$97 billion per annum;

- Ronald Reagan, 1981-1988: +$64 billion per annum;

- Jimmy Carter, 1977-1980: +$62 billion per annum;

Federal Spending: Annual Real Growth Rate:

- Trump, 2016-2020: 6.92%;

- Obama, 2008-2016: 1.96%;

- George Bush the Younger: 3.95%;

- Bill Clinton, 1992-2000: 1.19%;

- George Bush the Elder: 3.90%;

- Ronald Reagan, 1980-1988: 3.15%;

- Jimmy Carter, 1976-1980: 3.72%

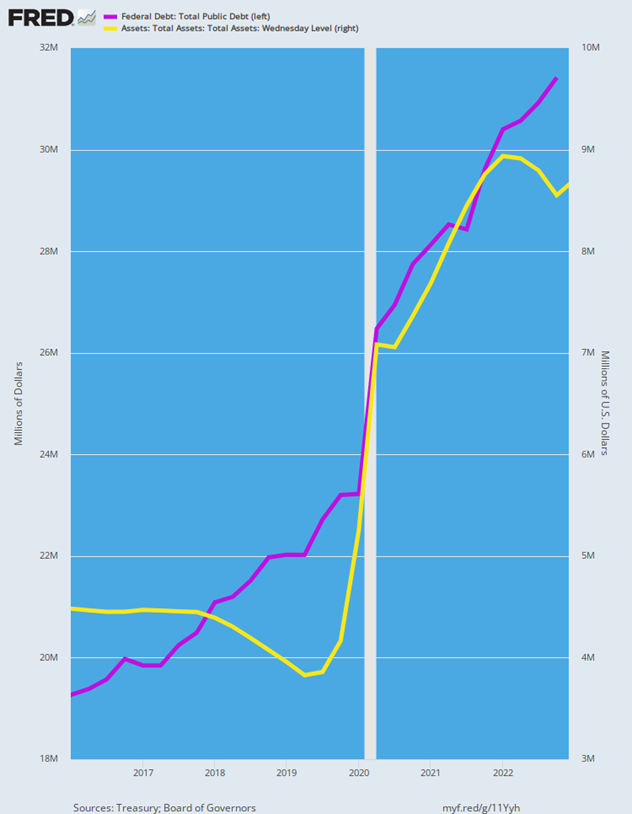

Likewise, when it comes to ballooning the public debt, Donald Trump earned his sobriquet as the King of Debt and then some.

Again, in inflation-adjusted terms (constant 2021 dollars), the Donald's $2.04 trillion per annum add-on to the public debt amounted to double the fiscal profligacy of the Obama years, and orders of magnitude more than the debt additions of earlier occupants of the Oval.

Constant 2021 Dollar Additions To The Public Debt Per Annum:

- Donald Trump: $2.043 trillion;

- Barrack Obama: $1.061 trillion;

- George W. Bush: $0.694 trillion;

- Bill Clinton: $0.168 trillion;

- George H. W. Bush: $0.609 trillion;

- Ronald Reagan: $0.384 trillion;

- Jimmy Carter: -$0.096 trillion.

Ultimately, excessive, relentless public borrowing is the poison that will kill capitalist prosperity and displace limited constitutional government with unchained statist encroachment on the liberties of the people. So for that reason alone the Donald needs be locked-out of the nomination and the Oval Office.

Of course, the great enabler of the Donald's reckless fiscal escapades was the Federal Reserve, which increased it balance sheet by nearly $3 trillion or 66% during the Donald's four year term. That amounted to balance sheet expansion (i.e. money-printing) equal to $750 billion per annum-compared to gains of $300 billion and $150 billion per annum during the Barrack Obama and George W. Bush tenures, respectively.

Still, the Donald wasn't satisfied with this insane level of monetary expansion, and never did stop hectoring the Fed for being too stingy with the printing press and for keeping interest rates higher than the King of Debt in his wisdom deemed to be the correct level.

In short, given the economic circumstances during his tenure and the unprecedented stimulus emanating from the Keynesian Fed, Donald Trump's constant demands for still easier money made even Richard Nixon look like a paragon of financial sobriety. The truth is, no US president has ever been as reckless on monetary matters as Donald Trump.

That's why it's especially rich that the die-hard MAGA fans at the likes of Fox News are now gumming loudly for a revival of the great Trump economy. Yet it is the egregious fiscal, monetary and regulatory excesses during his tenure that gave rise to the current economic mess.

Then again, the MAGA faithful have been thoroughly Trumpified. After years of the Donald insisting that even more fiat money should be pumped into the economy, the GOP politicians gave the Fed a free hall pass during the 2022 campaign; and did so during an inflation-besotted election season that was tailor-made for a hammer-and-tongs attack on the inflationary money-printers domiciled in the Eccles Building.

