July 26, 2024

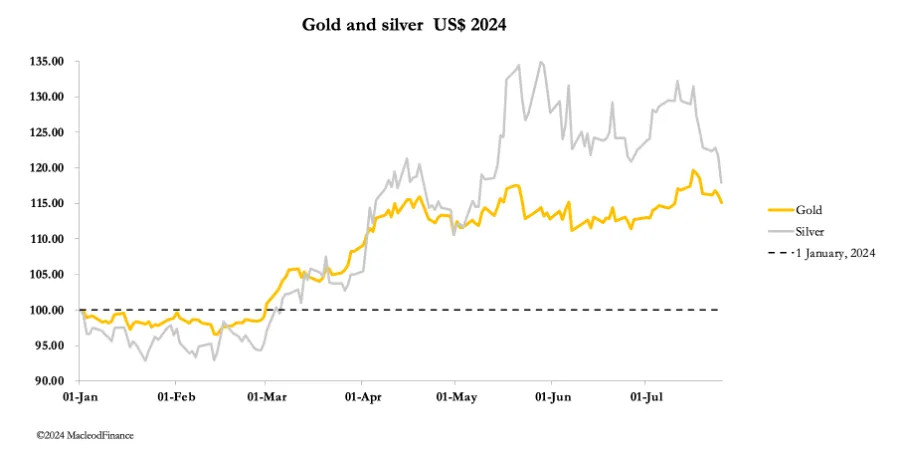

After declines in gold and silver prices in the second half of last week, this week started on a steady note, before heading south yesterday afternoon. In early morning trade in New York today (Thursday), gold was $2370, down $30 from last Friday, and silver at $27.60 was down $1.60.

The reason for this sudden development has little to do with gold and silver per se but is due to a developing panic in equities. While the US tech bubble was running out of steam, the rot set in in Japan, with the Nikkei falling over 10% since 11 July. At the same time, the yen has rallied strongly, both moves shown in our next charts.

Japanese institutions faced substantial losses on their domestic portfolios, and the rally in the yen also imposes losses on their foreign investments. It is hardly surprising that they are panic sellers of Japanese equities and US equities alike.

Other markets Japanese investors are known to be long include France and Italy, whose major indices have also fallen, 2% and 2.5% respectively this morning.

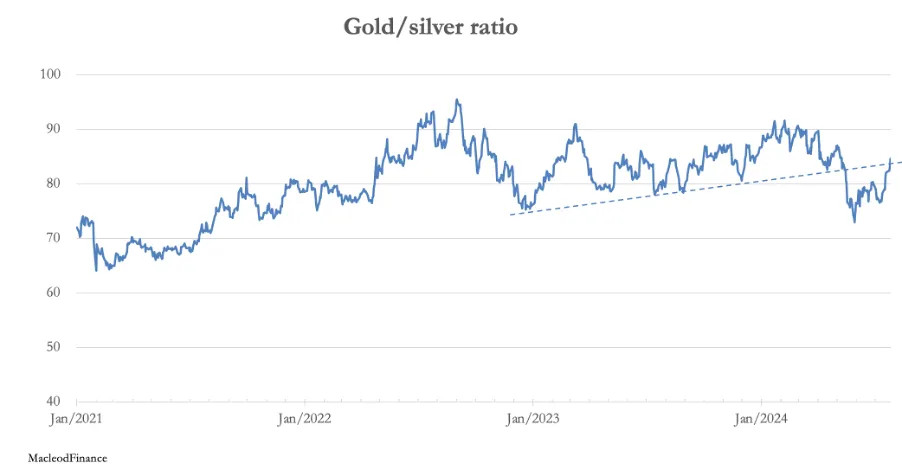

Since US equities peaked last week, the S&P 500 Index has fallen nearly 5%, with large caps badly hit. Consequently, hedge funds geared to rising tech stocks have been forced to liquidate long positions, and these are often the same players in the Managed Money category in Comex gold and silver contracts.

The first whiff of distress sees buyers vanish and the bullion banks in the Swaps category are taking the opportunity to mark paper market values down. At the same time buyers of bullion sense that this distress will provide a buying opportunity at lower prices, and at the margin will be withdrawing their bids. But when buyers do return, it is likely to turbocharge silver. The gold/silver ratio has risen to 85 on silver's markdown (for that's what it is). This is our next chart.

There is no knowing how long or how deep the panic in equities will go. But at a guess, it won't be long before the gathering speculation is of crisis and that the Fed will need to reduce interest rates urgently to stop it. At that point in time, foreign holders of dollars are likely to turn sellers of dollars more aggressively, perhaps buying other major currencies (including the rising yen) but particularly gold, silver and base metals.

This is making sense of China's policy of stockpiling commodities. The Economist and other media have recently reported buying of oil and grain beyond her consumption needs, as well as copper and other metals. Speculative explanations abound, but none have twigged that it's about dumping dollars and euros as much, if not more than acquiring commodities.

In the very short term, for gold and silver prices it looks like being a volatile, rough ride. But perhaps this is the widely expected crisis. If so, it didn't start with a bank run or a debt crisis, but a good old fashioned equity crash. The rest follows, and as safe havens from a major credit crisis gold and silver as money without counterparty risk will shine.

Reprinted with permission from MacleodFinance Substack.