President Trump promises to be the "affordability president." The problem is that he-like presidents before him-won't address the root cause of rising prices.

By Eric Sammons

Crisis Magazine

December 15, 2025

Donald Trump doesn't want us to believe our own eyes. He wants us to accept that things are getting more affordable, even though we see prices rising all around us. To be fair, he's not the first president to try to play sleight-of-hand on Americans; every president spends his time in office selling Americans on how great the country is doing under his leadership, regardless of the reality on the ground (or in the grocery store).

In this vein, President Trump is hitting the road to talk about the "great economy" he's created in less than a year in office. In typical Trumpian terms he recently gave the economy a grade of " A+++++," but the facts say otherwise. Let's look at a few indicators.

Since ground beef is a staple in many Americans' diet, it offers a good example. Its price has skyrocketed in recent years-including under Trump. A pound of ground beef was $3.95 five years ago, and as of September 2025 it was $6.32/pound-a 60% increase. And lest you believe the entire increase occurred under the Biden Administration, ground beef was $5.54/pound this past January, which means it's increased by 14% in just the first nine months of the second Trump presidency.

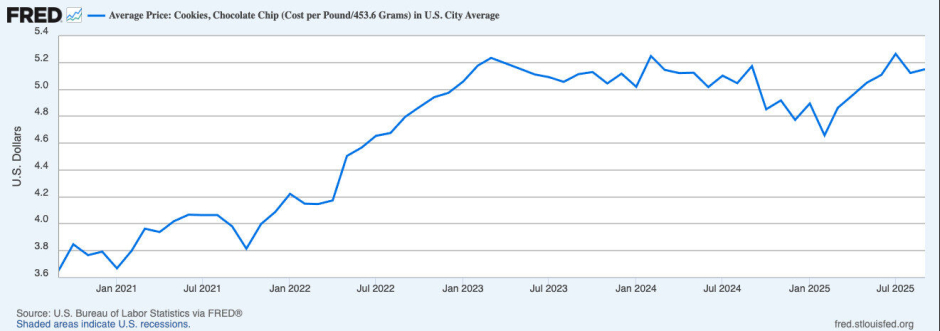

Let's look at another commonly purchased product (especially during stressful times): the chocolate chip cookie. In the past five years it has increased in price by almost 30%, and in just the first nine months of Trump's second presidency, the delicious dessert has gone up 5.3% in price.

Regular Americans aren't surprised by this data; they feel it every time they go grocery shopping. Even goods that aren't skyrocketing-such as milk, which has increased "only" 2.7% in price since January-are still steadily rising in price, leading to an increasingly tighter pinch in our pocketbooks.

So Trump's claims that the economy is humming along doesn't match real world data and experience. And it's clear that Trump does realize this, no matter how much he might pretend otherwise when being interviewed. He's taken a number of steps to make life more affordable, but most of them do little to actually reduce prices.

His pitch for normalizing 50-year mortgages is a perfect example. While on the surface this may appear to make housing more affordable (by reducing the monthly mortgage payment), it actually does the opposite, particularly when you consider the massive increase in interest payments one would be required to make over the life of the loan. And after the initial impact of these new lifetime loans, housing prices will increase as more people are able to afford more expensive housing.

And of course there are Trump's highly-touted tariffs, which arguably might have a positive impact on the country from a geopolitical standpoint, but even a first-year economics student will tell you that they cause a rise in prices since they are essentially a tax that's passed on to the consumer.

While President Trump might be able to enact some policies on the edges that could slightly offset the increase in prices (and he's far better than the Democrats at doing so), he's never going to make things truly more affordable because he-like every modern president, Republican or Democrat-refuses to tackle the root problem. The ship of our economy is foundering from a hull breach, and Trump's using a thimble to bail us out.

So what is the root cause of the affordability crisis ? Runaway government spending.

It might not be obvious why massive government spending causes inflated prices, and government officials like it that way. They've got to hide the fact that they are the cause of your inability to afford ground beef for your kids. But here's a simplified breakdown.

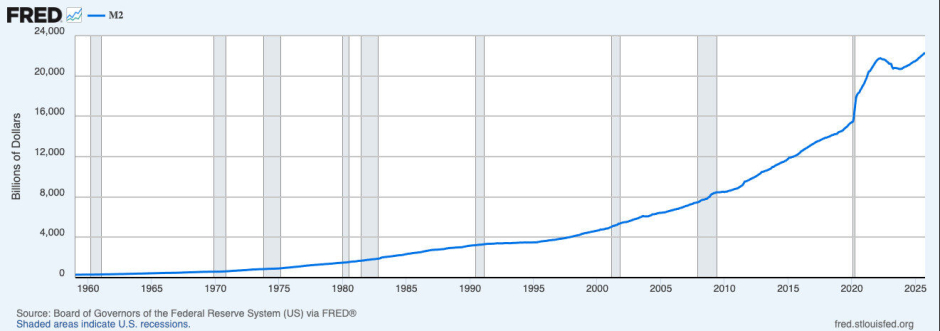

The government spends far more money than they bring in from taxes and tariffs. Far more. So it needs to make up for that imbalance. It does this with massive deficit spending (i.e. adding to the debt), to the tune of $1.8 trillion in the past years, and $38 trillion overall debt. But it also makes up for the imbalance by printing new money. It's the one thing a government can do that an ordinary citizen can't when it comes to budgeting. If you make $5,000 in a month, but spend $8,000, you take on a $3,000 debt. You can't print that $3,000 in your basement. But the government can. Sure, it uses fancy financial tricks to obfuscate what it's doing, but it is essentially just printing money.