Needless to say, once upon a time GOP politicians knew better. Certainly Ronald Reagan did amidst the double digit inflation of 1980.

The Gipper did not hesitate to say that Big Government, deficit-spending and monetary profligacy were the cause of the nation's economic ills. He was right, and he won the election in a landslide.

Indeed, your editor and friends even persuaded him to include a gold standard plank in the 1980 GOP platform.

By contrast, consult the videos or transcripts of a score or two of MAGA rallies. Did anything remotely resembling the Reagenesque take on inflation ever flow from the Donald's bombastic vocal chords?

Of course not. That's because Trump is not an economic conservative in any way, shape or form. He's simply an opportunistic demagogue who chanced to stumble upon the violent illegal alien theme (murders and rapists) on his way down the elevator to the announcement of his candidacy in June of 2015, which theme he then paired with his life-long adherence to a primitive form of trade protectionism.

The essence of this couplet was the misbegotten notion that America's problems are caused by foreigners lurking off-shore, when in reality the nation's ills stem from bad policy ideas deeply embedded inside the Washington beltway.

Yet since June 2015 there has emerged a toxic formulation of MAGA that amounts to stopping the alleged hordes of illegal aliens at the border and the flow of foreign goods at US ports. That was and remains the heart of the Donald's domestic program.

Unfortunately, it is the wrong answer to the nation's economic, social and political ills, and will never be a winning platform like the one upon which the Gipper rode into office under similar circumstances in 1980, as we intend to amplify in Part 3.

In the meanwhile, the catastrophic error embodied in the Donald's Covid policies during the spring and summer of 2020 has now been dramatically underscored by the age-adjusted mortality data depicted in the chart below.

Of course, the whole COVID-plague narrative was built on the insane diarrhea of numbers regarding tests, case counts, hospital counts, death counts and heart-rending anecdotes generated by the public health apparatus and its megaphones in the MSM. But the single most important thing to grasp is that when it comes to the heart of the narrative-the alleged soaring death counts-the narrative is just plain bogus.

The undisputed fact is that the CDC changed rules for causation on death certificates in March 2020, so now we have no idea whatsoever whether the 1.05 million deaths reported to date were deaths because OF Covid or just incidentally were departures from this mortal world WITH Covid. The extensive well-documented cases of hospital DOAs from heart attacks, gunshot wounds, strangulation or motorcycle accidents, which had tested positive before the fatal event or by postmortem and were then recorded as Covid deaths, are proof enough.

Fortunately, what we do know is that not even the power-drunk apparatchiks at the CDC and other wings of the Federal public health apparatus found a way to change the total mortality counts from all causes.

That's the smoking gun unless you consider the year 2003 to have been an unbearable year of extraordinary death and societal misery in America. To wit, the age-adjusted death rate from all causes in America during 2020 was actually 1.8% lower than it had been in 2003 and nearly 11% lower than it had been during what has heretofore been understood to be the benign year of 1990!

To be sure, there was a slight elevation of the all-causes mortality rate in 2020 relative to the immediately preceding years. That's because the Covid did disproportionately and in some ghoulish sense harvest the immunologically vulnerable elderly and co-morbid slightly ahead of the Grim Reaper's ordinary schedule.

And far worse, there were also extraordinary deaths in 2020 among the less Covid vulnerable population owing to hospitals that were in government ordered turmoil; and also due to an undeniable rise in human malfunction among the frightened, isolated, home-bound quarantined, which resulted in a swelling of homicides, suicides and a record level of deaths from drug overdoses (94,000).

Still, the common sense line of sight across this 30-year chart below tells you 1000 times more than the context-free case and death counts which scrolled across America's TV and computer screens day-in-and-day-out, even as the Donald's Task Force was fanning the flames of hysteria from the White House bully pulpit.

In short, the data below tells you there was no deadly plague; there was no extraordinary public health crisis; and that the Grim Reaper was not stalking the highways and byways of America.

Compared to the pre-Covid norm recorded in 2019, the age-adjusted risk of death in America during 2020 went up from 0.71% to 0.84%. In humanitarian terms, that's unfortunate but it does not even remotely bespeak a mortal threat to societal function and survival and therefore a justification for the sweeping control measures and suspensions of both liberty and common sense that actually happened.

This fundamental mortality fact-the "science" in bolded letters if there is such a thing-totally invalidates the core notion behind the Fauci policy that was sprung upon our deer-in-the-headlights president stumbling around the Oval Office in early March 2020.

In a word, this chart proves that the entire Covid strategy was wrong and unnecessary. Lock, stock and barrel.

And also that with regard to the Covid-Lockdown disaster, Harry Truman's buck stops with Donald J. Trump.

