By JD Breen

Premium Insights

February 17, 2025

"Sweeping tariffs and a shift away from strong dollar policy can have some of the broadest ramifications of any policies in decades, fundamentally reshaping the global trade and financial systems."

- Stephen Miran, nominee: CEA Chairman

"We're going to monetize the asset side of the US balance sheet, for the American people."

- Scott Bessent, US Treasury Secretary

- Matt Smith, entrepreneur and rancher

Henry George observed that tariffs are nations doing to themselves in peacetime what enemies inflict during wars.

Donald Trump disagrees.

Last week, the president issued...then postponed...hefty tariffs on Canada and Mexico. He also intimated he'd apply import duties on the EU, and imposed a 10% levy on products from China.

This week, he announced a 25% impost on foreign aluminum and steel, which appears to impact Canadians the most (or the Chinese, to the extent they reputedly ship steel to Canada and Mexico for laundering to the U.S.).

More tariffs are reflexively threatened based on how countries behave.

Dresden and Detroit

What's going on here? Is this more "Art of the Deal" 4D Chess?

Or are these tariffs unforced errors, revivals of ideas so imbecilic even most credentialed economists can see the stupidity?

This administration assumes (or wants us to believe) that other governments have been ripping us off. But China, Canada, and Mexico are mere scapegoats. The real enemy is within... mostly in Washington, DC, northern Virginia, and southern Manhattan.

Corporate boardrooms, in conjunction with their purchased politicians, the Fed, and Wall Street are the real source of America's woes. These are the entities that hollowed Cleveland, St Louis, and Baltimore, and shipped American manufacturing overseas.

If we look at Dresden and Detroit in 1945, then take a glance at each today, we know something went terribly wrong. It started with corporate boondoggles like the Marshall Plan, but continued with Cold War escapades like the Korean "conflict" and a catalogue of coups.

But, as always, to connect the dots we must follow the dollars. And especially what backs them... or doesn't.

Monetary Resets

During the late 19th century, the U.S. prospered under a genuine gold standard. This lasted till the advent of the Fed in 1913.

A Potemkin version emerged after the First World War. But gold exchange rates in Britain were unsustainable, prompting the Fed to print money to help prop up the pound. This amplified the Roaring '20s boom, which collapsed when the hot air inevitably left the balloon.

Under the post-war Bretton Woods system, the US dollar was tied to gold, with other currencies tethered to the dollar. But "Guns and Butter" became scissor blades that cut the ropes.

As deficits mounted during the Great Society and Vietnam War, U.S. gold reserves dwindled. Other countries... notably France... feared their portion wasn't there. On August 15, 1971, Richard Nixon proved them right.

It wasn't the first time the U.S. government defaulted. FDR did so on April 5, 1933, when he devalued the dollar by 60%, and confiscated gold from American citizens.

Now Nixon took it from the foreigners. The "gold window" was officially closed, converting the dollar into what Doug Casey calls a "floating abstraction".

The same day, to coerce cooperation from other countries, Nixon imposed 10% tariffs on all "dutiable articles" entering the US. Almost a decade and a half later, tariffs were again a lever that compelled US trading partners to help weaken the dollar.

On each occasion, the imposition or prospect of tariffs preceded a monetary reset. Is that what Trump's tariffs portend now? Or perhaps the process is already underway?

Bread Crumbs

Most of what follows is based on digging my friend Matt Smith has done. He didn't need to delve too deep. The components of the plan are out in the open, proudly proclaimed by the people implementing them.

But Matt brought them to my attention, and I think he's on to something. 𝕏 x.com that "the biggest economic shift in fifty years is happening right now".

His X feed and this podcast reveal in detail why he thinks so. In essence, it's because Trump's team is telling us it is.

After several weeks following the bread crumbs, Matt found them to be as much a radar as a reminder. They suggest where we're going, and that we've been there before.

Donald Trump is known for shooting from the hip and flying by the seat of his pants. But because he's known for that doesn't mean that's always what he's doing. In this case, he appears to be following carefully choreographed footsteps along a well-worn path.

Smithsonian to the Louvre

In a paper published several months ago, Stephen Miran, Trump's nominee as Chairman of the Council of Economic Advisors, noted that international monetary systems can change unilaterally or multi-laterally. The latter is more desirable, yet more difficult.

