David Stockman's Contra Corner

March 26, 2024

RFK has pointedly announced that he will pardon Deep State prisoner Julian Assange on day #1. That sent a powerful message that the destructive rule of Washington's bipartisan War Party will be brought to an abrupt end if he is elected President.

Likewise, RFK should announce an intent to stop dead in its tracks the Fed's egregious servitude to Wall Street and the one percenters who luxuriate in the massive inflation of financial assets it enables. Pledging to hand ex-private equity impresario, Jay Powell, his walking papers on January 20, 2025, would give forceful expression to that intent.

At the substantive level, three policy markers could further convey that a sweeping regime change at the nation's central bank is coming down the pike-changes that would liberate the Fed from the grip of Wall Street speculators and Washington spenders alike:

- Enactment of an extended moratorium on any further Fed purchases of US Treasury or Federally guaranteed debt.

- An end to Fed bailouts, interest rate subsidies, stock market puts and any other open market manipulations on Wall Street.

- Return to a discount window-based modus operandi as provided by the Fed's original authors, where member banks needing liquidity can get Fed advances against sound commercial collateral at market rates of interest plus a penalty spread for using the public credit.

These measures would kill two very bad birds with one stone. Without the prospect of the Fed's false bid for government debt, bond yields would rise sharply and the warmongers and big spenders on both ends of Pennsylvania Avenue would finally be faced with the true economic cost of their profligacy.

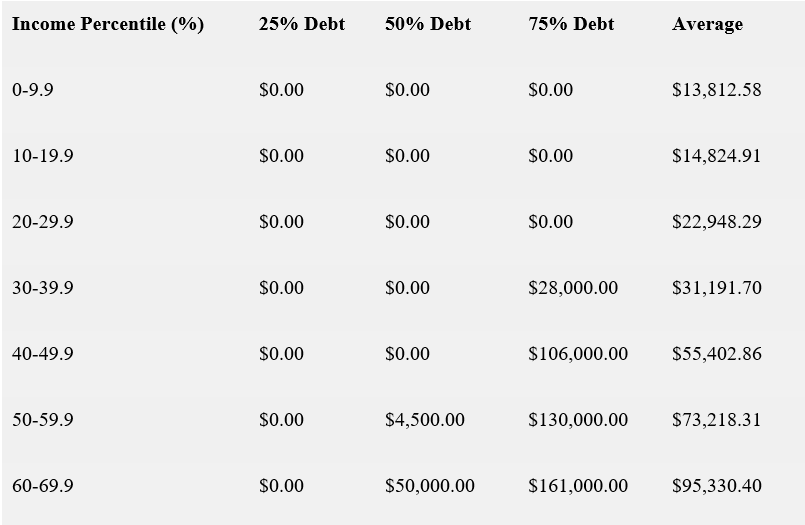

At the same time, a sharply higher bond yield would put the kibosh on the gigantic stock market bubble that has massively shifted wealth to the tippy-top of the economic ladder. Since 1989, for example, the net worth of the top 0.1% has soared from $1.8 trillion to just under $20 trillion. That's a gain of $138 million per household.

By contrast, the aggregate net worth of the bottom 50% or 66 million households has risen from $0.7 trillion to $3.6 trillion. That's a gain of just $44,000 per household.

Accordingly, the top 0.1% gained 3,100X more net worth each than the bottom half of America's households. And that lopsided outcome was not due to the fact that the top 0.1% was much richer to begin with.

In fact, the aggregate net worth of the top 0.1% was 2.45X that of the bottom 50% in 1989, but by Q3 2023 it had grown to 5.45X. But that shift had nothing whatsoever to do with merit, investment prowess or contribution to American economic life. It was simply a product of financial asset inflation and the ready ability of the very wealthy to speculate with the cheap leverage supplied by the Fed.

In short, the drastic widening of the wealth gap depicted in the chart below was not the natural outcome of free market capitalism functioning on the basis of honest money. Instead, it was a product of the rampant money-printing by America's rogue central bank-a state institution that has been taken over by Wall Street lock, stock and barrel.

Net Worth Of Top 0.1% Versus Bottom 50%, 1989 to 2023

The reason Powell needs to go, of course, is that he has now proven in spades he is clueless about the real impact of the Fed's endless flood of cheap credit on Wall Street.

The latter, in turn, has been driven by the sheer insanity of its 2.00% inflation target, and the license it gives the Eccles Building to print money with reckless abandon.