Part 3

As we documented in Parts 1 and 2, Donald Trump is not an economic conservative in any way, shape or form. On everything that matters for prosperity and liberty--fiscal rectitude, sound money, free markets and small govenrment-he's on the wrong side of the policy fence.

So to repeat: The Donald is simply an opportunistic, self-promoting demagogue who chanced to stumble upon the illegal alien menace theme (murders and rapists) on his way down the elevator to the announcement of his presidential candidacy in June of 2015, which theme he then paired with his life-long adherence to a primitive form of trade protectionism.

Accordingly, the essence of this couplet was the misbegotten notion that America's problems are caused by foreigners lurking off-shore, making it incumbent upon Washington to stop the alleged hordes of illegal aliens at the border and to staunch the flow of foreign goods into US ports.

That was and remains the heart of Trump's domestic program. In fact, foreigner-bashing is all there is, there ain't no more.

And it's not surprising. The Donald is the furthest thing from a thinker or idea advocate. His whole career was built on bashing his opponents-a modus operandi that he simply escalated to the national and world stage.

Still, it is hard to think of any proposition that could be so wrong-headed, so lacking in factual foundation, so confused as to cause and effect and so utterly irrelevant to the underlying ills that actually plague the US economy.

To be sure, we do have too many imports and there are millions of immigrants piled up at the southern border. But those conditions are owing to policy mistakes originating in Washington, not evidence that America is being assaulted by evils emanating from outside our borders.

In a word, the flood of imported goods is due to the Fed's wildly inflationary monetary policies, while the teeming hordes at the border are the result of utterly stupid and obsolete Federal laws which prohibit work-seekers from legally entering US territory.

As to the latter, a proper Guest Worker program would end the so-called immigrant crisis in one fell swoop. You would merely need to stand up a few dozen welcome stations along the southern border and invite the nation's employers, who are desperate for workers, to hold Job Fairs just inside US territory, and to offer signing bonuses and inland transport to their jobs sites to qualifying applicants.

So long as the resulting employers punched a monthly Federal form verifying that such workers were still on the payroll, their Guest Worker permit would be extended for up to 10-years. At that point they would be deemed to be American citizens, perhaps after paying a modest initiation fee of a few thousand dollars, as well.

Needless to say, among the numerous things that the Donald and his MAGA followers don't understand is the law of supply and demand. Yet when it comes to the lower-skill, lower-pay class of workers, there is a dire shortage in the US and a teeming surplus in Central America and elswhere.

Accordingly, all of the stupid statistics paraded daily on Fox News about the millions of "encounters"with illegals at the border and the hundreds of thousands of deportations each year are representative of nothing more than a vast, unnecessary human pile-up owing to the fact that politicians in Washington won't let the market clear.

Of course, the Donald would have you ignore the fact that upwards of 95% of the "illegals" pressing upon the border are job-seekers and families seeking a better life. Instead, he and his minions brandish red herrings claiming that these migrant populations are teeming with criminals, drug dealers, welfare cheats and jobs stealers.

But those are all truly red herrings that fuel Trumpian demagoguery and misdirected public fears and resentments. That is to say, they are an extension of the Donald's deeply deformed personality that oozes anger and resentment.

The facts, however, tell a wholly different story. For instance, nearly all Federal welfare programs prohibit the payment of benefits to non-citizens. The anecdotes about immigrant welfare abuse, in fact, are merely expressions of the unfortunate loopholes in these prohibitions for emergencies, kids, cold weather and numerous others. The "wall" that is needed, therefore, is not the Donald's concrete and steel boondoggle on the border, but a firmer legal wall against paying welfare benefits to any and all residents who are non-citizens, without exception.

Likewise, no immigrant is taking low-income jobs. For crying out loud, they are filling them because for reasons of culture and welfare inducements the native-born simply won't take them. And, in any event, the surging rise of wages in the leisure and hospitality (L&H) sector since the pandemic actually knocks the whole jobs theft canard into a cocked hat.

That is to say, if immigrants were actually taking entry level jobs in bars, restaurants, hotels, theme parks, sports venues, movie theaters etc, from America workers, the rate of pay increases in the L&H sector would be sharply depressed relative to gains in the higher pay sectors of the economy dominated by native-born workers.