Tariffs can be a crowbar to pry compliance. Miran reminds us of Nixon's in 1971, and the ones Reagan threatened in 1985. In his assessment, each prompted significant revisions in foreign exchange regimes. In both instances, US administrations convinced reluctant countries to help pull the dollar lower.

A few months after Nixon imposed his tariffs, the Smithsonian Agreement amended the dollar pegs under Bretton Woods. This devalued the dollar... but not enough. Markets kept driving it down. Within fifteen months, it was set adrift.

A decade later, after Volcker's exorbitant interest rates of the early 80s, capital flowed into the US and the dollar regained strength against its rivals.

At the time, Japan was considered the commercial challenger China is perceived to be today. To suppress the yen, Deutsch mark, and other currencies, Congress threatened "protective" tariffs.

Not wanting a trade war, Ronald Reagan sought a deal. In 1985, at the Plaza Hotel in New York, he got one. The U.S. and its major trading partners agreed to push the dollar lower.

They did. For two years the dollar weakened. At the Louvre eighteen months later, the parties met again, and the decline was halted at mutually agreeable levels.

Like his predecessors, Trump wants a weaker dollar. He also wants it to remain the world reserve currency, and has intimated he'd take action against countries choosing other options.

Triffin Dilemma

Valéry Giscard d'Estaing once referred to the dollar's exalted status as America's "exorbitant privilege". It allows the country to avoid balance of payments crises because it can purchase imports with its own currency (which its central bank can "print" at will).

US dollars are the medium of exchange for almost every country's cross-border purchases. This creates an inherent demand for dollars that lowers borrowing costs for Americans, and allows them to buy from abroad without commensurate production at home. As such, they needn't manufacture enough exports to pay for their imports.

So they haven't.

The US economy has been financialized, addicted to debt, and sustained by "services". Tho' some goods are assembled in the states, most of what Americans buy is made elsewhere. This forces foreigners to recycle their piles of dollars into US debt, which has been America's primary export the last five decades.

The "twin deficits" exemplify the "Triffin Dilemma" Miran describes in his paper. According to Belgian economist Robert Triffin, a reserve currency requires a current account deficit, by which it is recycled into Treasury bonds that become base money in foreign central banks.

As domestic manufacturing declines, global confidence in the currency begins to wane. Conversely, inadequate deficits deprive the world of currency, which strengthens the dollar and incentivizes corporations to move manufacturing offshore.

This is the dilemma Trump faces, and that his team will use drastic tactics to try to resolve.

Gold Rush

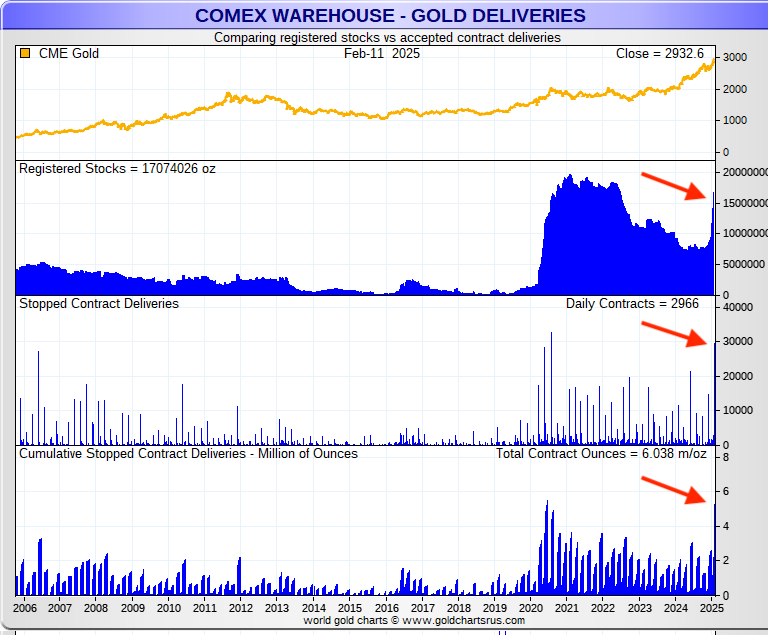

The gold market seems to sense this. Despite an abundance of "big" money shorts and dearth of of retail demand, the price of gold keeps climbing.

An ounce fetches 40% more dollars than it did a year ago... and 11% more than at the start of this year. In this morning's Wall Street Journal, beside the article discussing Trump's reciprocal tariffs, is a piece describing the recent rush to ship gold to the States.