This has become a time-honor practice of governments over the past 100 years. See for yourself in the following chart, which tracks the total money supply in the economy:

We see a gradual increase in the total amount of money over the past 60+ years, with a huge spike in 2020 due to Covid. But then after a small decrease in the immediate post-Covid years, the upward trend returns. Money printing isn't just for emergencies anymore; it's standard government practice.

And what does more money in an economy do ? It increases prices, as surely as the rising sun follows the dawn. This economic truth is reflected in the original economic definition of the word "inflation." It did not refer to inflating prices; it meant inflating the money supply. The definition was changed in popular usage when officials wanted everyone to ignore the reason prices were increasing: their runaway spending which required money printing. A more precise term for what most people just call "inflation" would be "price inflation," as opposed to monetary inflation (but remember: the latter causes the former).

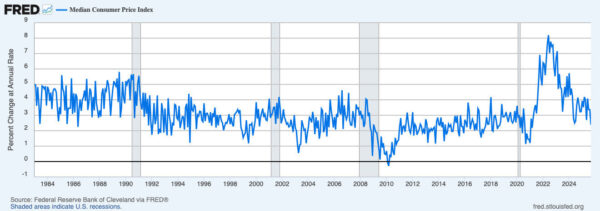

Let's look at the price inflation that's occurred in recent decades, as indicated by the Consumer Price Index: 1

At first glance, it might appear that price inflation has remained relatively stable over time, and that the spike in inflation during the Biden Administration has been corrected under Trump. But we need to remember that inflation is a percentage measurement, not a fixed price measurement. When inflation is "only" 2% (the goal of modern governments), that means prices went up by 2% from their previous levels. So inflation has a significant cumulative effect. Let's consider a can of soup that costs $1, and over the course of five years the price goes up by 2%, 3%, 4%, 7%, 2% each year. Here's how the price changes:

- Original Price: $1

- After first year inflation (2%): $1.02

- After second year inflation (3%): $1.05

- After third year inflation (4%): $1.09

- After fourth year inflation (7%): $1.17

- After fifth year inflation (2%): $1.19

In five years, the total price increase is 19% due to the cumulative impact of yearly inflation. Yet any politician in office between years four and five will imply that prices are going down because inflation went from 7% to 2% during that time frame. No, prices still went up, just not by as much, and they went up from the overly inflated prices from the previous year. Nothing is more affordable in year five; it's just getting more unaffordable at a slower rate. What we really need is for prices to go down, but that will never happen as long as governments can print money at will.

So what can be done? Obviously dramatically reducing government spending is the solution, but there's absolutely zero indication that almost any politician of either party actually wants to do so (while Democrats are proud of being big spenders, Republicans pretend to be miserly during campaigns before spending like Democrats once in office). But since the spenders can't be reformed, what needs to change is their allowance-their source of unlimited funds.

While all of us have lived in a world in which governments have total control of the money supply, this situation is actually atypical in history. While there were temporary instances of money printing before the 20th century, it didn't become a permanent fixture until World War I and its aftermath. Government leaders then got a taste for the power they had when they controlled the money printer, and they never gave it up. This is the cause of permanent price increases, something previously unheard of in history.

Perhaps then, the answer is to go back to the way it was before World War I ? Return to the gold standard, in which money is tied to a precious (and most importantly, scarce) metal ? This would definitely be an improvement over today's money, but history has shown that gold's limitations will likely bring us right back to government-controlled money. Since gold is incredibly difficult to actually spend (try to buy something from Amazon with a piece of gold), there must be another form that represents gold, such as paper bills or digital dollars. However, once that intermediate form is created, it's a small step for governments to take over its production and then detach it from gold again. Gold is a great store of value, but it's terrible as a usable currency in the modern world.

All is not lost, however. Another alternative combines the strengths of gold with the usefulness of modern money. I'm speaking of bitcoin. While I know this statement brings a roll of the eyes from a certain segment of the population, bitcoin truly is a money that can limit governments and control rising prices. It can make our savings actually last and not be consumed by the inflation beast. As I detail in my book, Moral Money: The Case for Bitcoin, bitcoin has all the properties to make it the best-and most moral-form of money available today.

It's unlikely many government officials will voluntarily decide to stop the money spigot, but at the very least adopting a personal "bitcoin standard" can help one navigate an inflationary world better. And as bitcoin becomes increasingly adopted, and people begin to recognize its superior qualities over the dollar, a real movement to adopt a national bitcoin standard can grow. This in turn could lead to a real revolution in money, one that would lead to a far more stable economy with goods like ground beef, milk, and chocolate chip cookies remaining affordable. Then we won't need a president telling us anymore to not believe our eyes.

This article was originally published on Crisis Magazine.