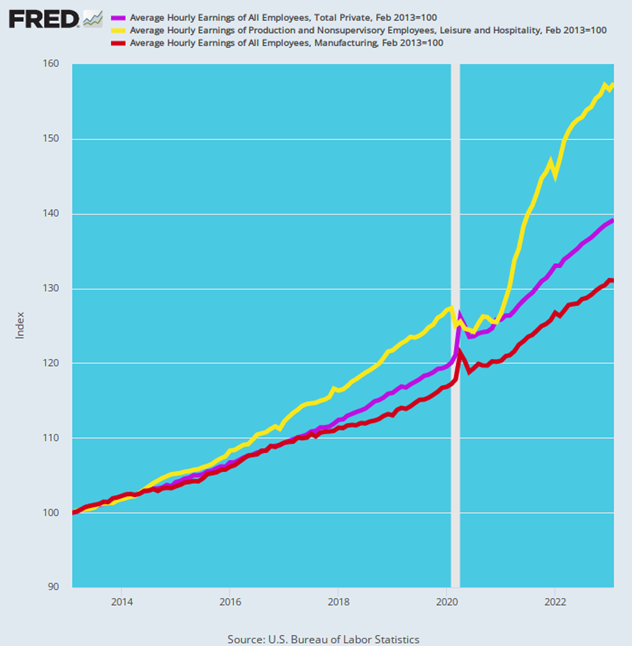

In fact, the opposite is true. During the last decade, hourly wages in the Leisure and Hospitality sector (yellow line) have risen by 57% compared to just 31% in the high-pay manufacturing sector (red line) and 39% for private sector workers (purple line) overall.

So there is no depression of wages at the bottom of the jobs ladder due to immigrant workers (legal and illegal). In fact, a large-scale Guest Worker program would be just what the economic doctors at the Fed have ordered: Namely, reduced wage cost/price push pressures in the domestic services industries that since December 2020 have seen L&H wages rise at a 11.0% annual rate.

Index of Leisure And Hospitality Wages Versus Manufacturing and All Private Workers Since February 2013

The drugs red herring is no more compelling or valid. Yes, illegal drugs do come across the border but undocumented workers have nothing to do with it. It's the law of markets, again.

When you make something contraband that is strongly desired by consumers, it becomes scare and the price goes up. A lot.

In turn, artificially high prices provide an economic umbrella for black market operators to absorb the costs of moving the merchandise from producers to users, notwithstanding the extra costs of illegal activities, vast product shrinkage due to government interdiction of goods and even the armed contingents needed to enforce contracts and protect territories and markets.

Stated differently, the so-called illicit drug problem isn't due to borders open to potential wage workers, but reflects the historically proven fact that state-enforced prohibition everywhere and always fails because it's defeated by the primal forces of economics. So if an end to the drug problem is desired, get them out of the black market and into open, legal commerce. Prices would fall, drug-related crime would disappear and Phillip Morris and the teamsters would have new businesses and jobs.

Finally, the alleged "crime" problem owing to illegals is the ultimate red herring. Most of the "crimes" committed by border crossers result from a 1929 law which, for the first time after 140 years of essentially "open borders", made unlawful entry into the US a federal misdemeanor on the first offense, and a felony on the second. Not incidentally, this law was authored by Senator Coleman Livingston Blease, a white supremacist southerner who had not inconsiderable support from the Klu Klux Klan and other nativist forces.

Self-evidently, a large-scale Guest Worker program would eliminate 99% of the so-called crimes authored by Senator Blease. Beyond that, every population has a small fraction of societal misfits and criminals, but there is no reason throw massive barriers in front of willing workers wishing to enter the US on account of this truism.

