April 2, 2024

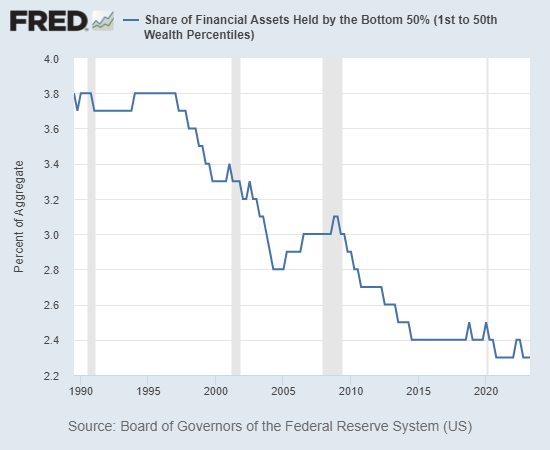

Imagine the impact of the Fed's new policy on the bottom 50% of American households, who currently own near-zero financial assets.

The Federal Reserve announced a new program today that offers every American household a $1 million loan from its new Household Discount Window at 2% interest. Before you start planning how to spend the $1 million, there's one catch: the $1 million can only be used to buy US Treasury bonds, notes and bills.

As disappointing as this restriction might be, it has an upside: borrowing $1 million from the Fed's discount window will cost $20,000 in interest annually, but with Treasury bonds, notes and bills paying around 4.5% or more in short-term durations, the $1 million will generate $45,000 in income annually-a $25,000 net profit for every household.

Yes, you'll owe federal income tax on the $25,000 annual interest income, but Treasury bond interest is tax-free in states that collect income taxes-a nice tax break for those living in states with high income-tax rates.

The new program is a radical shift in Fed policy, which boiled down to sluicing all the newly created currency / credit to banks, corporations and financiers, enabling the super-wealthy to become hyper-wealthy thanks to Fed largesse.

Stripped of econo-speak misdirection, the Fed gives free money to the hyper-wealthy who then loan it to commoners at high rates of interest, pocketing the profits. The commoners become debt-serfs whose earnings enrich the already-rich-a dynamic generated by the Fed's policy of free money for financiers.

A spokesperson who insisted on anonymity said, "We basically decided to offer a limited version of the 'free money' we offer to banks and financiers to households, starting with the bottom 50% of households who own few financial assets."

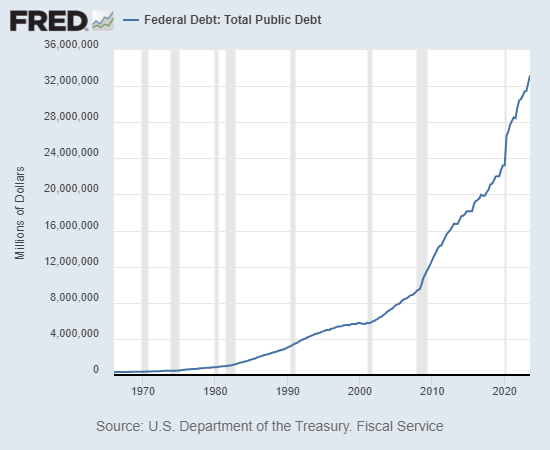

Many economists are pointing to the obvious goal of the new program: funding the ballooning federal debt by creating a pool of buyers who have no other way to get $25,000 in interest other than buying Treasuries. "It's a brilliant plan in two ways," one economist observed. "It funds the federal debt while sharing the wealth created by the Fed, starting with the bottom 50% of households who have received virtually no benefit from the Fed's 'wealth effect' financialization. It's truly win-win."

Retailers, airlines, the hospitality industry, auto dealers and others anticipating that much of the $25,000 in new household income will be spent on goods and services are vibrating with enthusiasm for the Fed's new policy. "Putting income in the hands of those at the bottom of the wealth-power pyramid is the surest way to boost consumption," the economist noted.

That the Treasury will need bond buyers in size to float the ballooning federal debt is obvious:

Imagine the impact of the Fed's new policy on the bottom 50% of American households, who currently own near-zero financial assets: $25,000 a year in interest income will change a lot of lives. Thanks, Federal Reserve, for finally sharing some of the tens of trillions in gains you've handed the already-wealthy with the rest of America.

Sadly, this is an April Fools post. Sadly, the Fed is incapable of doing anything but tearing the nation apart by continuing to enrich the hyper-rich.