Over the last several decades the Fed's excuse has been either that inflation was missing its 2.00% target from below or that any temporary inflation flare-ups were transitory and would be soon getting back into the target range. Accordingly, the Fed never stopped printing fiat credit, raising its balance sheet from $200 billion in 1987 to $9 trillion at the peak in 2022. That 45X gain in central bank money massively exceeded the mere 5X rise in national income (GDP) during the same period.

That lopsided ratio alone says that the Fed's printing presses need to be put on idle for a good while to come. Yet at Wednesday's presser Powell implicitly affirmed that Wall Street will soon get a new flood of money, with at least three rate cuts (75 basis points) later this year. And that's notwithstanding the fact that after family budgets have been clobbered by 20% higher prices since early 2021 the monthly inflation data in January and February was still coming in well above the Fed's dubious 2.00% target:

The Fed won't ignore bad news, but it also won't overreact, he said. "They haven't really changed the overall story, which is that of inflation moving down gradually on a sometimes-bumpy road toward 2 percent," Powell said.

But here's the thing. There is not a shred of evidence that 2.00% inflation does anything at all to benefit the main street economy or middle- and lower-income households. As we have demonstrated repeatedly, real economic growth rates, investment levels, productivity gains and middle-income living standards have all faltered badly relative to historical trends since the Fed went into heavy-duty money-printing during the Greenspan era.

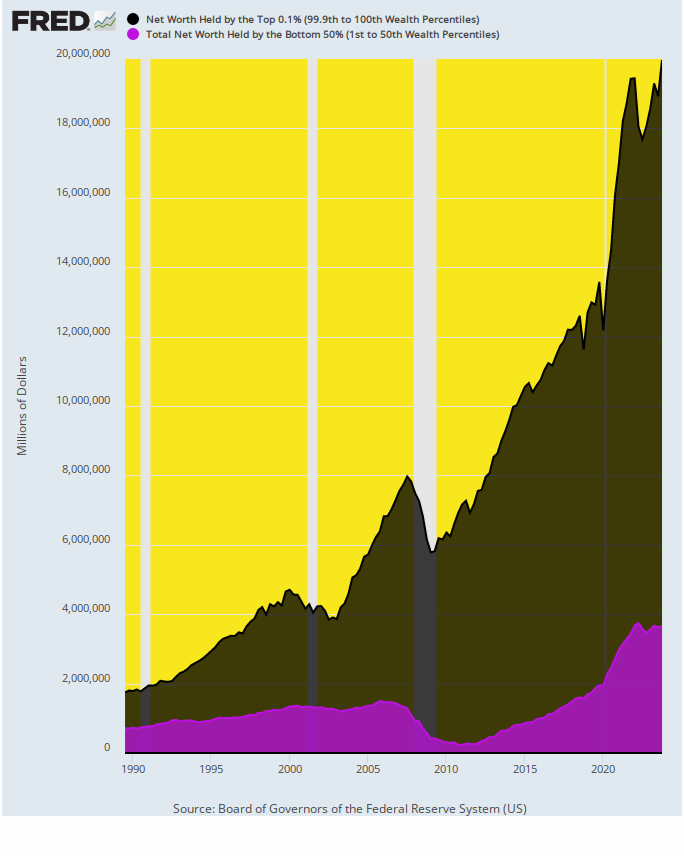

But what 2.00% or higher inflation actually does is destroy the meager savings of main street households, which cannot afford to roll the dice on Wall Street or invest in risky junk bonds, securitized real estate or other higher yielding assets. Accordingly, even as the net worth of the top 0.1% rose by 1,000% between Q3 1989 and Q3 2023, the value of a dollar saved by an average consumer back in 1989 was worth only 41 cents at the end of this 34-year period.

Stated differently, the Fed's pro -inflation policy savages the middle class and average wage-earners, even as it pumps massive amounts of cheap liquidity into the gambling dens of Wall Street.

So RFK simply needs to demand that the whole money-printing scam be brought to an abrupt halt. The rich don't need any more cheap gambling chips and inflated financial assets and the middle class truly cannot stand any more "help" from Fed-fueled inflation.

Depreciation Of Consumer's Dollar Since Q3 1989

What the PhD's who peddle 2.00% inflation targeting always ignore is that inflation is cumulative, and there is no guarantee that any particular worker's paycheck will keep up.