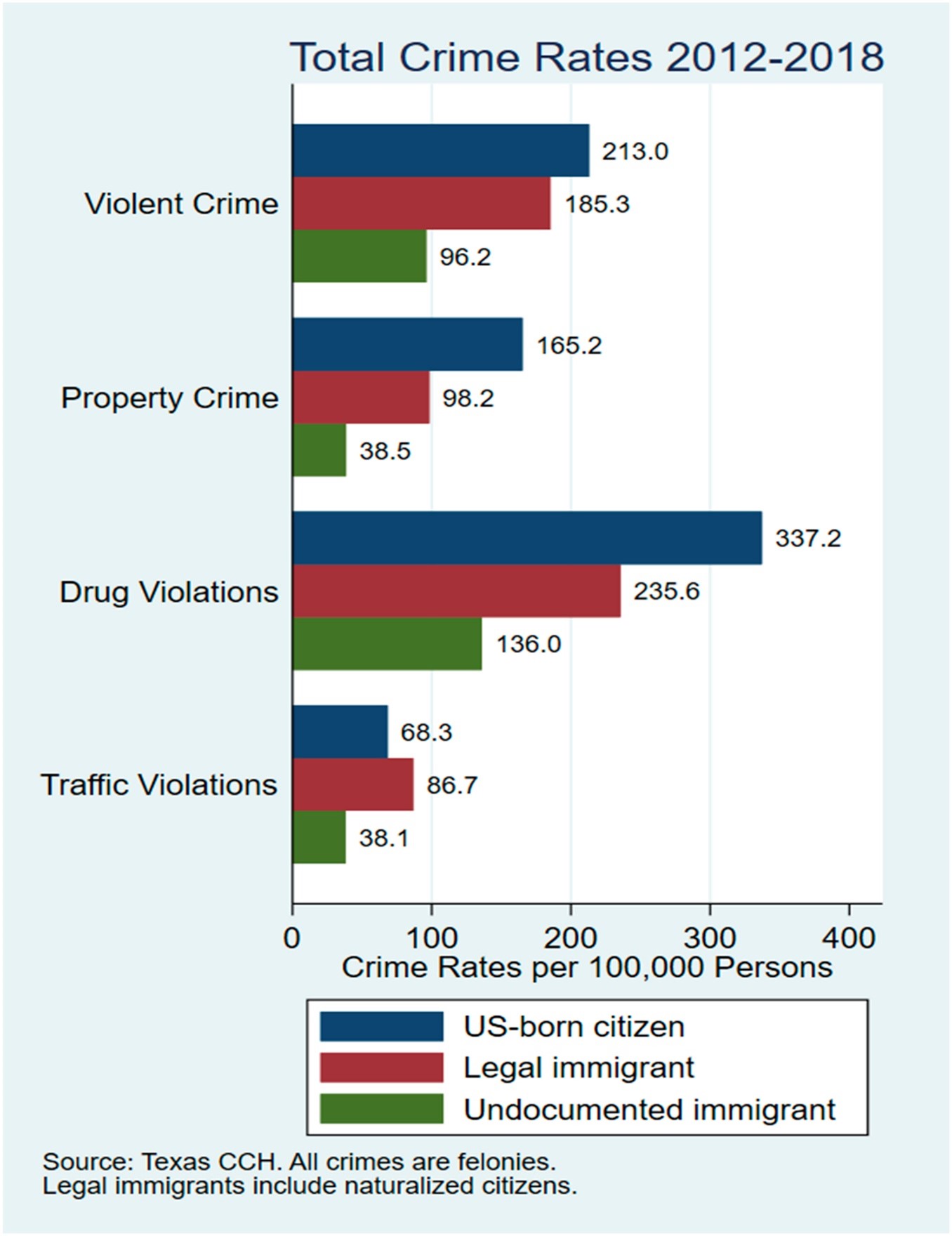

The real issue is whether undocumented immigrant populations have disproportionately higher rates of criminal conduct, but countless studies show that crime rates are actually lower among these groups than among native-born American populations. In this regard, a study based on uniquely comprehensive arrest data for 2012 through 2018 from the Texas Department of Public Safety is especially dispositive. After all, Texas is ground zero for the alleged flood of border crime.

This definitive study found that undocumented immigrants have substantially lower crime rates than both native-born citizens and legal immigrants across a range of felony offenses. Relative to undocumented immigrants, US-born citizens are:

- over 2 times more likely to be arrested for violent crimes,

- 2.5 times more likely to be arrested for drug crimes, and

- over 4 times more likely to be arrested for property crimes.

In addition, the proportion of arrests involving undocumented immigrants in Texas was relatively stable or decreasing over the 2012 to 2018 period, at the very time the Donald was waving the bloody shirt of purportedly rising immigrant crime.

Comparison Of Crime Rates In Texas Between US Born Citizen (blue bars), Legal Immigrants (red bars) and Undocumented Immigrants (green bars), 2012-2018

When it comes to the Donald's other economic panacea, it is obvious that decades of easy money by the Fed resulted in the very opposite of the ballyhooed MAGA economy. That's because easy money distorts and inflates wages, prices, costs and assets in a manner that undermines efficient allocation of resources, punishes private savings and weakens productive investment on main street in favor of financial engineering and speculation on Wall Street.

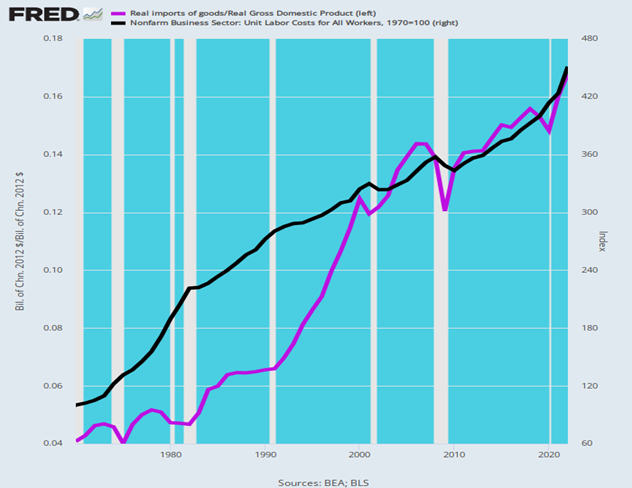

One important symptom of this long-brewing harm is the relentless rise of unit labor costs. Thus, in a healthy noninflationary capitalist economy wage growth is largely off-set by productivity gains, meaning that unit labor costs rise by 0.0% per annum or drift higher at a snails pace.

