By Ira Katz

September 17, 2024

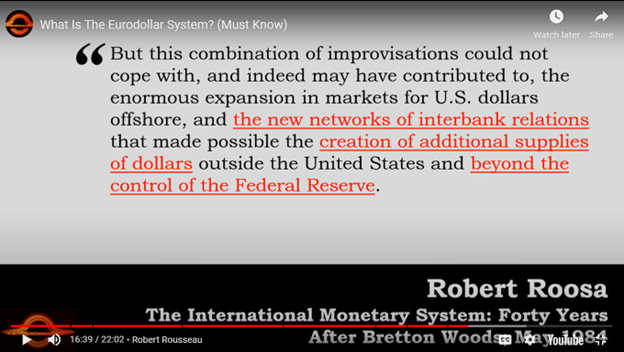

One of the most interesting commentators on the legal-political scene is the attorney Robert Barnes. Whenever Barnes discusses economic analysis and predictions he relies on Jeff Snyder, who in turn bases his reasoning on investigation of the Euro-dollar international system of exchange. In this video Snyder explains what the Euro-dollar system is. My takeaway from Snyder's video is that the Euro-dollar system is a fractional reserve banking system based on Euro-dollars not backed (controlled) by the Federal Reserve. Thus, they are not Federal Reserve notes; i.e., US dollars. Snyder believes that Euro-dollars are the real worldwide currency (a good thing) that allow international movement of capital and goods.

Screen shot from Snyder's video.

In this video Tom Woods and Bob Murphy discuss inflation predictions and the relative lack of inflation after the Federal Reserve's injection of money into the banking system after the 2008 financial crisis. Murphy explains that many Austrian economists, himself included, predicted more price inflation than actually occurred. I also expected more inflation. My post hoc analysis attributes the lower posted official inflation statistic to an understanding of the statistic itself. That is, the measure did not include the particular assets which were bid up by the created money, not in basic products for people because they didn't get any of the new money, but to stocks and other speculations, parked in the banks, and of relevance here, the money went overseas.

Thus, in understanding the current economy and international geopolitics the Euro-dollar system might be a key element that most analysts miss. However, when listening to Snyder, or Barnes following Snyder, several questions arise that are critical to assess the true impact of this system. I hope these questions might be addressed by Snyder, Barnes, or anyone else who might come across this article.

My questions:

- Am I correct that Euro-dollars are not the same as US dollars (Federal Reserve notes)?

- If the Federal Reserve does not back the Euro-dollar system who does? That is, a fractional reserve system is sure to fail eventually without a government fiat backstop.

- Can Euro-dollars be used equivalent to Federal Reserve notes in the USA?

- Are Euro-dollars considered to be equivalent with Federal reserve note dollars in exchange for goods on the international market, in effect making the FRN dollars worth less in terms of real goods?

- Can the US government control Euro-dollar international exchanges through the SWIFT system?

- Are Euro-dollars included in any of the common money supply measures used for the US economy? (For example, see this classic article by Dr. Salerno.)

- If Euro-dollars are FRN dollars, what is their percentage of total dollars?