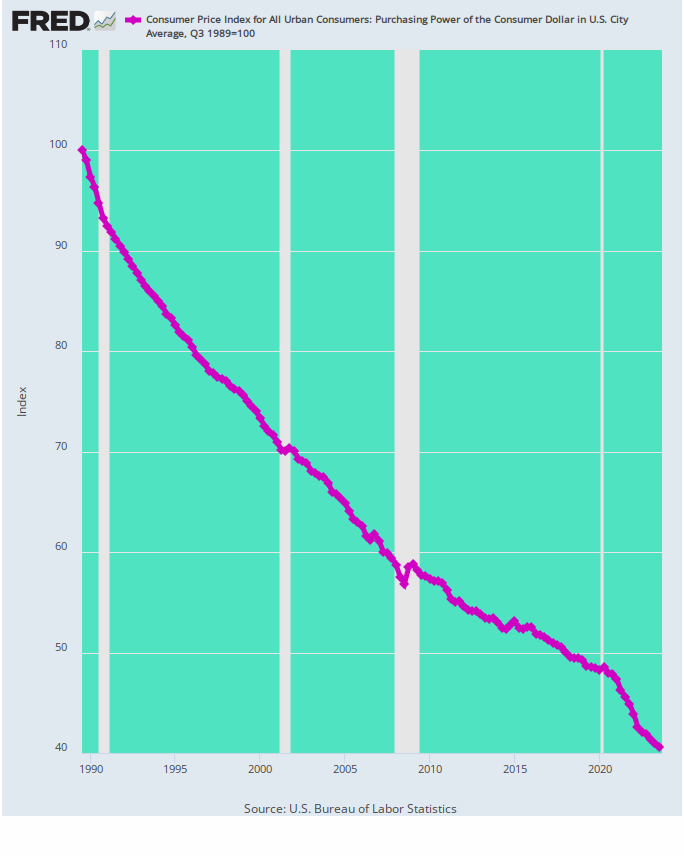

For instance, here is the average manufacturing wage (dashed red line) since Q3 1989 compared to food, energy and shelter costs.

We'd say that all this Fed-supplied inflation was not exactly a bargain for the average manufacturing worker-if he or she managed to actually keep their job. In point of fact, however, there are actually 5 million fewer such well-paying manufacturing jobs today than there were 34-years ago.

Nevertheless, the average hourly wage for manufacturing workers did not keep up with any of the principal living cost items during that period.

Cumulative % Change Between Q3 1989 and Q3 2023:

- Hourly Wage of Mfg. workers: +156%.

- CPI for Food: +157%.

- CPI for Shelter: +188%.

- CPI for Energy: +211%.

In a word, inflation ain't no bargain for wage workers. The whole idea of targeting anything other than price stability amounts to thinly disguised academic gobbledygook designed to obfuscate the Fed's true aim, which is to generate wealth on Wall Street out of the misbegotten Greenspanian notion that "wealth effects" and "trickle down" are a boon to main street America.

But when you compare the chart below with the net worth gains shown in the chart above the evidence screams out quite loudly: Inflation is a very bad deal for main street and a completely unwarranted and unfair windfall to Wall Street.

Change In Average Manufacturing Wage Versus CPI for Food, Shelter And Energy, Q3 1989 to Q3 2023

Needless to say, both ends of the Acela Corridor would scream bloody murder about firing Powell and shutting-down the cheap money spigot to the US Treasury. But there are simple and straight-forward answers to all of the red herrings that are likely to be offered by beneficiaries of the current rotten monetary policy regime at the Eccles Building.

Yes, a new President technically cannot fire the Chairman of the Federal Reserve, but Powell's term as Chairman does end on May 15, 2026. So he can be called into the Oval Office on day #1 to receive word that he will not be reappointed under any circumstance and that should he choose to be a wounded lame duck during the following 16 months he will face an unrelenting assault from the Bully Pulpit.

Put that way, we are quite sure that Powell would choose to take the gold watch on January 20, 2025.

Secondly, it will be claimed that significantly higher bond yields will cause mortgage rates to rise proportionately, and to the detriment of middle class.