As is evident in the chart below, however, the very opposite happened after 1970. That's the pivot point when the dollar's anchor to gold was severed by Tricky Dick Nixon, and the modern age of reckless money-printing worked up an accelerating head of steam over the next half century.

As a result, unit labor costs grew by 351% or 3.0% per annum over that long period. And this happened at a time when China's 1980s shift to red capitalism and the rise of technology-enabled global supply chains caused a massive global arbitrage of labor markets. Consequently, production moved from high cost developed economies to the rice paddies of China and elsewhere.

Accordingly, the last thing the US needed was a pro-inflation central bank, especially after 1990 when Mr. Deng's sparkling new export factories began to boom and US vendors progressively globalized their sourcing process.

That was unfortunately occurring even as the Greenspan, Bernanke and Yellen Feds became enmeshed in the folly of 2.0% inflation targeting. To the contrary, what the US actually needed in that period was to purge the huge increase in unit labor costs which had accrued during the 1970s and 1980s before the new global supply chains became operative, and which had left the US cost structure highly uncompetitive with the new global supply base.

Stated differently, the 2.0% inflation ideology fueled an unwarranted fear of "deflation" when what the doctor ordered was, in fact, a healthy dose of that very thing. That is, shrinkage of the bloated unit labor cost levels extant by the mid-1990s in order to keep a reasonable level of manufacturing production in the domestic economy. And that, in turn, meant that nominal prices and wages needed to fall, not increase at 2.0% per annum in lockstep.

As is evident in the black line of the graph, however, unit labor costs just kept on climbing skyward after the mid-1990s, when in a sound money economy the line would have turned sharply lower. The result was that the US lost large chunks of its industrial base.

As of 1970 imports (purple line) had accounted for just 4.1% of GDP, but by 2022 that fraction had more than quadrupled to nearly 17%.

The crucial point that evades the Donald and his protectionist gang, however, is that the soaring purple line in the chart is not evidence of the free market and free trade at work, but is the rotten fruit of bad, inflationary money. So the problem needs be addressed not at the customs window with tariffs, but at the Eccles Building with sound, non-inflationary money.

Indeed, the Donald's sweeping tariffs now add hundreds of billions of cost to the landed price of imported goods, even as central bank-fostered inflation drives domestic production costs even higher relative to those abroad. The only real beneficiaries of these blunderbuss levies, therefore, are the next in line low labor cost venues like Vietnam and Mexico, where some production is being re-sourced from China to avoid the Trump tariffs.

Rise In US Unit Labor Costs Versus Import Share Of GDP, 1970 to 2022

In short, restoration of robust capitalist growth and prosperity in America requires far less monetary inflation and far, far more immigrant workers-especially owing to the fact that the native-born work force is now shrinking and will become progressively smaller as far as the eye can see.

Both of these conditions require sweeping reform inside the beltway via a house-cleaning at the Fed and the substitution of a large-scale Guest Worker program for the current failed 90-year old restrictionist regime at the southern border.

These changes would truly amount to draining-the-swamp. So the irony is that where it actually counts, the Donald wants to keep filling it.

Part 4

As we have seen, Donald Trump inherited an economy that was slowly coasting forward on the momentum of the post-crisis cyclical recovery, but he then hammered it into a violent tailspin during his last year in office.

And, yes, the Lockdowns and Covid quarantine hysteria were ultimately his doing: Coach Trump sent the Fauci shutdown play out to the field on March 16th and stuck with it for the next 10 months despite the carnage that ensued.

The net result, as we have also seen, is that the US economy grew at just 1.52% per annum during the Donald's 48 months in the Oval Office, representing just half the 3.04% average growth rate under the previous 11 presidents between 1954 and 2016, and the very worst growth score posted among all of them.

So the question recurs: How in the world do the MAGA fans keep insisting that the Trump economy was a time of plentiful economic milk and honey?

As the man said, the transformation of the worst economic record in 66 years into a triumph of policy does require some 'splainin'. In that regard, economic ignorance and partisan willfulness probably go a long way toward the answer, but there are also some specific factors that shed light on the question as well. These include-

- The catechismic assumption that the economy was good just because Trump cut taxes;

- The failure to acknowledge that policy actions have a considerable lag and that much of what presidents implement during their time in the Oval Office shows up on the doorstep of their successor;

- The (deserved) partisan loathing of Joe Biden enables the Trump tenure to be cast in a favorable light relative to the stagflationary blow-off now underway, much of which Sleepy Joe inherited from Trump, his predecessors and most especially the Fed.

Stated differently, the record during Trump's tenure was punk and it's legacy during the subsequent years was worse, as we amplify further below. So the only thing that gives it a glow in hindsight is Joe Biden bashing, which is partisan hectoring, not analysis.