As we noted regarding silver earlier this week, the LBMA is having trouble fulfilling obligations to US buyers trying to take delivery. 𝕏 Who are these eager customers?

h/t: @jameshenryand on X

There's obviously a large buyer in the U.S. Whoever it is is indifferent to rising price or higher margin requirements, and has been purchasing huge quantities representing more than ten percent (30M oz) of total US holdings (260M oz).

Matt speculates either the Fed or Treasury (or both) is accumulating the metal, perhaps in anticipation of a gold audit, and to ultimately use the stash to back the buck. We don't know. But the size of the purchases substantiates this supposition.

As does what the Trump team has been saying. Their plan is to revive US manufacturing, boost American exports... and reset the monetary order.

Mar-a-Lago Accord

As with everything else Trump is doing, he wants this to occur relatively quickly. Gold is signaling the process is already underway: it's price isn't rising; that of the dollar is going down.

Based on current quantities of dollars and ounces, it has a long way to go. Miran suggests this could happen at a new agreement he calls the "Mar-a-Lago Accord", reminiscent of the Bretton Woods and Plaza agreements.

At about the same time, Scott Bessent (now Trump's Treasury Secretary) supported this assessment. Matt Smith provides 𝕏 the audio evidence:

A price of $20K/oz would be needed for the current quantity of dollars to be backed by gold. This ~85% weakening of the dollar (from current gold prices) would be extraordinarily inflationary. Even a debasement to (say) $10K/oz would be enormously disruptive.

As part of the plan, to retain U.S. security guarantees, foreign governments would be required to invest in new long duration zero-yielding Treasury bonds. This would reduce both the cost of borrowing for the U.S. government and the value of the dollar. This would support exports and help wash away debt that infests the system.

The Balance Sheet

In this scenario, consumer prices would soar. But the administration expects wages would rise with them, as wealth flows from American assets into Americans' pockets.

How?

To find out, let's look at the other side of the ledger, and how Trump plans to deal with the debt. It can be dispatched in one (or a combination) of three ways: it can be paid, it can be repudiated, or it can be inflated away.

The first two alternatives are moral, in that they either compensate creditors... or teach them a lesson for making bad loads to the government. Yet each is unlikely. The last option (inflationary theft) is what'll probably happen, and appears to be what's planned.

But that doesn't mean there won't be efforts to buttress the balance sheet by balancing the budget. Matt refers us to Billionaire Says Bitcoin, Tariffs and Donald Trump Will Make You Rich | Howard Lutnick , former Chairman and CEO of Cantor Fitzgerald, and Trump's outspoken nominee to be Commerce Secretary.

After acknowledging the $2T annual deficit... and a $29T GDP supporting $36T in debt... Lutnik estimates America's assets to exceed $500T. Making a mere quarter percent on those resources provides $1.25T against the $2T shortfall.

The rest would come from reduced "waste" and improved efficiency. Throughout the years, such promises have conditioned us to laugh. But this is where DOGE comes in.

Removing "waste" from the government is a song budget hawks have shrieked for decades. Like "immigration" or "abortion", "waste, fraud, and abuse" is a mantra politicians chant to get elected, then promptly goes mute when they get into office.

No one disputes that billions are lost to ineptitude. But much of the loot flows to entrenched monopolists, embedded bureaucracies, and other vested interests (and the elected officials who feed them) who get fat off the pork. There's no incentive for the waste to go away.

So it doesn't. Because the benefits are concentrated and the pain dispersed, both persist.

Sovereign Wealth Fund

But the hysterical reaction to Elon Musk and what he's doing with DOGE suggests this time is different. A few months ago, Howard Lutnik (then a member of Trump's transition team) said this was coming.

He also suggested ways the government could raise revenue without direct taxation. Part of that plan is a potential Sovereign Wealth Fund, which Trump has tasked Lutnik and Bessent to explore.

What would go in it? In this revealing interview, Lutnik provided some clues:

He (jokingly?) recommends rechristening the Department of Interior as the "Department of All the Land and Mineral Rights of the United States of America." Merely realizing reasonable return on these resources would put a significant dent the deficit.

Lutnik reminds us that (for example) the Arctic National Wildlife Reserve (ANWR) alone has about as much oil as Saudi Arabia. This could be extracted and sold to American allies to boost the balance sheet. The same could be said of countless other mineral deposits throughout the US.

In essence, the Department of Interior could become America's Sovereign Wealth Fund. Lutnik suggests the revenue from these resources (and tariffs) could replace the income tax.