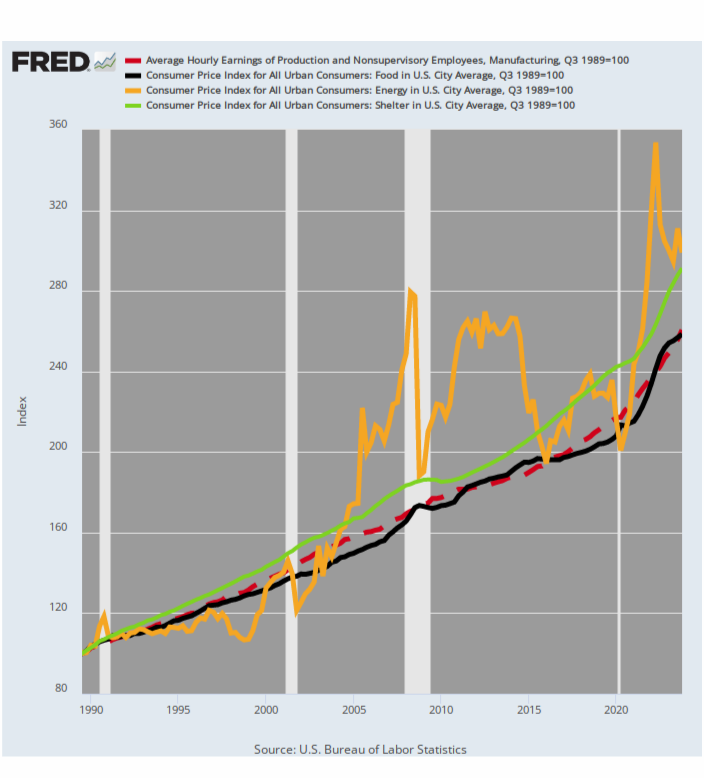

Well, yes to the first part and no to the second. According to the current government data, the average home mortgage in the US is $89,643, but in this case the average tells you almost nothing.

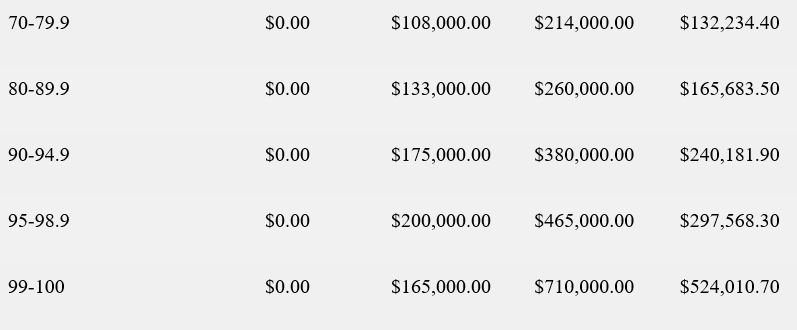

As shown below, the average mortgage held by the bottom 20% of households amounts to less than $15,000, while that for the 50th percentile is about $55,000 and the 99th percentile is $524,000. So the dollar benefits of artificially low mortgage rates overwhelmingly accrue to more affluent households.

Mortgage Debt Secured by a Primary Residence By Income Class

Moreover, if the government want to help middle- and lower-income families afford market rate mortgages, then the solution is not to subsidize the jumbo mortgages of the rich by suppressing interest rates, but to provide targeted, means-tested transfer payments to households on the lower end of the income scale. A buy-down of the mortgage interest rate for first-time homebuyers would be one mechanism to accomplish that.

Finally, it will be argued that an extended moratorium on Fed purchases of government or GSE debt will leave the financial system high and dry in the event of a liquidity crunch.

But that's the worst red herring of all. If we want a radical break from the Fed's abject servitude to Wall Street, the answer is to shutdown the FOMC (Federal Open Market Committee) and get the central bank's operations out of the canyons of Wall Street entirely.

Indeed, the original designers of the Fed led by the great Carter Glass took great pains to keep the central bank as far away from Wall Street as possible. That's why they provided for the Fed to operate through 12 regional discount windows, where member commercial banks in each region could obtain cash advances, but only on the basis of sound commercial collateral and at an interest rate based on the free market plus a penalty spread.

Today, the commercial banking system holds more than $12 trillion of loans and leases excluding Treasury debt and GSE securities. That's more than enough collateral to meet any financial stringency; and, besides, what is wrong with requiring banks to pay market rates of interest plus, say a 200 basis point penalty, for using the credit of the central bank?

We'd say, there is nothing wrong with that at all, even as it would free the Federal Reserve from the baleful grip of its current Wall Street masters.

Reprinted with permission from David Stockman's Contra Corner.