Surely, the mere passage of a tax cut that was estimated to add $1.46 trillion to the public debt over tens years (2018-2027) is hardly proof of anything. Well, except the GOP's latter day axiom that red ink-financed tax cuts are inherently good and that deficits don't matter.

That's dangerous nonsense, of course, but for good measure it is worth noting that the 2017 Trump tax cut was heavily focused on the corporate rate cut from 28% to 21% and the parallel pass-thru provision for noncorporate business that provided a 20% deduction for qualified income. The estimated 10-year revenue loss from these two provisions alone was $1.76 trillion, meaning that the balance of the act actually raised taxes by about $300 billion.

So it would be fair to say that the Trump/GOP tax cut did pack a fair wallop in the direction of incentivizing business to invest. But the fact is, you can't find a trace of evidence for that in the data for real nonresidential fixed investment.

To wit, during the five years ending in 2017 the real growth rate of business investment was 3.72% per annum. By contrast, during the five-years after the Trump tax cut (2018-2022) real nonresidential fixed investment growth slipped to 2.98% per annum.

Of course, all things are never equal and many other things impact investment rates including stage of the business cycle, interest rates, business cash flows and numerous more. Still, to claim a sterling policy success there should be at least a tad of evidence in the data-especially when on the margin the US treasury borrowed $1.7 trillion to make it happen.

Actually, as it really happened, the overwhelming share of the increased after-tax cash flow from the Trump/GOP tax cuts went to monumental levels of stock buybacks and dividend payments. For instance, the sum of S&P 500 stock buybacks and dividends rose form $960 billion in 2017 to $1.51 trillion in 2022. That amounts to a $550 billion annualized increase or 56%.

Those robust distributions to shareholders, in turn, were a function of a bubble-bloated and speculation-ridden stock market that was fueled by the Fed's relentless money printing. And the Donald's insistence on ultra-low interest rates and a continuation of the Fed's massive bond-buying program was surely a reinforcement to that folly, if any was needed.

To be sure, businesses are free to do what they deem best with their cash flows. But they should not be induced to distribute rather than reinvest by inflationary monetary policies. And Uncle Sam should never borrow trillions in order to indirectly fund stock buybacks and dividends that mainly accrue to the top 1% and 10% of US households.

In a word, the real Trumpian legacy is not a strong economy or robust investment cycle, but just a further slide into the abyss of profligate monetary and fiscal policies-policies which will eventually bring capitalist prosperity to an abrupt end.

For want of doubt, the chart below is the ultimate report card on the Trump years. Given that the Donald inherited an already massively bloated public debt of $19.8 trillion and a bulging Fed balance sheet at $4.5 trillion, his policies should have been focused on balancing the budget and supporting the Fed's tepid efforts to normalize its balance sheet and drain the excess liquidity and credit from the financial system.

Alas, the Donald did neither. By the end of his term, the public debt (purple line) had risen by $7.8 trillion or nearly 40%; and the Fed's balance sheet-after a lot of hectoring from the Oval Office-had climbed to $7.4 trillion, reflecting an unprecedented gain of 65% in just four years.

Needless to say, as depicted in the chart below Joe Biden kept on spending, borrowing and printing where the Donald left off. At the end of 2022, the public debt was up by another $3.7 trillion and the Fed's balance sheet had further expanded by $1.2 trillion.

But here's the thing. Neither with the naked eye nor a magnifying glass can you tell where the Trump tenure ends and the Biden presidency starts-the very opposite of the sharp break that should have been the mark of a Republican president.

So as we said. Donald Trump didn't even need to buy a membership in the spending and borrowing uniparty; they made him honorary chairman long before he left office.

Public Debt And Fed Balance Sheet, Q4 2016 to Q4 2022

But now the long-delayed reckoning begins. The printing presses have been shutdown and will remain so for a prolonged time to come because a virulent goods and services inflation has been finally released.

Likewise, the built-in public debt is already heading for $55 trillion by the end of the current 10-year budget window, even if Congress doesn't authorize another dime of new spending or tax cuts. Already enacted Trumpian policies did their fair share to fuel this fiscal doomsday machine, and his current position against spending cuts for Medicare and Social Security and robust DOD appropriations to remediate Sleepy Joe's alleged neglect of national security requirements would only insure that we remain on a fast track to fiscal disaster.

That's actually the Trumpian legacy.-a doubling-down on the uniparty's fiscal and monetary profligacy.

In the meanwhile, the US economy has been twisted, tortured, unbalanced and booby-trapped by the policy chaos the Donald unleashed during this 48 months in office.

