April 6, 2023

A Diligent and Judicious Return to Price Stability

Please consider A Diligent and Judicious Return to Price Stability by Cleveland Fed President Loretta Mester

I thank the Money Marketeers of New York University for inviting me to speak this evening. I look forward to hearing what is on your minds, but first, I would like to present some prepared remarks on the economy and monetary policy.

The Fed is responsible for ensuring price stability. Fed policymakers are committed to bringing inflation back to our 2 percent goal. Given where we are on that journey, I plan to remain diligent in setting monetary policy to return the economy to price stability in a timely way and to be judicious in balancing the risks so as to minimize the pain of the journey.

My expectation is that with tighter financial conditions, demand in product and labor markets will continue to moderate. Output growth will likely be well below trend this year and pick up a bit next year. Employment growth will slow, with the unemployment rate rising to 4-1/2 to 4-3/4 percent by the end of the year. So far, high inflation has not unanchored medium- and longer-term inflation expectations, which remain at levels reasonably consistent with our 2 percent inflation goal. The continued anchoring of inflation expectations is an important factor underpinning my outlook that we will see a meaningful improvement in inflation this year, with inflation moving down to about 3-3/4 percent this year, continuing to improve next year, and reaching our 2 percent goal in 2025. In my modal projection, to put inflation on a sustained downward trajectory to 2 percent and to keep inflation expectations anchored, monetary policy moves somewhat further into restrictive territory this year, with the fed funds rate moving above 5 percent and the real fed funds rate staying in positive territory for some time.

Precisely how much higher the federal funds rate will need to go from here and for how long policy will need to remain restrictive will depend on how much inflation and inflation expectations are moving down, and that will depend on how much demand is slowing, supply challenges are being resolved, and price pressures are easing.

Footnotes

- The Federal Reserve Bank of Cleveland produces the median and trimmed-mean CPI inflation rate and the median PCE inflation rate.

- The Federal Reserve Bank of Dallas produces the trimmed-mean PCE inflation rate.

- The Federal Reserve Bank of Cleveland’s Center for Inflation Research produces inflation measures and analyses of inflation and inflation expectations to inform policymakers, researchers, and the general public

Mean-Trimmed Inflation

A Dallas Fed Working Paper offers this assessment of mean-trimmed inflation.

Trimmed-mean inflation is the superior communications and policy tool because it is a less-biased real-time estimator of headline inflation and because it more successfully filters out headline inflation’s transitory variation, leaving only cyclical and trend components.

Ultimate Absurdity in Inflation Measures

The idea behind trimmed-mean inflation is to chop of the items increasing most in price and the items increasing the least in price.

I commented on trimmed-mean-inflation about a year ago. It’s so absurd that I have not looked at it since.

Please consider Trimmed Mean Inflation Is the Ultimate Absurdity in Inflation Measures

- The Dallas Fed chopped off items with a combined weight of 24.07% from the low end.

- This was “balanced” by chopping off items with a weight of 32.50% at the top end.

- Everything that went up by more than 9% annualized was chopped off the top culminating with gasoline up 103.5% and air transportation up 112.7%.

Ultimately, the Dallas Fed discarded 56.57% of the entire PCE, heavily weighted by discarding high inflation items to arrive at a preposterous 2.8% year-over-year measure of inflation.

At the time of my post, I reported the year-over-year CPI was 6.8%, PCE at 5.7%, and trimmed mean PCE at 2.8%.

The Dallas Fed says “Trimmed-mean inflation is the superior communications and policy tool,” no doubt because it is the biggest lie.

Inflation Expectations

I have discussed the silliness of inflation expectations many times. And It came up in a Tweet thread yesterday.

This is precisely why inflation expectations are total nonsense. Fed studies show this, but Powell still preaches it.

“People don’t transport goods unless there is demand on the other end. Just because freight prices are cheap, doesn’t mean that companies will transport more products.”

Bingo!

Inelastic Demand

- Merchants don’t ship goods just because shipping is cheap.

- People will not rent two houses if they think the price is about to go up. And housing is about a third of the CPI.

- Nor will people get two operations or hold off getting one if they think operations will be cheaper next year.

- People won’t stop eating if they expect lower prices next month. They might buy a freezer (and I recommend they do and buy what’s on sale), but freezers only hold so much.

- People buy auto insurance because they have to, no matter what the cost. But if they have one car, they don’t buy two policies even if they expect a huge price jump next month.