That would be wonderful. But is it realistic?

Lutnik correctly notes that (excepting an income tax under Lincoln) tariffs and excises funded the government from the ratification of the Constitution till the 16th Amendment.

The U.S. prospered during the latter part of this period, under the gold standard and a relatively feeble federal government. Today's behemoth could be financed by tariffs only if most of it ceased to exist.

That'd be great. But as many schemes and scams as DOGE has identified, it has a ways to go (particularly within entitlements and "Defense") to make this feasible.

Implications

Suppose, as Matt Smith believes, that a "monetary reset" is already underway. If the US re-accumulates gold, imposes tariffs as a tool to devalue the dollar, reduces expenses by cutting waste, and leverages American assets to increase revenue while reducing taxes, what are the implications?

Higher inflation would be inevitable. That's what dollar devaluation means, and what the gold price is already predicting.

But won't holders of dollars anticipate this, and try to dump the currency? Almost certainly.

This is where capital controls kick in. The US could emulate the China by having two currencies under strict controls. 𝕏 As Matt says, we should

"expect major capital controls to keep money from fleeing the US. Foreign holders of US debt & perhaps even stocks could get hit with restrictions or fees. A two-tier dollar system may emerge (internal & external dollar). Believe it or not, the US will be copying some of the Chinese economic model."

In the presumed two-tier system, capital must be contained so, as Smith puts it, "it doesn't flee to places where it won't get inflated away." Usually capital controls are to prop a currency. These would be imposed to drag it down.

As the dollar weakens, the debt is wiped away... which seems the only way it could ever be paid. In this scenario, bonds get crushed.

What about stocks? There are cross-currents. The devaluation should push them up. But forty percent of the US equity market is foreign dollars. There'd need to mechanisms to dissuade them from selling.

Those of us who've long wanted to end the Fed would get their wish. 𝕏 Matt continues:

"Trump's advisors want to kill the Fed....What replaces it is likely to be a private stablecoin-backed system (like Tether). A gold-backed digital dollar (CBDC) is coming. The entire monetary order is being reset."

In a Fourth Turning, people are open to novel ideas. The corruption and grift DOGE is exposing could convince Americans a change must be made. The rapidity with which the Trump team is addressing these scams helps people believe this administration is up to the task.

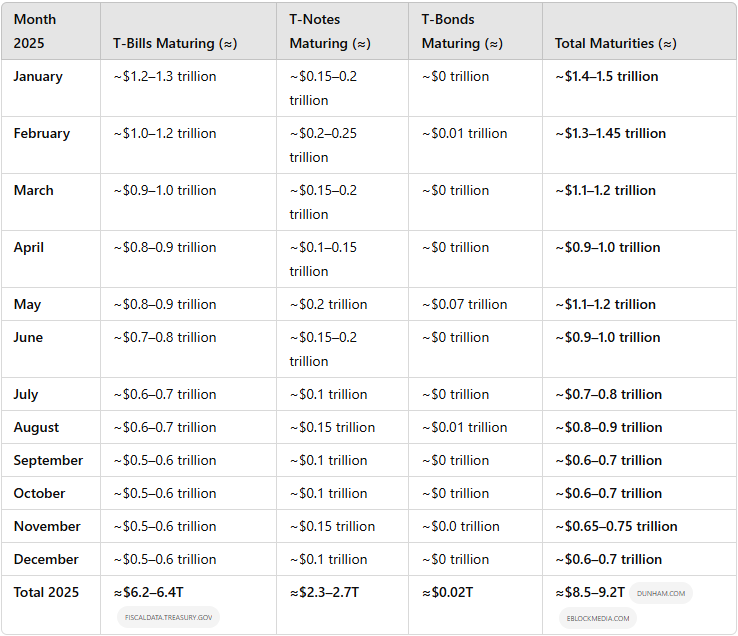

Smith expects this transition to happen fast, with a "Mar-a-Lago Accord" within two years. This is partly because Trump doesn't have much time. But also because the debt doesn't. There's a necessary sense of urgency. Almost $9T of Treasuries mature this year:

Source: 𝕏 1888945576349241521

This is a vast restructuring requiring a delicate operation. But, as Smith says, something must be done.

And it will be. The only question is whether it's by controlled demolition and careful reconstruction... or by waiting for the system to implode and then sifting the rubble.

Either way, however much gold you own... it probably isn't enough.

JD