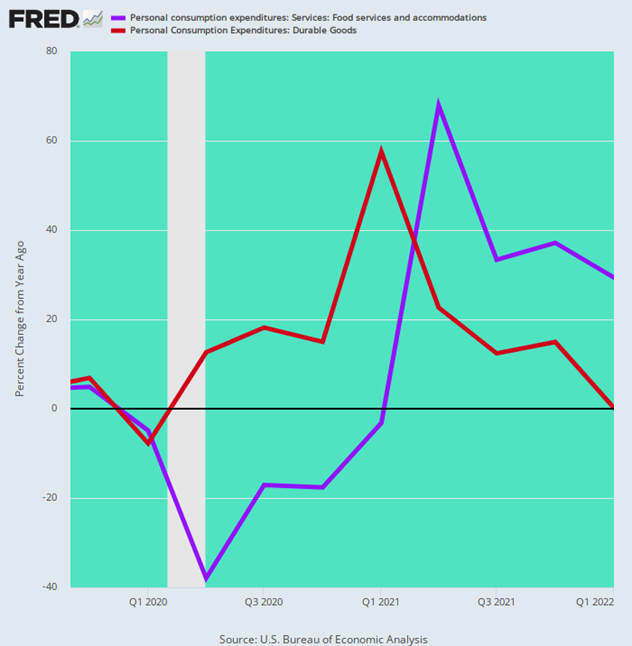

For instance, the combination of the Lockdowns of service sector venues like restaurants, bars, movies and gyms and the massive stimmy checks caused an explosion of spending for merchandise goods.

The latter initially drained the inventory pipeline like never before, and then caused vendors to become drastically over-ordered and over-stocked when demand abruptly shifted backs to services and experiences after mid-2021. Thus, as shown in the chart below, the Y/Y rate of spending on durables goods went from +12% in Q2 2020 to +58% in Q1 2021 to +0% in Q1 2022.

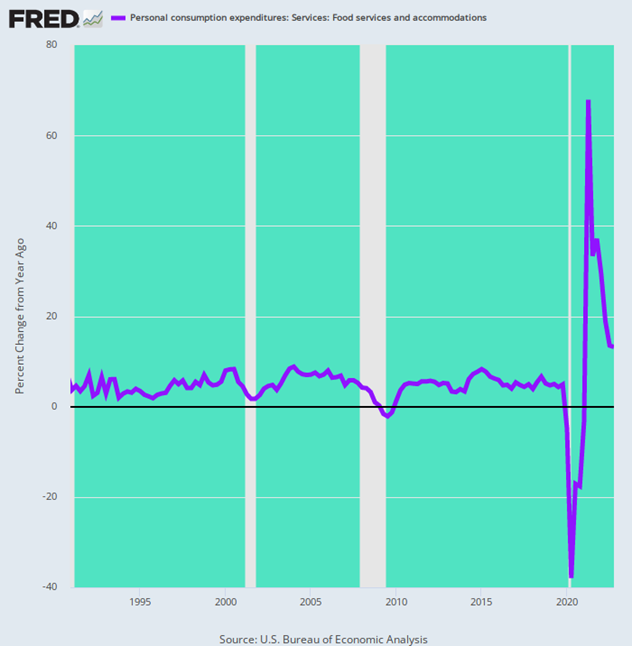

By contrast, spending at food service establishments plunged by -38% during the initial Q2 2020 lockdowns, remained negative through Q1 2021 and then soared by +68% Y/Y in Q2 2021 when the lockdowns were lifted and the final round of stimmies were distributed.

Needless to say, the wild swings in the chart below were unprecedented and caused massive distortions and inefficiencies throughout the main street economy, as well as windfall gains and losses to the impacted businesses. And it all stemmed from the Donald's two weeks to flatten the curve and the spend-a-thons and print-a-thons which accompanied it.

Y/Y Change In PCE for Food Services & Accommodations Versus Durable Goods,Q4 2019 to Q1 2022

For want of doubt, here is the last 32 years of Y/Y changes in nominal spending for restaurants, bars, hotels and resorts. Needless to say, neither American consumers nor businesses would ever engage in the recent burst of drunken yo-yoing on their own accord.

To the contrary, the chart depicts the spoiled fruits of massive state intervention on the Donald's watch--none of which was remotely justified, as we demonstrated in Part 2.

Y/Y Change In PCE for Food Services and Accommodations, 1991-2022

There is endlessly more data where this came from. The American economy is more distorted and imbalanced then ever before because Washington has literally gone off the rails in its assaults on the free market, fiscal rectitude and sound money.

Whether the resulting deep impairment to capitalist prosperity and constitutional liberty can ever be ameliorated and reversed is dubious at best. But one thing is sure-Donald J. Trump is not remotely part of the solution.

So lock him out of the nomination. Lock him out of the Oval Office. That's just plain imperative.

Reprinted with permission from David Stockman's Contra Corner.