Inflation Expectations Don’t Matter

The New York Fed does surveys of inflation expectations every month.

I commented Inflation Expectations are Crashing. So What? It Doesn’t Matter.

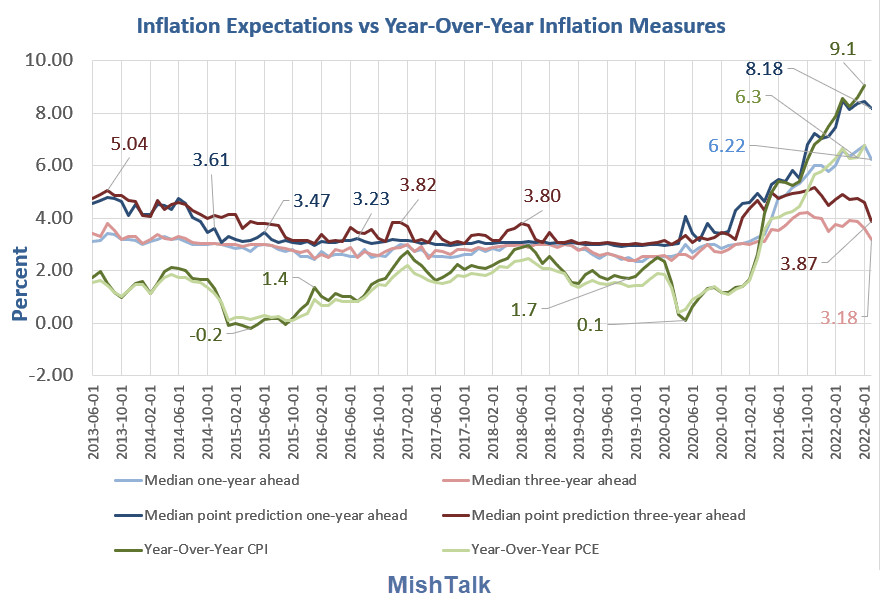

If inflation expectations mattered, the above chart could not exist. From 2013 to 2020 consumers expected three to five percent inflation and most of that time measured inflation was well under two percent.

It’s not really lack of inflation of course, but rather how clueless economists measure it.

Fed Research Inflation Expectations

Please consider the 2021 report Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?) by the Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board.

- The direct evidence for an expected inflation channel was never very strong.

- What little we know about firms’ price-setting behavior suggests that many tend to respond to cost increases only when they actually show up and are visible to their customers, rather than in a preemptive fashion.

The paper also blasted belief in the Phillips Curve. Here are a few direct quotes.

The direct evidence for an expected inflation channel was never very strong. Most empirical tests concerned themselves with the proposition that there was no permanent Phillips curve tradeoff, in the sense that the coefficients on lagged inflation in an inflation equation summed to one.

In addition, most standard tests of the new-Keynesian Phillips curve suffer from such severe potential misspecification issues or such profound weak identification problems as to provide no evidence one way or the other regarding the importance of expectations (much the same statement applies to empirical tests that use survey measures of expected inflation).

It is far, far better and much safer to have a firm anchor in nonsense than to put out on the troubled seas of thought. John Kenneth Galbraith (1958).

Few things are harder to put up with than the annoyance of a good example. Mark Twain, The Tragedy of Pudd’nhead Wilson (1894)

Fed Studies Debunk the Phillips Curve

- Fed Study Shows Phillips Curve Is Useless

- Yet Another Fed Study Concludes Phillips Curve is Nonsense.

Both studies were done by Fed staffers.

Yet, Fed Chairs Janet Yellen and Jerome Powell did not believe the Fed’s own study.

One should not need a study to prove the obvious. And it’s obvious that inflation expectation theory is nonsensical.

Asset Irony

People will rush to buy stocks in a bubble if they think prices will rise. They will hold off buying stocks if they expect prices will go down.

People will buy houses to rent or fix up if they think home prices will rise. They will hold off buying homes if they expect prices will drop.

The very things where expectations do matter are the very things the Fed ignores.

Routine CPI deflation is actually beneficial according to a Bank of International Settlements study.

Again, this is logical. No study should have been needed. Lower consumer prices improve standards of living because more people can afford more things. It’s asset bubble deflation that’s damaging.

For the BIS take, please see Historical Perspective on CPI Deflations: How Damaging are They?

The ultimate irony is that by stoking asset price inflation while trying to create routine price inflation, the Fed sowed the seeds of a very damaging asset deflation bust.

This post originated at MishTalk.Com.